EUROPEAN SHARES

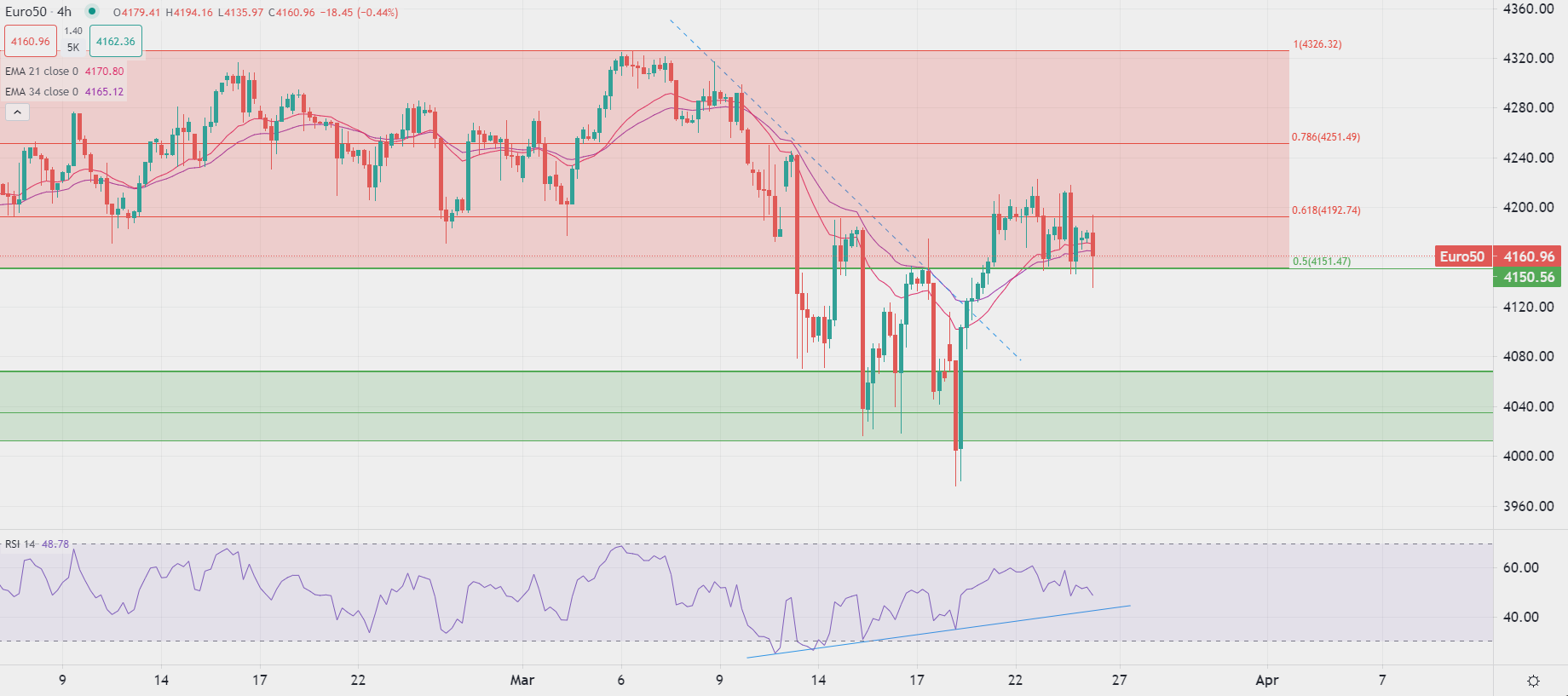

Stocks slid lower in Europe at the opening of the last trading session of the week, as lingering worries about the financial sector keeps pressuring market sentiment.

Despite US treasury secretary Janet Yellen’s reassuring speech yesterday, most investors remain cautious towards riskier assets and prefer to seek for safety while waiting for further development. Today’s bearish price action has also been brought by a batch of poor PMI data from France and Germany and disappointing GDP figures from Spain, that have sent benchmarks towards their first support levels.

However, even if global uncertainty remains, the fact major central banks have pledged to provide support to economies through an increase in liquidity to the financial sector, is likely to lift market sentiment on the short to mid-term basis. We see the current price action as a potential pull-back on newly registered support zones, before reaching new highs. The Stoxx-50 trades close to a major support at 4,150.0pts, weighed down by financial and energy shares, while both the RSI and moving averages remain bullish so far.

Pierre Veyret– Technical analyst, ActivTrades

Source: ActivTrader

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.