FX

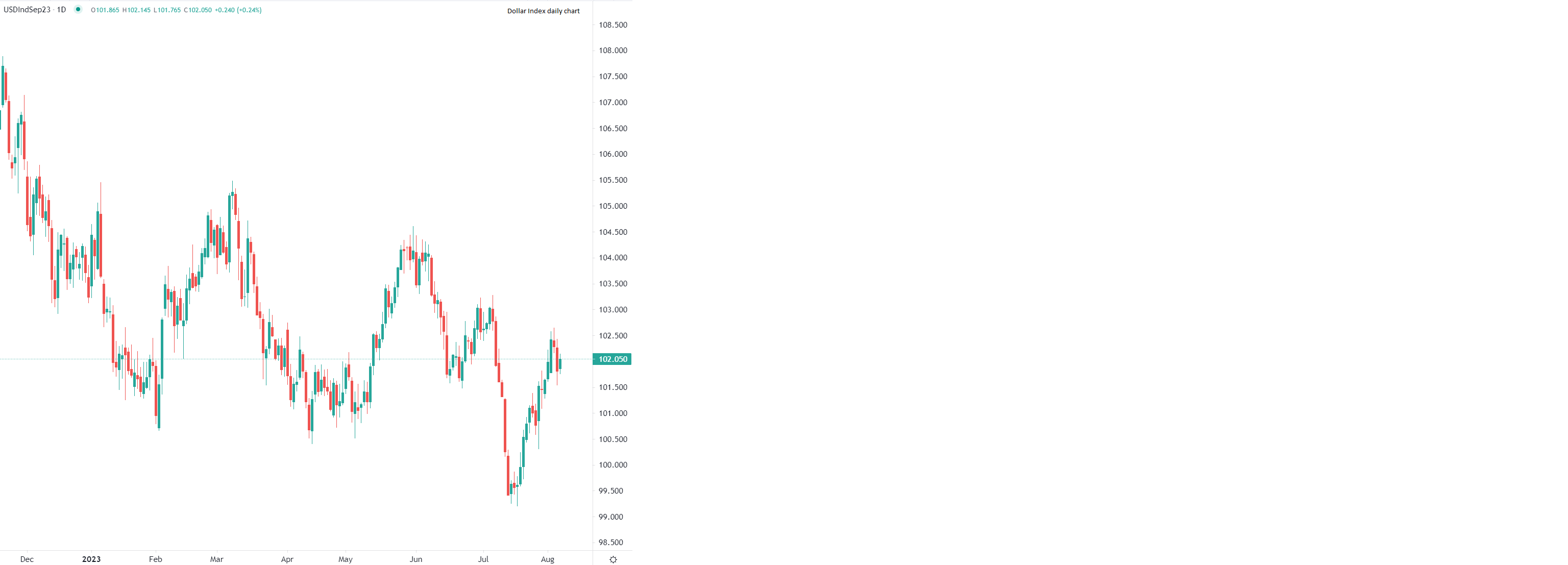

The US dollar climbed against other major currencies during early Monday trading, erasing some of the losses recorded at the end of the previous week. The labor report released on Friday revealed a lower number of jobs created in July, compared to economists’ expectations, triggering a knee jerk reaction in the markets and weakness for the dollar. However, a closer look at the data reveals that despite the disappointing headline number, wages continued to increase, and unemployment actually fell in July, bringing home the reality of a hot economy where inflationary conditions remain a cause for concern. Against this background, the release of US inflation numbers later this week gained renewed importance. A low reading will be likely to mark the end of the current hiking cycle and could generate dollar weakness. On the other hand, a surprise to the upside will raise the spectrum of at least one more Fed hike before the end of the year, and would be likely to drive dollar gains.

Ricardo Evangelista– Senior analyst, ActivTrades

Source:ActivTrader

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.