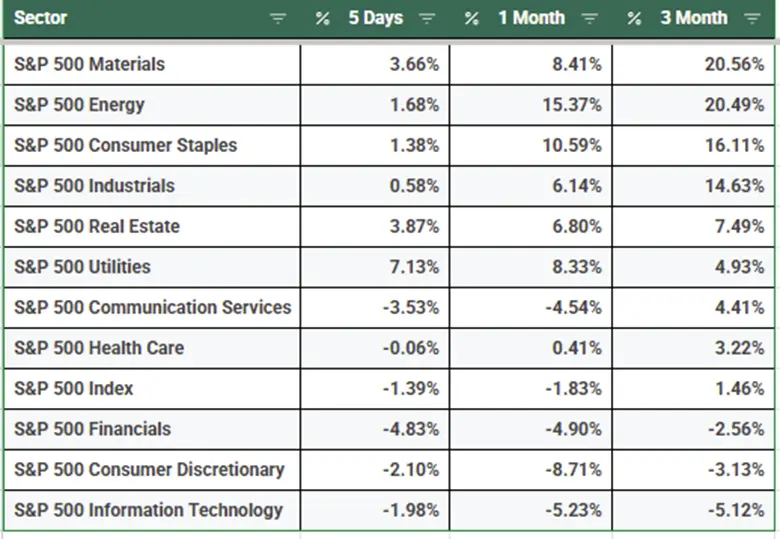

I am starting today's piece with the table below, because I want to emphasise the rotation that’s been going on in US equity markets over the last three months.

During which time, the Information Technology sector has lost more than -5.0% whilst the Materials sector has gained more than +20.0%.

S&P 500 Sector Performance Percentage Change

Source:Barchart.com/Darren Sinden

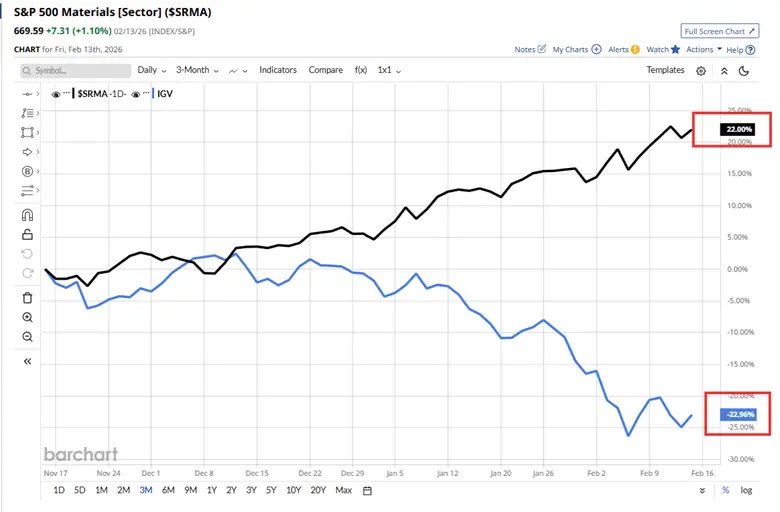

We can get an even clearer idea of the outperformance of old economy sectors versus the new economy, in this chart, which shows the iShares Expanded Tech/Software Sector ETF, IGV US, against the S&P 500 Materials sector index.

IGV is down -23.13% in these three months, whilst the materials sector has added +22.0%.

Source:Barchart.com

If we dig down deeper into the materials sector, we find that Freeport McMoran FCX US, and Albemarle ALB US are among the best performing stocks in the sector, having risen by +55.0% and +45.0% respectively over the last three months.

However, It isn’t just the performance of the two stocks in question that give me a sense of pride.

In fact what pleases me most is that I was able to identify this trend, and latch onto two stocks that have gone from strength to strength, and to have done so, early on in that cycle/rotation.

Can it be done again?

That raises the question of whether or not it's possible to repeat the exercise and identify stocks, and areas of the market, that might outperform over the next three months?

Well one way to do that might be look over the rubble from the recent IT and Software shakeout.

Handily for us that's exactly what analysts at US investment bank Morgan Stanley have been up to.

They have cast their eye over 3600 stocks as part of their latest AI mapping report.

The banks analysts take the view that the AI trade has evolved from one that says:

Just own anything with exposure to the sector, into one of owning stocks that demonstrate Returns on Equity and or Investment, created as a result of AI deployment.

Or if you prefer, look for companies which can show that AI is helping them to cut costs and improve efficiency.

The US bank believes that as much as +80.0% of the economic benefits derived from AI will show up in the form of cost cutting and savings.

