As a trader, you have to be able to think tactically and strategically and distinguish between the two.

It seems there might be a tactical opportunity in US equity markets, despite question marks around things such as AI and Private Credit.

Doom and Gloom

There was plenty of doom and gloom around last week, as US equity markets struggled for direction and some high-beta technology names and sectors came under pressure.

That shouldn't have come as too much of a surprise to regular readers of my articles and comments.

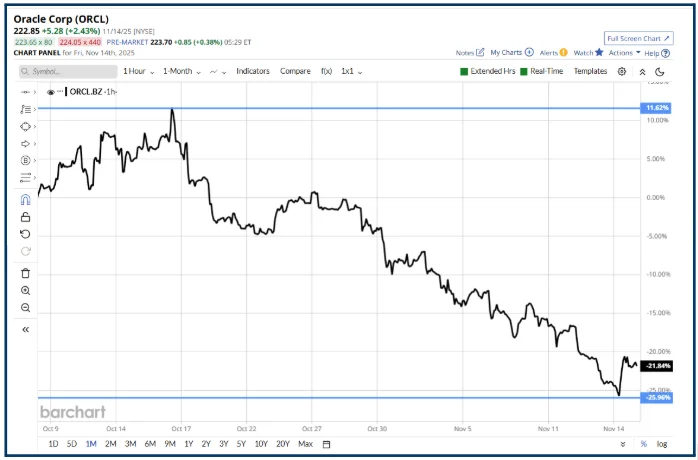

After all, I recently discussed what I saw as “reward decay” in Oracle ORCL, as traders reassessed the value of the multi-billion-dollar deals being signed in the AI sector.

Many of which have a” jam tomorrow” flavour about them.

Source:barchart.com

That said, the negativity in the market on Thursday and Friday seemed misplaced to me.

And it smacked of a climate in which traders have got used to things “only going up”.

So, when we do experience a pullback, even a minor one, people start to get anxious.

That’s not a good sign in itself, because it speaks to overreaction, and it made me think about what would happen if a significant negative catalyst were to appear.

It also says to me that some retail traders have short memories

Consider this comment from Goldman Sachs, part of a much wider note on global strategy from the bank.

“Between February and April (2025), the S&P 500 contracted by nearly 20% and the Nasdaq by 17%; other equity markets generally corrected but by far less”

Goldman Sachs

Double-digit falls in the major US Indices happened as recently as 7 months ago, driven by President Trump’s aggressive trade agenda. That was a genuine (if short-lived) correction, not just a wobble.

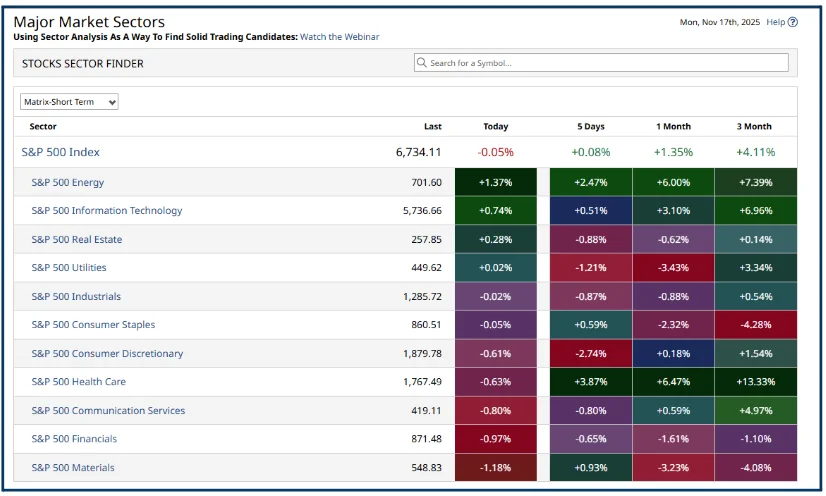

Here’s how the S&P 500 and its sectors have fared over the near term:

The index is up +4.11% in the last three months and was flat over the last week.

Source:barchart.com

Context should always be part of your decision-making process when it comes to the markets.

Listen to your head, not your heart, and try to stay objective at all times.

So what is the outlook for US equities?

Well, that might depend on who you listen to.

