The phrase

“They took the stairs up and the elevator down” is a perfect metaphor for the behavior of stock prices during a market correction.

It illustrates the slow, steady climb that stock prices often experience in a bull market, followed by the sharp, sudden drops that characterize corrections.

This dynamic is not just a quirk of the market—it also reflects human psychology and market mechanics -the greed and fear that drives price change.

The Slow Ascent: Taking the Stairs Up

In a bull market, stock prices tend to rise gradually over time. This steady climb is driven by optimism, improving corporate earnings, economic growth, and increasing investor confidence.

Historically buyers have entered the market cautiously, often waiting for confirmation of upside trends before committing significant capital. This created a methodical, step-by-step rise in prices—much like climbing a set of stairs.

This slow ascent is often also fueled by long-term fundamentals.

Investors are focused on growth prospects, and as positive news trickles in over months or years, stock prices reflect this optimism incrementally.

The process is deliberate and measured, because investors are generally more cautious when committing to long-term positions.

Though with the rise of growth investing time scales have shortened and price moves have become steeper.

The Sharp Descent: Taking the Elevator Down

In contrast, when a market correction occurs, stock prices can plummet rapidly.

Corrections are classically defined as declines of -10.0% or more from recent highs and they often feel like a freefall.

This sharp descent reflects panic selling, where fear overtakes greed and rational decision-making goes out od the window .

Investors rush to exit positions to preserve their capital, triggering a cascade of sell orders that accelerates the decline.

The speed of these drops is amplified by modern trading mechanisms, like algorithmic trading and stop-loss orders, which can add to the downward momentum.

Additionally, bad news such as disappointing earnings reports, geopolitical tensions or the introduction of game changing technology tends to spread quickly in today's digital age, further fueling fear-driven sell-offs.

Why Does This Happen?

The asymmetry between the slow climb and rapid fall is rooted in human psychology.

Gains are often driven by hope and optimism, which build gradually over time.

Losses, however, are driven by fear, a much stronger emotion that prompts immediate action.

Behavioral finance shows that people feel the pain of losses much more acutely than they do from the pleasure derived from trading gains.

A concept known as loss aversion. This leads to faster, more violent reactions during downturns.

An AI earthquake

We saw just such a correction earlier this week, as the market became aware of the Chinese AI DeepSeek., which was built by researchers at a subsidiary of Chinese Hedge Fund, for a fraction of the cost of the resource heavy, large language models (LLMs) of the likes of Open AI.

What’s more, DeepSeek has reportedly been built using older GPU chips, because the US has banned the export of high-end chips to China.

Although some in the market have questioned the outsize sales of Nvidia’s most sophisticated and powerful chips to Singapore, the inference being that many of these chips subsequently find their way to China.

Whatever the truth behind that the effect on Nvidia was profound.

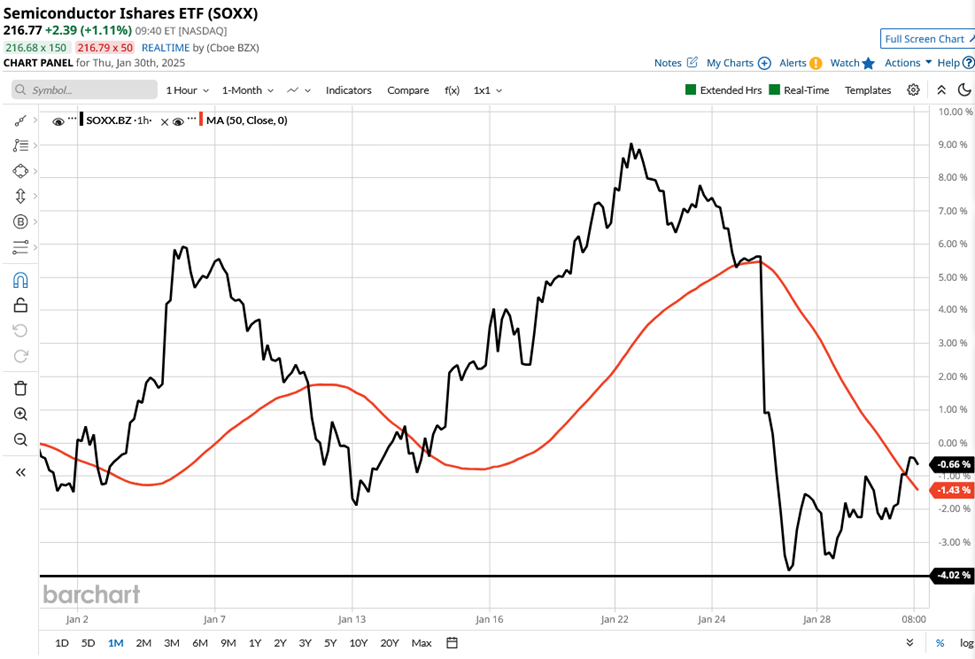

Source:Barchart.com

We can see then sharp reversal in the price action that the emergence of DeepSeek brought about in the price of Nvidia earlier this week in the chart above.

