FOREX

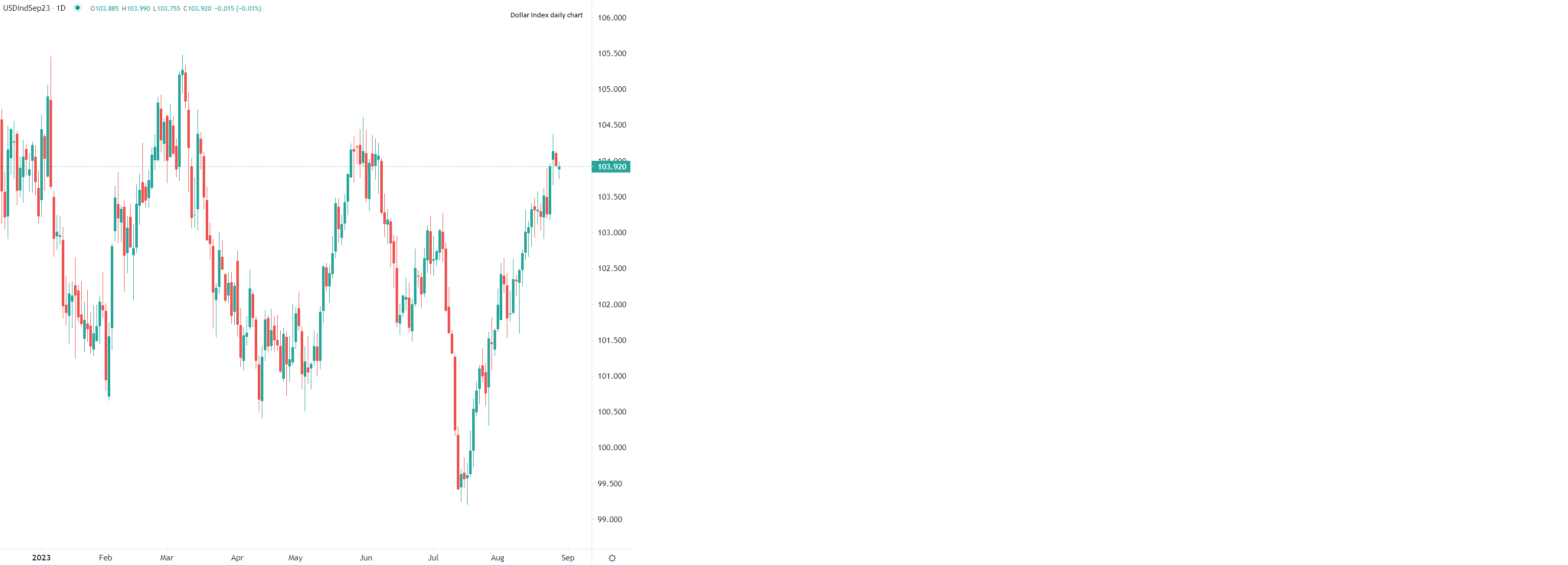

After touching a multi-month maximum at the end of last week, the US dollar started the week on the back foot and continued to edge down during early Tuesday trading. However, the greenback’s losses have been small, and the dollar is still close to last week’s maximums. Jerome Powell left a clear message when he spoke at the Jackson Hole symposium, saying that inflation remains a problem and leaving the door open for further interest rate hikes. This moderately hawkish stance is positive for the dollar, and we should not be reading too much from this early week softness, which is likely to be the result of some traders locking in gains ahead of the release of important US economic data this week, including consumer confidence, GDP, and employment.

Ricardo Evangelista – Senior Analyst, ActivTrades

Source: ActivTrader

EUROPEAN SHARES

European shares climbed higher on Tuesday, extending the bullish sentiment registered during the Asian session, ahead of key data this week.

Most benchmarks traded significantly higher in the Eurozone, led by real estate, basic materials and energy shares, as investors welcomed the latest announcement from China, which pledged to provide further stimulus measures towards its economy.

However, this wind of relief from the second biggest economy in the world may be the calm before the storm as traders brace for a crucial week on the macro data front.

In addition to today’s US consumer confidence data, investors are likely to focus on US unemployment growth, PCE data, and the highly awaited August NFP release on Friday. Furthermore, volatility is expected to remain high towards EU shares as investors await inflation prints from the Eurozone to get more clues about the future of monetary tightening from the ECB.

With lingering questions about monetary policies, many investors may be tempted to bring significant adjustments to their portfolio’s exposure to riskier assets, depending on the tone provided by this week’s batch of data.

Pierre Veyret– Technical analyst, ActivTrades

Source: ActivTrader

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.