Donald Trump surprised the market when he appeared to use the carrot and the stick on US defence companies.

The carrot was a proposal to increase US defence spending by a whopping 50.0% to $1.50 trillion per annum.

For comparison, that's larger than the GDP of countries such as Indonesia, Turkey, Saudi Arabia, the Netherlands, and Switzerland.

On the face of it, that should have been great news for defence contractors and manufacturers. However, the President offset that sizable carrot by wielding a very big stick, saying that he would block defence companies from paying dividends or conducting share buybacks and sped up and improved the quality of the production and programs.

The President announced an executive order. Reuters reported that:

“The order said that within 30 days, Pentagon chief Pete Hegseth will identify defence contractors who are underperforming on their contracts and have engaged in stock buybacks. The Pentagon chief would then engage with those firms, which would have a chance to submit a remediation plan for review by the Pentagon within a 15-day period after the notification, the order added.”

Mr Trump also indicated that he would limit executive pay at the defence manufacturers to no more than $5.0 million a year.

Defence companies spend billions of dollars on purchasing their own shares. For example, Lockheed Martin LMT US has allocated $9.10 billion to share buy-backs.

The company has also increased its dividends for 23 years in a row. Two traits which will have attracted investors to the stock but which are now in doubt (the shares currently yield 2.58%).

Lockheed Martin has recently broken out on the upside, but will that momentum be maintained under President Trump’s new proposals?

Source: Barchart.com

So what are share buybacks and why are they important

- A share buyback occurs when a company purchases its own shares from existing shareholders and typically cancels them, thereby reducing the total number of shares in issue.

- Buybacks are an alternative to dividends when it comes to returning cash to shareholders, and they can raise the EPS or earnings Per Share on the outstanding shares after the buyback is completed.

- Buybacks can also boost stock prices.

- Companies buy back shares using the company’s cash, typically through open-market purchases or tender offers.

- Repurchased shares are generally cancelled or held in treasury, reducing the stock's free float and outstanding share count.

- Key motives for buybacks include returning excess cash, potentially improving tax efficiency for shareholders when compared to dividend payments, boosting a stock's EPS, and possibly the share price.

- Supporters highlight benefits such as higher EPS, optimised capital structures, and signalling that management believes the stock is undervalued.

- Critics argue that buybacks can encourage short-termism, may rely on debt funding, and can misallocate capital if shares are repurchased when they are “overvalued”.

Donald Trump would like defence companies to reinvest any excess capital into their businesses rather than paying it away to shareholders. Indeed, one longstanding criticism of share buybacks is that they show management has run out of ideas or that the underlying business has reached maturity and the company can no longer deploy capital efficiently inside the business it’s in.

I am not sure that “one size fits all” when it comes to share buybacks, and I think we need to look at the merits of each case individually. And of course the lens we look through will influence our judgement, be that as traders, investors, long-term shareholders, analysts, or other market participants.

