FOREX

The US dollar index dropped a few more points as this Tuesday’s European trading session gets underway. The greenback continues its slow but steady decline in relation to its peers; a process that started shortly after it reached a multi-year high at the end of the summer. Investors are now pricing-in a softening of the Fed’s stance, as US inflation shows signs of stabilization and avoiding a hard landing for the American economy becomes a priority. At the same time, in Europe and Japan, the story is different. Economic data continues to surprise to the upside, reinforcing expectations of further hawkishness from the respective central banks. The growing divergence between other major central banks and the Fed, which many now expect to start cutting rates before the end of the year, may lead to further dollar weakness.

Ricardo Evangelista – Senior Analyst, ActivTrades

Source: ActivTrader

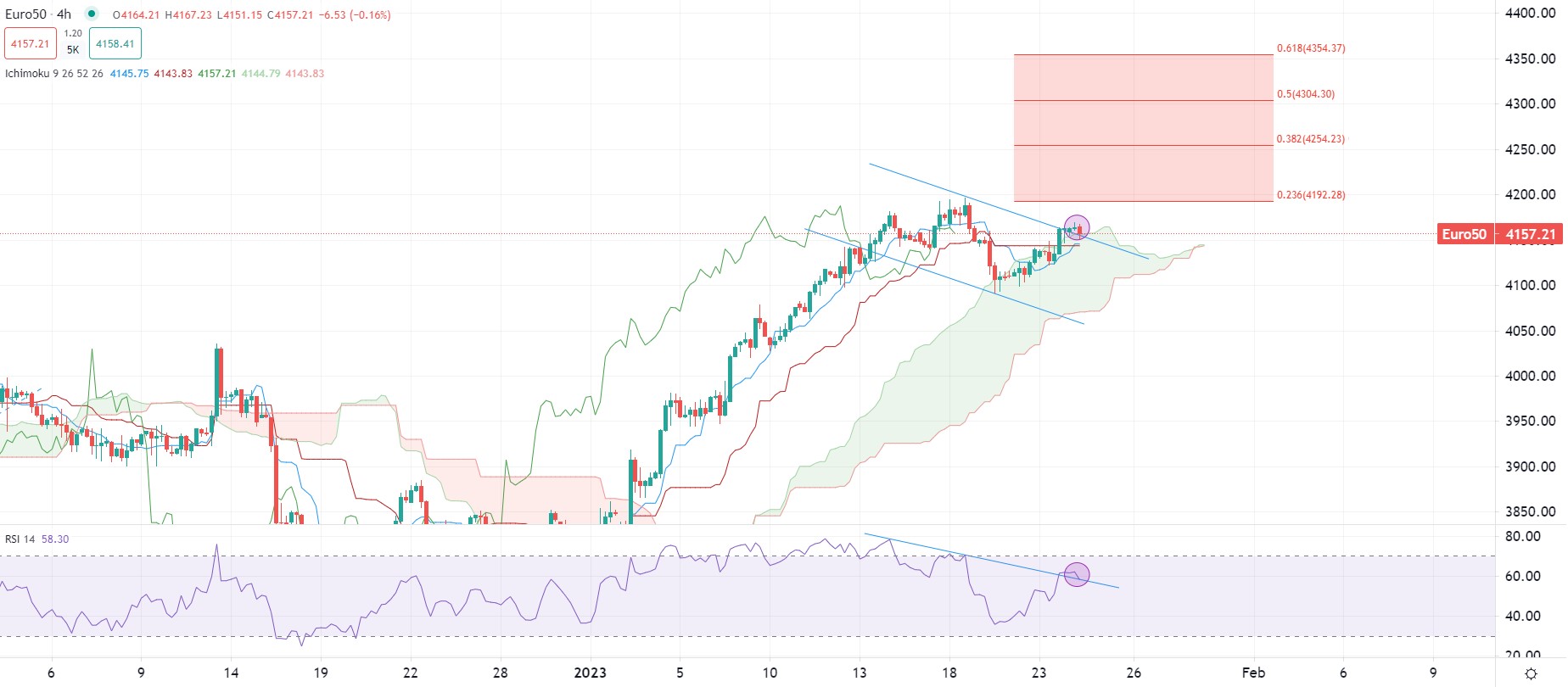

EUROPEAN SHARES

All of the Eurozone stock indices were trading in the green on Tuesday, extending gains from the day before, as bullish sentiment continues. Despite most Asian markets still closed for the day, bull traders continue to hold their gains in both Europe and the US, with a particular increased appetite towards tech shares.

This sentiment is however shared across many different sectors like consumer cyclicals, financials, industrials and real estate as investors continue to price a less aggressive stance from the Fed as well as more resilient corporate earnings than initially expected. The STOXX-50 index now trades above 4150.0pts following the successful clearing of the upper bound of its bearish flag pattern yesterday, with the road towards higher targets around 4190.0pts, 4255.0pts and 4305.0pts now cleared. We expect more market volatility than yesterday as investors digest the latest EU PMI figures and wait for the same data release in both the UK and the US, while the Richmond Fed manufacturing index and a speech from ECB President Christine Lagarde loom later this afternoon.

Pierre Veyret– Technical analyst, ActivTrades

Source: ActivTrader

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.