FOREX

The US dollar index showed a slight recovery as European trading got underway, but remains close to the nine-month low touched earlier in the session. The greenback lost ground in relation to its peers following the Federal Reserve’s rate decision and guidance statement on Wednesday. As expected, the central bank opted for a 25 basis points rate hike, and the Fed chairman delivered a message that acknowledged the stabilization of inflation, without hinting at a pivot in the bank’s stance. Jerome Powell maintained that he doesn’t expect the Fed to cut rates this year, however that wasn’t enough to sustain the value of the dollar, especially in relation to the euro and the pound. Britain and the eurozone are running behind the Fed and still have more to do in terms of monetary tightening, starting with today’s expected announcement by the respective central banks of a 50 basis points rate hike. With the interest rates of its peers quickly catching up with those of the Fed, further dollar weakness may occur.

Ricardo Evangelista – Senior Analyst, ActivTrades

Source: ActivTrader

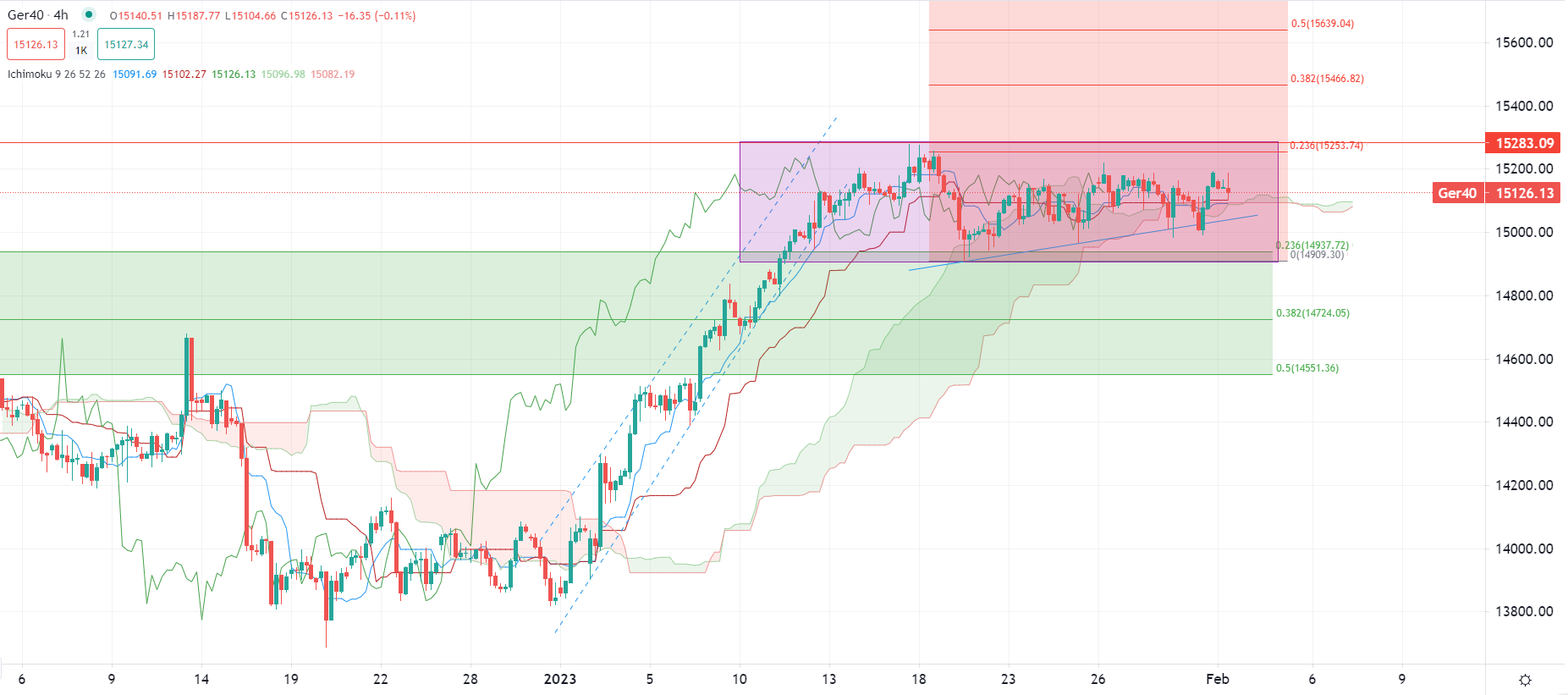

EUROPEAN SHARES

All equity benchmarks climbed higher in Europe on Thursday, alongside US futures, as investors continue to cheer yesterday’s reassuring comment from Jerome Powell on inflation.

The bullish sentiment is clearly dominating the old continent, and investors are driving prices up everywhere with the best performances being brought by real estate and tech shares as chairman Powell confirmed the Fed has made some progress in its fight against rising price pressure. This has been very well received by most traders as it opens the door of a much less aggressive stance on the monetary front, boosting risk appetite across all sectors following a difficult 2022.

That said, EU stock traders still have to digest the latest decision on rates from the ECB, due later today. Christine Lagarde is likely to announce another 50 bp rate hike, and all eyes will be on the wording she will use during the press conference. Market volatility is then likely to remain high for today, the STOXX-50 index has cleared the upper-bound of its lateral triangle, trading above 4,200.0pts, which paves the way for further market tops.

Pierre Veyret– Technical analyst, ActivTrades

Source: ActivTrader

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.