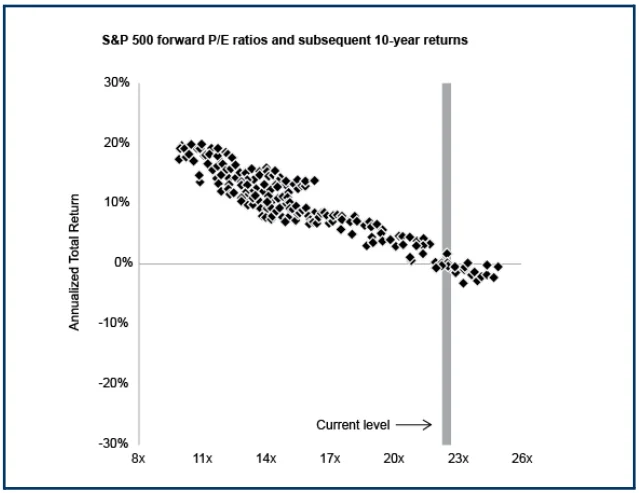

At the start of 2025, Howard Marks, the highly respected CEO of Oaktree Capital Management, which runs US$218.0 billion of assets, wrote a memo that contained the following chart, which looked at the correlation between current PE ratios and subsequent 10-year returns in the S&P 500 Index.

Source: Oaktree Capital

The chart tells you that if you bought the S&P 500 at a PE ratio of X, you could expect to receive a return of Y over the next decade.

The chart is based on 27 years' worth of data, and it found the following:

“When people bought the S&P at p/e ratios in line with today’s multiple of 22, they always earned ten-year returns between plus 2% and minus 2%.”

OaktreeCapital

The current PE ratio for the S&P 500 is as follows:

“The forward 12-month P/E ratio for the S&P 500 is 22.4. This P/E ratio is above the 5-year average (20.0) and above the 10-year average (18.7)”

Factset Research

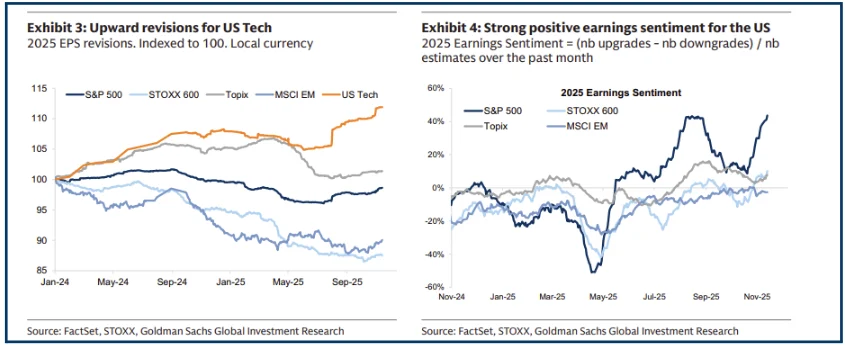

The bearish statistical take on the S&P 500 is not reflected in the views of Wall Street analysts

As this chart from the Goldman Sachs strategy report shows.

Earnings estimates for US technology stocks, shown in orange LHS, have been rising rapidly since May, and are running well ahead of the change in earnings estimates for the wider S&P 500, Europe, Japan and the Emerging Markets.

Now, of course, that could just mean that Wall Street is as wrapped up in the AI narrative as traders have been, and we have to consider that possibility.

However, the chart on the right-hand side suggests that the bullish sentiment towards US equities extends far beyond the Information Technology sector, with earnings upgrades for the S&P 500 (dark blue line), climbing once more in the final quarter of 2025.

Source: Goldman Sachs

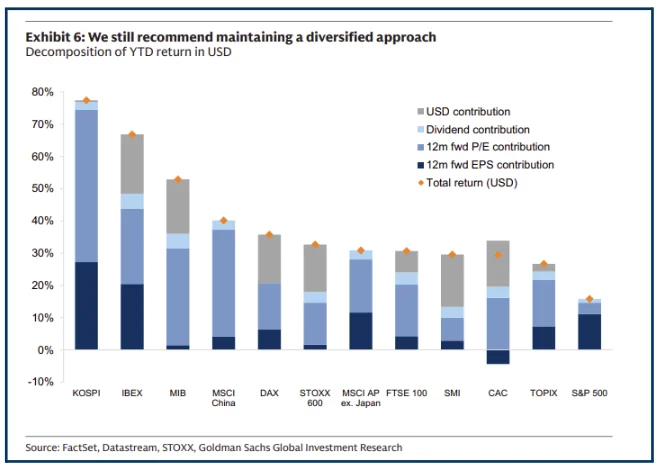

The third chart in this section is also courtesy of Goldman Sachs, and it highlights year-to-date returns across global equity markets. And also the contributions to those returns.

