So we've had the July Fed meeting and the Non-Farm Payrolls report, the Federal Reserve sat pat as they say, and did nothing, and left US interest rates unchanged, though two members of the FOMC dissented and voted for rate cuts.

A cynic might suggest that they were trying to curry favour with President Trump and whoever he ultimately appoints to replace Fed Chair Jerome Powell

The Non-Farm Payrolls report, which tracks the rates of non-agricultural job creation in the US, came in way below consensus estimates,m at 73,000 new roles compared to expectations of 110,000.

However, earlier reports were subject to some savage revisions, with, for example, June's data being cut by 147,000 roles to just 14,000 new jobs;

The revisions to prior data were some of the largest ever seen.

The size of the revisions may have cost the Bureau of Labor Statistics Commissioner, Erika McEntarfer, her job.

Though when he fired her, President Trump suggested that her appointment by Joe Biden had also played a part in his decision.

I wondered if cuts made to headcount and funding in government departments by DOGE have limited the Bureau of Labor’s ability to collect and collate accurate employment data.

Bloomberg ran an article this week that looked at what might happen to the $2.0 trillion Tips (inflation-linked US Govt Bonds ) market if the inflation data becomes unreliable.

The bonds account for some 7.0% of total US government debt.

The returns they offer, and the demand for the product, depend on the market having confidence in the way that US inflation data is captured and calculated.

It would be ironic in the extreme, if in an age of AI chatbots and endless information on stream, that we could no longer rely on government statistics; Those concerns are not just limited to the US, in the UK, the Office of National Statistics or ONS, is having its own issues compiling accurate employment and inflation

data.

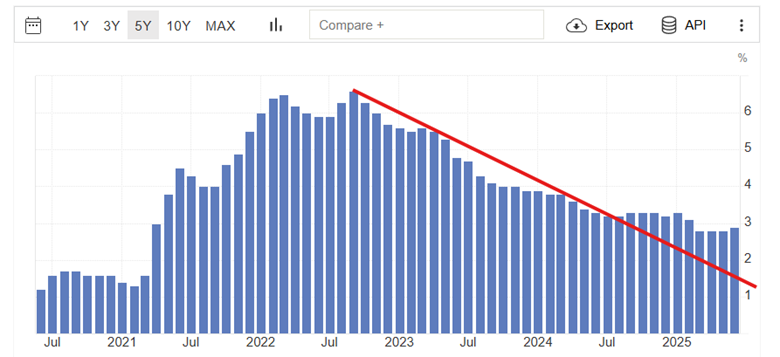

Speaking of inflation, we will see the release of US Inflation data on August 12th.

Source: Trading Economics

Core Inflation in the US has been rising again of late, breaking above the down trend line, shown below, in July last year.

Could we see another upside surprise and a reading above 3.0 percent next week?

United States Core Inflation Rate

Source: Trading Economics

After all, tariffs are inflationary as they raise the prices of foreign goods to US buyers; that's particularly true in a period when the dollar is weak, because a weak dollar increases the cost of most imports to US buyers, whether the goods have attracted tariffs or not.

US Dollar Index % Change

Source: Trading Economics

The influence of AI

I have written a lot about AI in recent articles, and that’s because it's almost impossible to ignore whether we are considering the job market, the stock market or the wider economy.

As I recently noted, AI Capex, that’s spending on AI infrastructure; power generation, data centre construction and fit out, etc, in the US, is having a direct effect on the economy, and is likely to boost US GDP this year and well beyond.

However, in doing so, it's likely driving up prices for materials and components.

Some of which will already be subject to tariffs, if they are sourced from outside of the US, as technology often is.

Trillions of dollars of investment, which is what the capex will ultimately amount to, will surely have a knock-on effect on the inflation data.

All of which leads me to think that US rate cuts in September, or the balance of 2025, are far from a foregone conclusion.

The market post-earnings

We are now most of the way through Q2 2025 earnings season, and overall, the majority of S&P 500 companies reporting have produced positive and revenue surprises. Earnings growth is looking like it could be above 10.0% which would mean we have seen three consecutive quarters of double-digit growth in US earnings.