Interestingly the stocks that Morgan Stanley identified as being AI Adopters and beneficiaries, aren’t all from the world of technology,though of course many are:

Here are some examples:

Samsung Electronics, SK Hynix, Airbus ,Nokia, Visa, Mastercard, Coca-Cola and CVS Health are some of the stocks that MS highlighted in its recent report.

The bank suggests that traders, and investors examine three key areas before jumping in.

These can be summarised as follows:

When companies cut staff, they should explain why, and show how AI/tools will help maintain, or better still improve output.

AI projects should boost key financial metrics (revenue, costs, profits), and not just be experiments that are run on the side.

AI needs to be part of the firm's core business strategy, and create measurable returns, especially in the case of higher margins. and productivity indicators.

Earnings Transcripts a test bed?

We are still in the final stages of Q4 2025 earnings season, so there are plenty of earnings transcripts that we could examine, looking for these traits.

I ran a preliminary screen of Q4 earnings using AI, looking for the qualities outlined by Morgan Stanley.

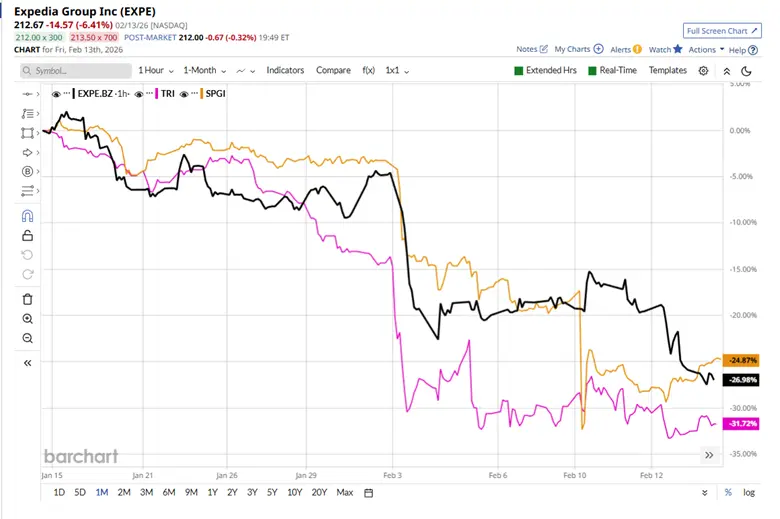

The AI screen highlighted Thomson Reuters TRI US, S&P Global SPGI US, and Expedia Group EXPE US, as mentioning these trends in their earnings calls.

Somewhat ironically all are three stocks have been in the heart of the “AI will eat your lunch” sell-off, and as you can see their share prices are down significantly as a result.

Source:Barchart.com

On that basis alone they make an interesting test case.

Though clearly we will need to exercise a high degree of caution before even considering a trade here.

However, if we start to see signals in the price action that suggest the falls are over done, and that share price corrections may be coming, then that could be a different story entirely.

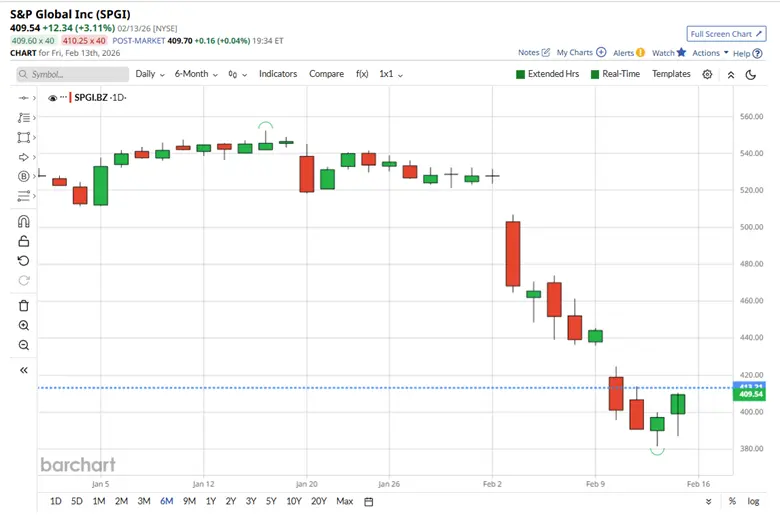

I note that SPGI rallied +3.11% on Friday for example, closing at $409.54.

Looking at their chart I see there is a prior high at $424.80 to be aware of and a gap above at $436.09 to focus on as well.

Source:Barchart.com

These are early days AI clearly has the potential to cut costs and increase efficiencies at most businesses. What’s not clear is the time scales that this could happen over, and just as importantly, which businesses will enjoy first mover advantage? That’s exactly what we need to be watching for in the weeks and months ahead .

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.