EUROPEAN SHARES

Stocks extended losses for a third day in Europe on Thursday amid rising uncertainty ahead of key macro data.

Risk appetite continued to fall after the downgrade of the US credit rating combined with the latest batch of mixed earnings reports sparked economic worries. Investors have seized the opportunity to limit their exposure to stocks while waiting for more bullish market drivers ahead of key macro data from the US and Europe.

While all eyes are likely to be on tomorrow's highly awaited US NFP, the focus of investors today is likely to be on the Bank of England's rate decision. While a 25 basis point rate increase is widely expected, there is still some speculation about the possibility of a more hawkish stance in the form of a 50 basis point rate hike, which has weighed on market sentiment.

Traders will closely scrutinise the speech of BoE Governor Bailey to glean insights into the outlook for interest rates and bond sales for the rest of 2023. While there is already speculation about a continuing hawkish stance due to stubbornly high UK inflation, investors remain cautious and await further clarity from the central bank.

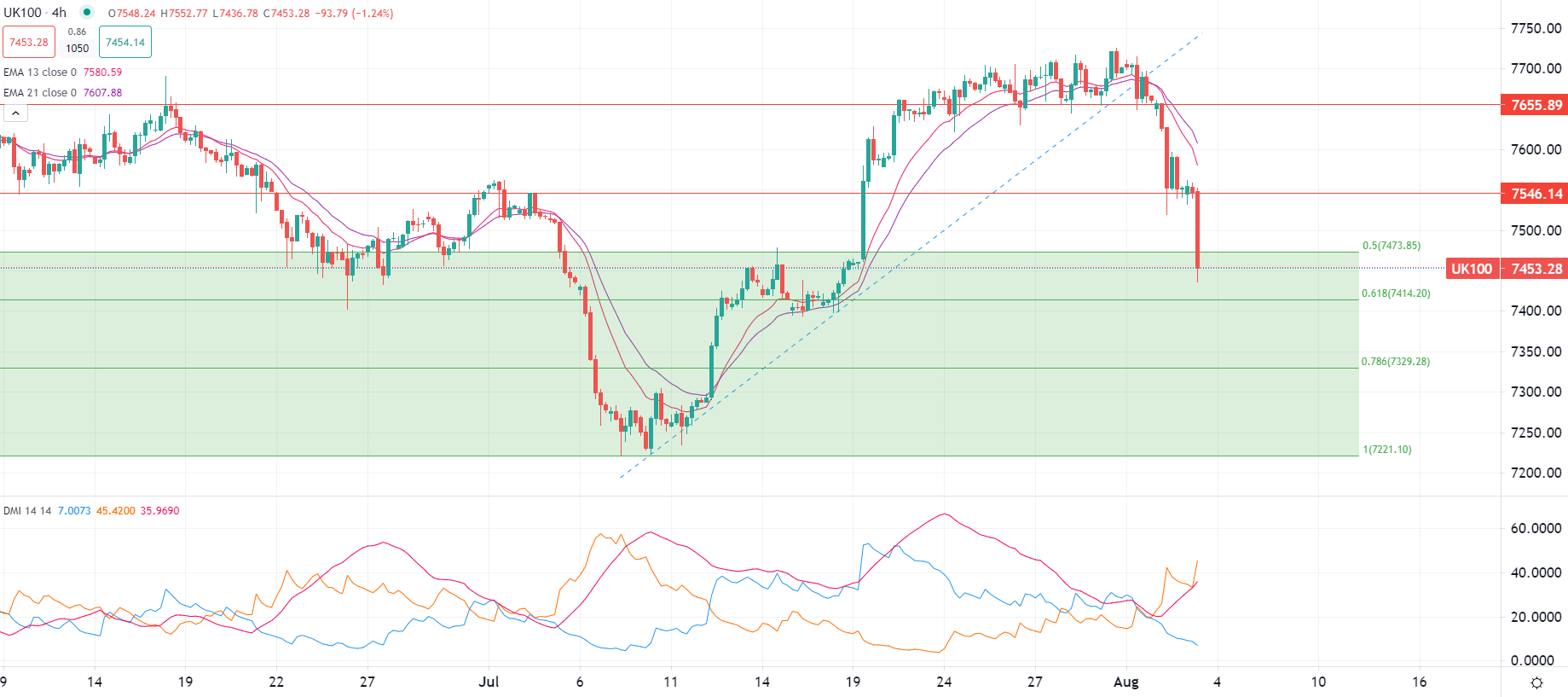

The FTSE-100 index is currently testing its 50% Fibonacci retracement at 7,474.0pts, in a sharp bearish price action since the appetite for stocks fell everywhere, and we expect market volatility to increase further with today's and tomorrow's macro announcements.

Pierre Veyret– Technical analyst, ActivTrades

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.