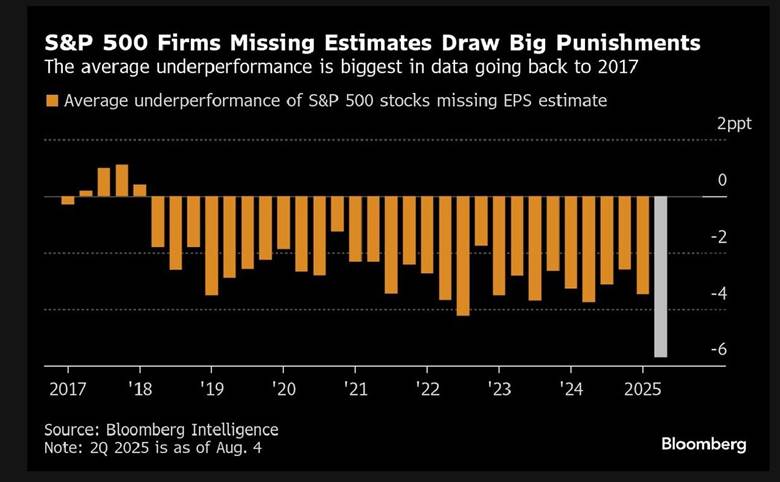

However, against that positive backdrop, if you didn't beat estimates, then the market was in no mood to be charitable.

With the stock price of S&P 500 companies that missed estimates, underperforming their peers by more than -6.0%.

That’s the largest markdown in 8-years and at least 50.0% bigger than we saw in 2023/2024.

Reactions to earnings misses

Source: Bloomberg

I note that the average percentage change for an S&P 100 stock over the last month is -1.78% and that the median or mid point in the list of individual percentage changes in S&P 100 stock prices is -2.07% so not everything in the garden is rosy.

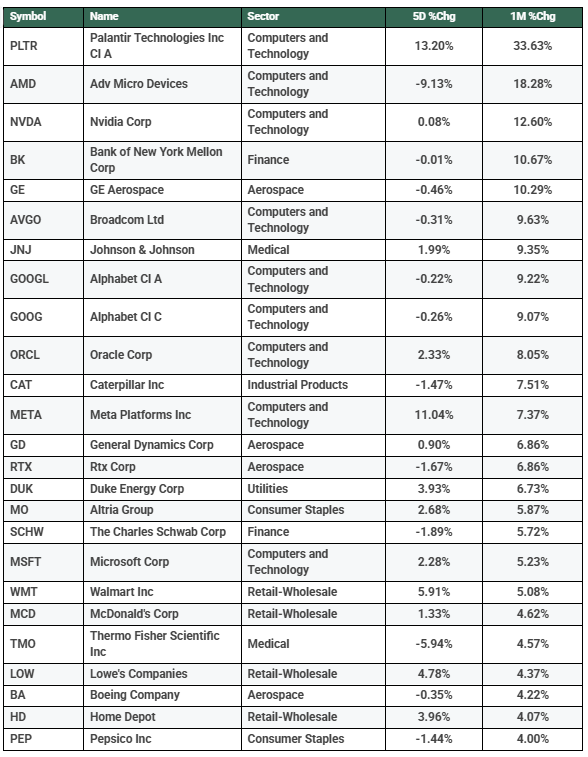

That said, there are stocks in the index which have had a decent run over the last month, as we can see in the table below. Though not all of these names have been able to maintain that momentum over the last week, for example, chip makers Nvidia NVDA US and Advanced Micro Devices AMD US.