And for the wider semiconductor sector in the chart below.

Source:Barchart.com

The goal posts have moved

To get a feel for how far the AI goal posts had now moved, I asked the following question to one of DeepSeek’s AI rivals, Perplexity.

What has been the impact of the release of Deepseek on the prices of US technology shares and chip manufacturers?

I got the following answer:

“The release of DeepSeek’s new AI model has sent shockwaves through the US technology and semiconductor markets, triggering sharp declines in stock prices. The model, which is significantly more cost-efficient and less reliant on high-powered chips, challenges the prevailing investment thesis that AI progress requires massive computational power and hardware spending”.

DeepSeek’s innovation signals a shift away from "brute-force" computing power for AI, raising questions about the long-term viability of large-scale investments in AI infrastructure.

While the initial reaction was negative, some analysts suggest that these developments could democratize AI adoption, benefiting smaller tech firms and consumers in the long run.

However, for now, the disruption has exposed vulnerabilities in the valuations of leading US technology companies and chipmakers.

Much cheaper to deploy

It’s estimated that Deepseek could be deployed for just 25.0% of the cost of competitor AIs, such as Chat GPT.

What's more this new type of AI won't be so dependent on data centres, as it’s been designed with what's called “Edge Computing”in mind.

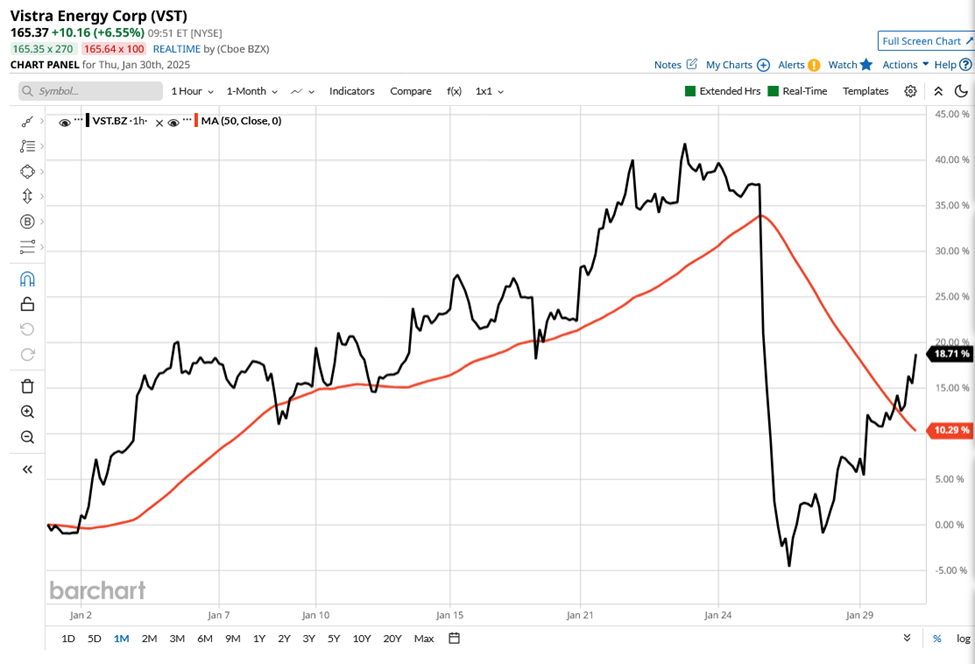

Fewer data centres implies much less demand for power from the AI companies.Which in turn fed into the prices of power generators, such as Vistra Energy VST which also fell sharply.

Though they have subsequently started to recover as we can see below.