For example, South Korea’s KOSPI index has returned almost +80.0% year to date, but the biggest contributor to that has been PE ratios - in other words, traders and investors have been paying ever higher P/E multiples/prices to own Korean equities.

Source: Goldman Sachs

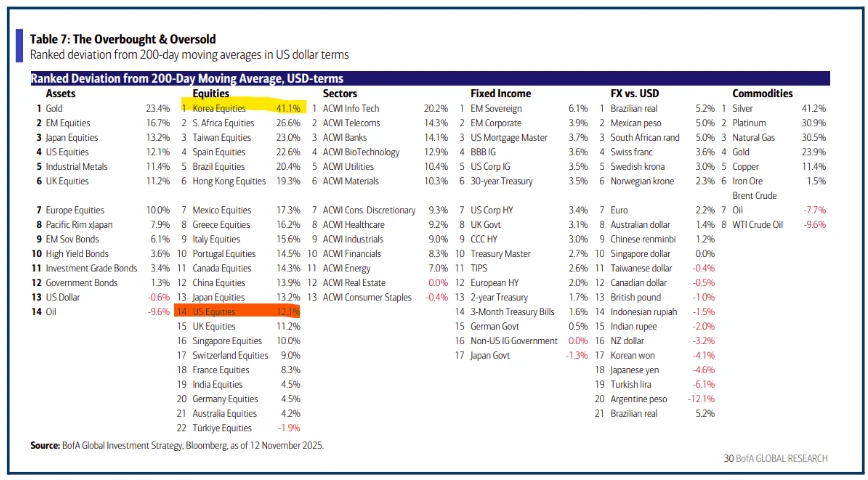

As a result of that, Korean equities are +41.10% above their 200-day Moving Average, according to Bank of America.

Source: Bank of America

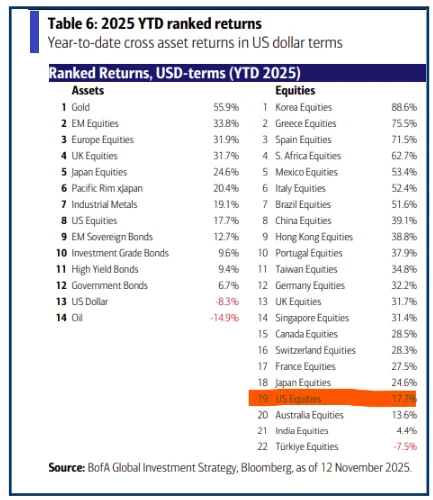

If we look at US equities in the returns chart, we find that forward earnings have been the biggest contributor, but the total return on US equities year to date is far lower than its peers.

And looking at the table above, we find that US equities are trading just 12.10% above their 200-day MA, and what's more, they sit 19th in the list of equity returns in US dollars during 2025.

Source: Bank of America

Takeaways

The long-term statistical outlook for US equity returns is pretty bleak, and below current rates of inflation. However, a decade is a long time, and those subpar returns may not be generated immediately, if at all.

There is a question mark about AI earnings, or rather about the ability of businesses deploying AI to monetise their investments.

The S&P 500 PE ratio remains above its long-term averages; however, earnings estimates for the information technology sector are rising, and earnings upgrades for the wider S&P 500 are significantly outweighing any downgrades.

US equities could be thought of as undervalued when compared to the returns generated in other markets in 2025.

Forward earnings per share estimates have been the biggest contributor to muted US equity performance in 2025, whilst PE multiples have only made a modest contribution.

US equities don't look expensive in comparison to their peers on these metrics.

And, with the US Q3 earnings season in its final stretch, earnings are growing at a rate of +13.10% year over year, with Wall Street estimating +13.90% growth in 2026.

It's hard to escape the conclusion that there could be more upside for US equities as we approach the year-end and enter 2026.

That is just as long as we don't see a macro shock, as we did in the spring.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.