1-month gainers in the S&P 100 Index

Source: barchart.com / Darren Sinden

US influence

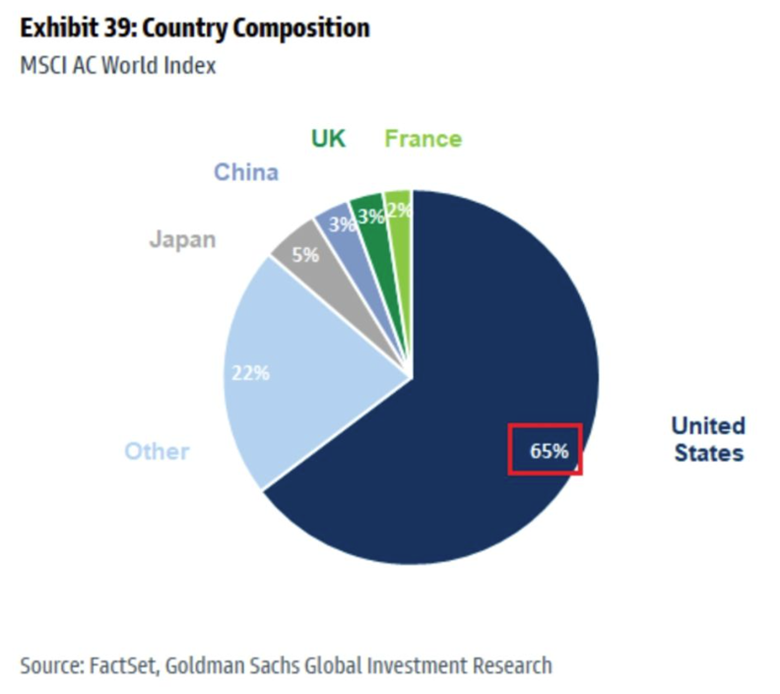

The focus remains on the US as far as equity markets are concerned, simply because its influence is too large to ignore. The chart below breaks down the weightings by country within the MSCI All Cap World Index, almost two-thirds of which is made up by the USA.

Source: Goldman Sachs

That doesn't mean that there aren't opportunities to be found elsewhere; it simply means that what happens to US stocks will frame the bigger picture and directly influence sentiment.

A question mark about valuations

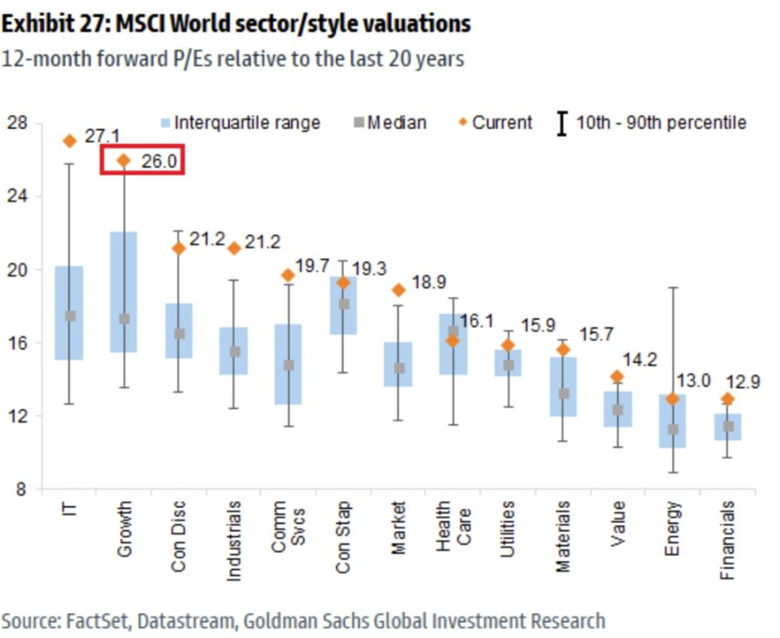

With that in mind, the question of valuations jumps out at you, and the chart below shows us 12-month forward PE ratios across a variety of sectors at a global /top-down level, where the gold diamonds represent current valuations on the vertical slider, and the grey squares the median level over the last 20 years.

The growth style and information technology sector are trading way above their median levels, and that raises the question of whether it's right to keep chasing stocks in these cohorts higher.

The conclusion that the markets reach about that question will likely drive the price action in US equity indices and influence the rest of the world in the final quarter of this year.

Source: Goldman Sachs

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.