I often discuss the rules of trading and how having a trading plan that you adhere to is of the utmost importance.

The rules within that trading plan will fall into one of two camps: rigid money management and exposure rules, which are designed to preserve your capital and prevent you from getting carried away and blowing up your trading account.

These include minimum risk/reward ratios, trade sizing, exposure and position limits. The placement of stop losses, take profits, etc.

We should think of these as being hard and fast boundaries, like the crash barriers on a motorway.

However, the other category contains what we might think of as sound advice or market wisdom.

Lessons that other people have learnt the hard way and have shared with the wider trading and investing community.

These rules are there to guide you and inform your trading behaviour.

And we can think of these as being like road markings and speed limits, notional barriers, rather than physical ones.

As these guidelines have developed over time by a wide variety of traders, there are plenty to choose from.

However, I recently came across this set of rules that were written by analyst and investor Robert” Bob “Farrell, who pioneered a technical approach to the markets in the years after WWII.

And went on to become the first President of the US-based Chartered Market Technicians Association or CMT.

They may be decades old, but they are just as relevant today as they have always been:

Markets return to the mean - markets are often driven by sentiment, which in turn is driven by human emotions and foremost among these are greed and fear. Those emotions can exert an undue influence on the markets and prices of securities within them, causing them to move sharply away from long-term averages, standard behaviours and valuations.

As these emotions fade away, sentiment becomes normalised and traders assess the “damage” and look for issues that have swung too far, often for no good reason other than greed or fear. Traders and investors take positions in these stocks in the expectation that they will fall back into line with the wider market.

S&P 500 Stocks that have outperformed or underperformed the S&P 500 Index by + or - 50.0% YTD

Source: Barchart.com /Darren Sinden

Excess in one direction leads to the exact opposite: “ Bubbles create busts”.

The simplest analogy here is to think about an inflating balloon: as more air or gas is pumped into the balloon, it expands. However, there is a tipping point, which is reached when the pressure inside the balloon exceeds the ability of the balloon to contain it, at which point the balloon bursts and all the gas instantly escapes.

There is not much value or utility to be found in the remnants of a burst balloon.

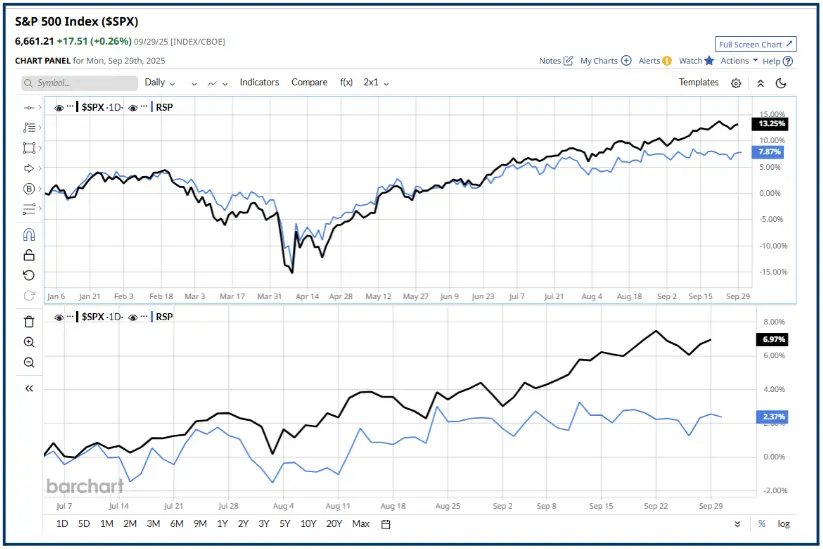

The chart below compares the performance of the S&P 500 cap-weighted index versus the equal-weighted version of the index, the outperformance of the cap-weighted index over the year-to-date and the last quarter suggests that large/mega cap stocks are responsible for that outperformance.

Source: Barchart.com

The index is towards its all-time highs, but by this measure, at least, breadth/participation looks to be on the narrow side.

Source: Barchart.com

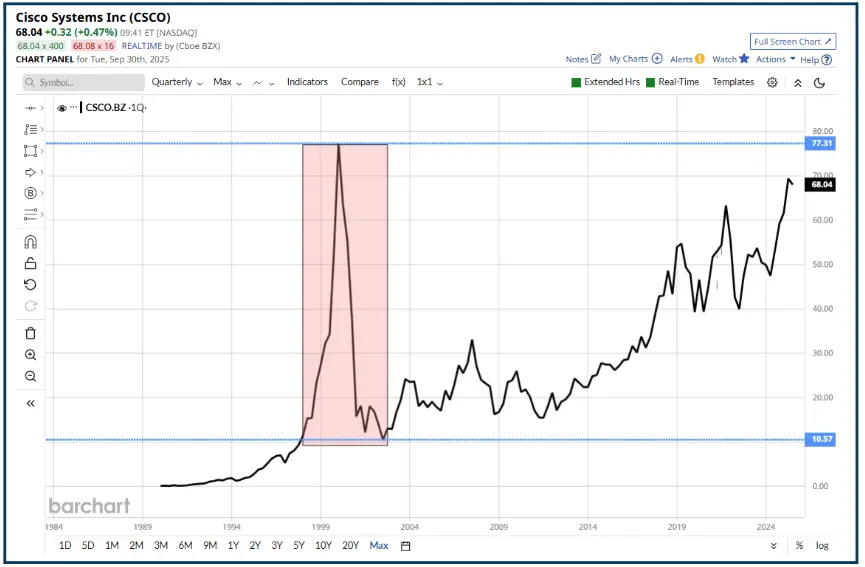

There are no new eras. This time it’s different” really is a dangerous phrase or thought process.

Times and technologies change, and stocks have a natural life cycle, but what remains constant (at least for now) is human nature and the way we think and act.

AI and data centres are the prevailing narrative right now. 25 years ago, it was the internet, World Wide Web and the promise of e-commerce.

In the 1920s. Radio was the must-have technology of the day; before that, it had been the Telegraph and the Railways.

All of these investment manias created a bubble and ended in a bust.

Traders repeated the same mistakes in each instance by overleveraging, falling foul of confirmation bias, taking increasing risks, playing less established stocks, or opening positions at higher and higher valuation multiples, which became increasingly divorced from the fundamentals.

Cisco Systems CSCO US in the dot-com boom and bust.

Source: Barchart.com

Now I should just add a caveat here because though it's true that until now, there have been no new environments, that’s because the overwhelming majority of traders, investors and money managers (decision makers) have been human, even if a lot of trade execution has been automated.

It's also true that even where you have a computerised system, making trading and investing decisions, those systems have been coded by humans and thus reflect our emotional biases, makeup and preferences.

However, that may change in the not-too-distant future; it is not hard to imagine some combination of machine learning and self-coded AI that studies the markets and act in them without human intervention or input.

And that would be a whole different ball game.

In the second part of this article, we will look at more of Bob Farrell's rules and how we can apply them in today's markets.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.