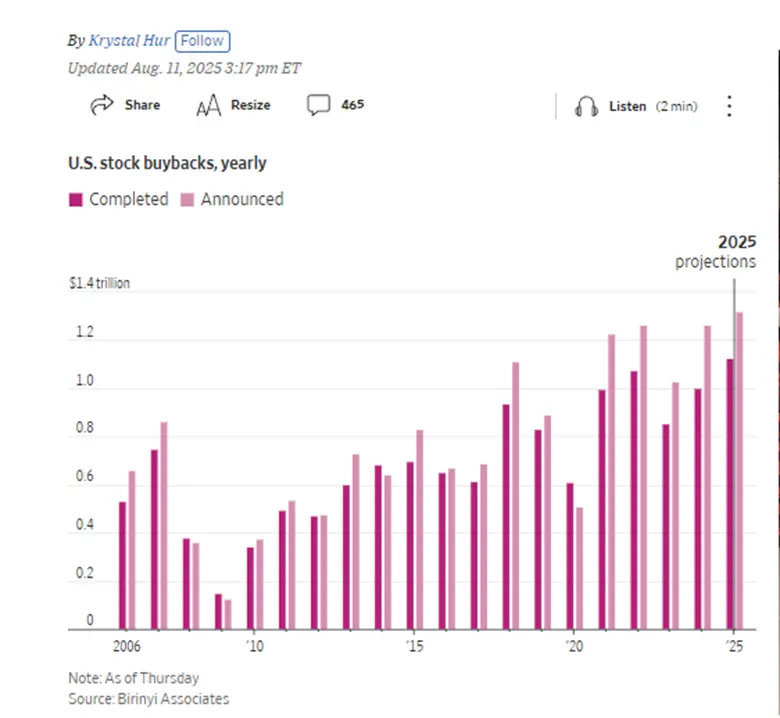

The chart below tracks the annual amount of share buybacks in the USA in billions of dollars.

The estimated total value of share buybacks in the US in 2025 is $1.40 trillion.

A figure that's just below the $1.49 trillion of fund flows into equity ETFs during 2025.

Source: Birinyi Associates

Tracking Buyback stocks' performance

Buybacks are big business, and at this scale, they have a direct influence on individual stock prices, sectors and indices.

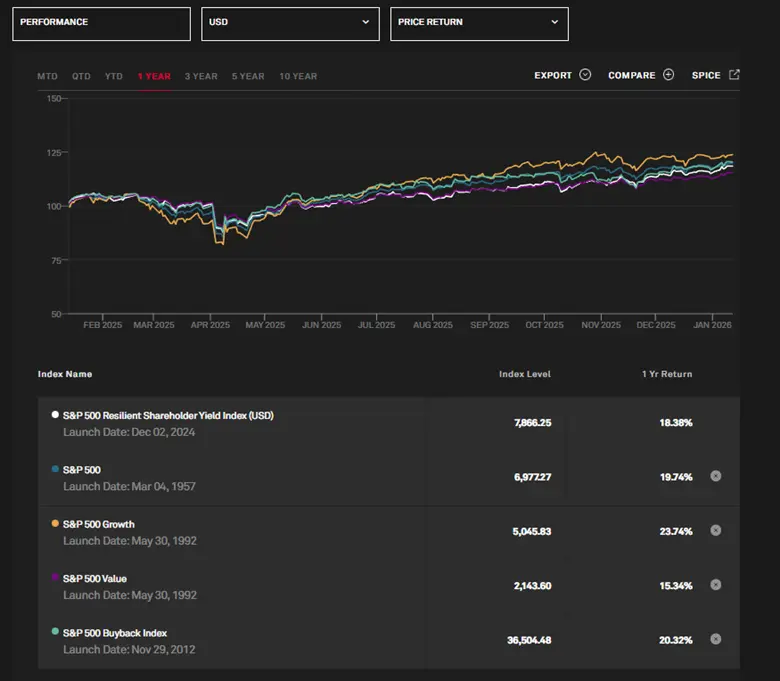

In this chart, we see the 1 year price returns generated by the S&P 500, the S&P 500 Growth index, the S&P 500 Value Index, the S&P 500 shareholder yield index and the S&P 500 Buyback index.

S&P 500 select factor index performance

Source: S&P Global Research

The Buyback Index (green line) outperformed everything, but the Growth Index (yellowline), over the last 12 months with gains of +20.23%.

Buybacks are not an even playing field, however, as these statistics from S&P Global show :

- 333 companies executed buybacks of at least $5m in Q3 2025 (387 did some buybacks in total), and 436 companies repurchased shares at some point over the 12 months to September 2025.

- Buybacks remained concentrated: the top 20 companies accounted for 49.5% of Q3 2025 repurchases, slightly below 51.3% in Q2 2025 but above the longer‑term averages (47.8% overall, and 44.5% pre‑COVID).

Source: S&P Global Research

Q4 2025 earnings season kicks off in the US today (13-01-2026), and it's not uncommon for companies reporting earnings to comment on share buybacks, whether that’s ongoing share purchases or new instructions.

Let's keep our eyes and ears open and be on the lookout for news of share buybacks, particularly among the largest US stocks.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.