Last time out we looked at how what’s going in the markets right now would put creative writers to shame

And how that behaviour created some outstanding trading opportunities, if you spotted them and were brave enough to pull the trigger.

But ,what if I told you that you could have avoided all of Trump's Tariff Turmoil and that you

could have continued to trade in the same way, that you had for the last couple of years.

Would you believe me?

Probably not, and yet it's true, because there are stocks that remain unaffected by all that's gone on recently and it's not just one or two stocks either, quite the reverse in fact.

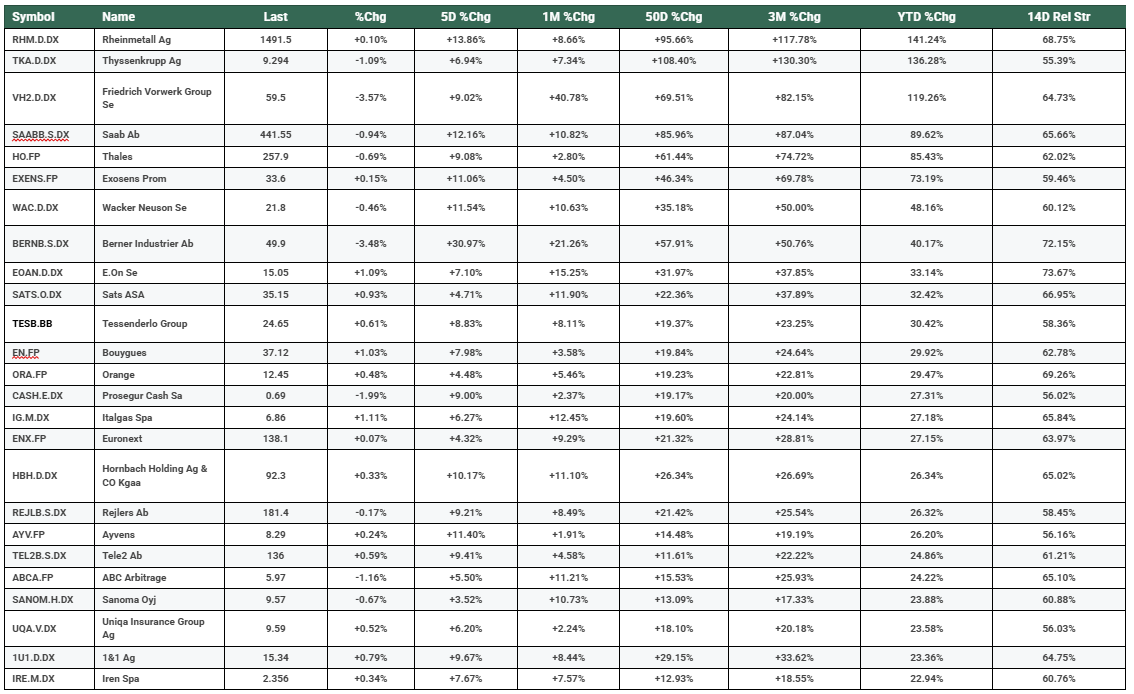

For example here is a list of European equities that are up over the year to date, over three months, over one month and five days.

I have even had to show a shortened version of the list here because of space constraints.

European equities that are up year to date and across intervening time periods

Source: Darren Sinden/Barchart.com

The stocks are drawn from a range of countries, sectors and industries.

Thought it's interesting to see two names that I have been regularly talking about, at the top of the list.

In the shape of Germany’s Rheinmetall AG and Thyssenkrupp AG both of which have posted triple digit percentage gains, year to date.

Gains that are largely thanks to the sea change in how Europe will maintain its security, going forward, and the current narrative of de-globalisation.

There are other names from the defence sector in the list as well, Thales and Saab for example, alongside Telecoms Operators, Utilities and Financials.

Pan European stock exchange EuroNext has posted a +27.0% gain in 2025 for example ou performing many peers as it did so.

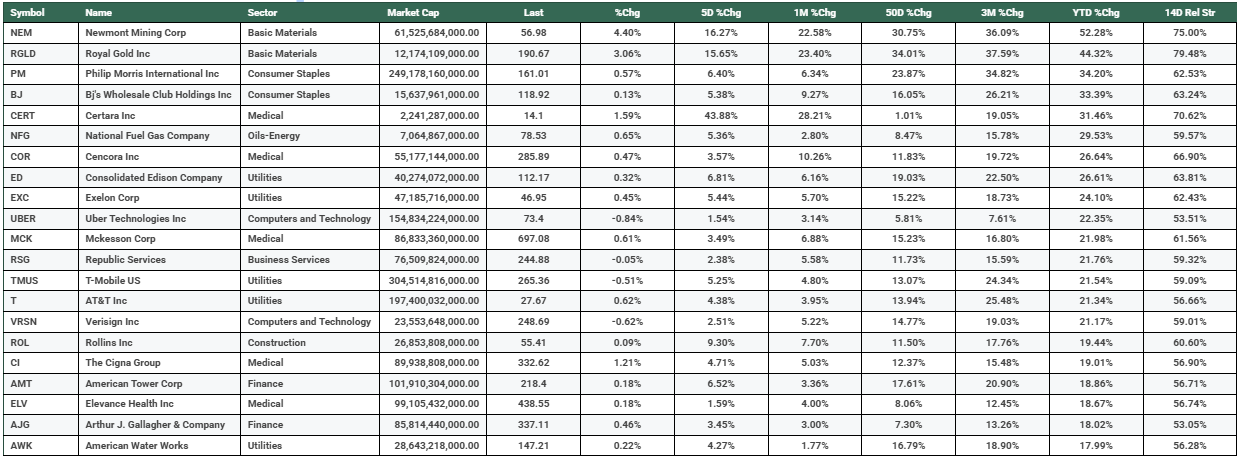

Tariff proofing isn’t confined to Europe either

Here are some examples of US stocks that are up over the year to date, over three months, over one month and five days once again the list has been truncated, to allow it to sit comfortably in the article (there were 55 names in the list as of the time of writing).

Russell 1000 equities that are up year to date and across intervening time periods

Source: Darren Sinden/Barchart.com

A tough selection process

The selection criteria for these lists are very strict and they excluded the best performing large cap stock in the US year to date, CVS, up by almost + 55.0% in 2025. But which has weakened slightly over the last 5 days

.

However it is worthy of an honourable mention regardless of that. And I have shared a chart of CVS below.

Source: Barchart.com

What’s the takeaway from all this?

Simply this - there are stocks in Europe, the US and elsewhere, that aren’t directly affected by US Tariffs; they are often domestically oriented, some are defensive or service sector based. Others are in the Real Estate or Utilities sectors, and there are even a smattering of Financials and Telecoms among them.

I doubt we have seen the last of the trade related swings in the market.

We only need to look at whats happened to Nvidia in the last 24 hours to see that.

However the sort of stocks that are found in the lists above may provide a port, in any future tariff storm.

Of course you shouldnt rely on their inclusion in these tables as a reason to trade them, but that does provide a starting point for further research of your own I hope.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.