Source:Barchart.com

A final question for now

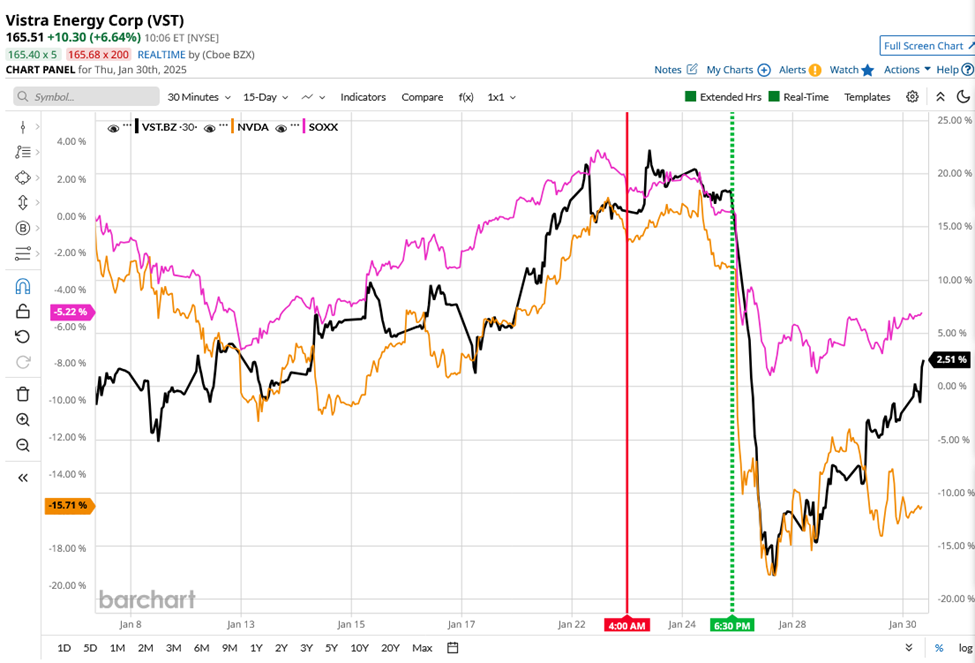

Finally I just want to consider one other thing, and that is the delayed reaction in the market to the emergence of DeepSeek. The news of which broke on Jan 23rd, as annotated by the red vertical line on the combined chart below.

Source:Barchart.com

Note the gap between that line and the green dotted line, which I have drawn to mark the point at which stock prices started to react.

That gap is a “lifetime” in the modern markets, especially when you consider the magnitude of the moves it ultimately caused, for example Nvidia lost- $600.0 billion in market cap.

Just a few years ago that would have been bigger than the market cap of almost any other, if not all, S&P 500 companies.

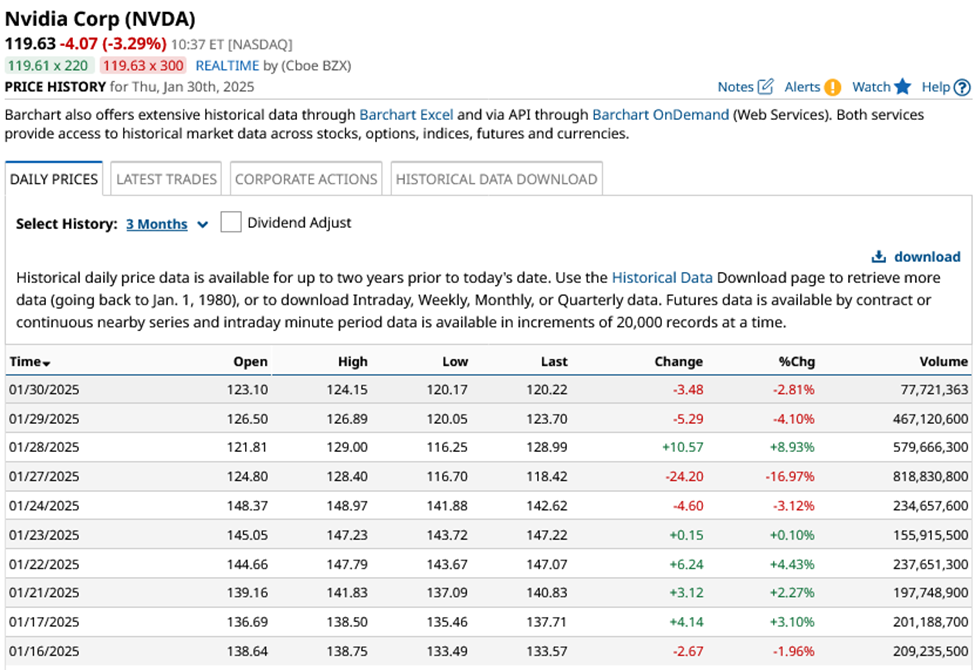

Nvidia’s short term price history

Source:Barchart.com

Here is the peak to trough move in the Nasdaq 100 during this period.

Source:Barchart.com

The very idea that for a couple of days nearly all of us were staring at probably the biggest trading opportunity of our lives, and did nothing about it is chastening.

However, it also reminds us (rather ironically) that even in an age of instant communications,supposedly all powerful chatbots, and trading algorithms. There are still opportunities for traders to make significant returns.

What comes next?

The jury is still out about exactly what this all means longer term. Back in August 2023 I wrote on Nvidia asking if it was the fifth force of nature?

We may now have to consider whether Deep Seek and its architecture is also the equivalent of some hitherto unknown but all pervading force.

Looking back

The following is an extract from my August 2023 article on Nvidia, but it seems appropriate to refer back to it after the events of this last week:

I wrote then that:

“As fantastic as Nvidia's performance has been, it's almost impossible to accurately predict who the ultimate winners and losers of the AI boom will be.”

Particularly when it comes to sustainable, scaleable earnings, future growth and longevity.

“As traders, we need to bear that closely in mind and remember not to fall in love with our positions, no matter how alluring the story around them is.”

“I will leave the last word on that subject to Professor Hendrik Bessembinder, of Arizona State University, who has studied the lifecycle of listed companies over the last century, and found that:”

“Nearly 60 percent of companies that have been public in the U.S. over the last century or so have failed to create value, defined as earning total shareholder returns in excess of one-month Treasury bills. And only 2 percent of companies were responsible for more than 90 percent of the aggregate net wealth creation (in that period)”

Darren Sinden August 2023

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.