Two weeks ago, I decided that it was right to be bearish on Natwest Group NWG LN. As you can see, the price has been unable to move above a persistent downtrend line since mid-June and has rejected at that line on several previous occasions.

What happened next was like something out of a textbook:

The price tried, but failed to establish itself above the downtrend line drawn in magenta, and having failed there, it sold off sharply.

Falling by just under 40.0p, a move that is highlighted by the yellow box in the chart below.

What's interesting to note is that despite recovering from the July 2nd low, the stock price has been unable to reassert itself above 500p, a price point adjacent to the descending downtrend line.

Source:Barchart.com

I believe this was one of my best ideas during 2025 to date, particularly because it played out as I had anticipated, and did so within 48 hours.

This article isn't about that, though; rather, it's about whether it's right for me to expect further downside in the name. Or whether I should move on and look for opportunities elsewhere.

There is a question that every trader is likely to ask themselves at some stage, and that is whether they should follow their instinct and look for more, when a stock has had a big move. Or should they call it quits and move on?

The first thing I want to say is that you should never become emotionally attached to an idea, a story, a stock, or a position.

Learning to control or even to remove your emotions in, and from trading is something of a holy grail for traders. Because our emotions and emotional responses are ill-suited for trading, and can lead us into behaviours such as snatching at profits, running losers beyond their stop loss, and ignoring money management and position sizing rules.

When traders blow up their accounts, particularly newbie and novice traders, it's often because they have traded emotionally and have ignored their trading plan and rules .

The hardest skill to learn or develop in trading is the discipline to stick rigidly to a set of trading and money management rules.

Applying and sticking to those rules should keep a trader in the game for the longest possible time and expose them to the optimal number of trading opportunities.

Despite that, there will always be the temptation to circle back to an old idea/opportunity in the expectation of a further and or bigger move.

And the sell-off in Natwest on July 2nd is one of those situations for me.

Are there circumstances when it's right to take another look at a trading opportunity?

I'm going to say that the answer to that is yes, but they have to be pretty specific/compelling opportunities to bend the rules fo.

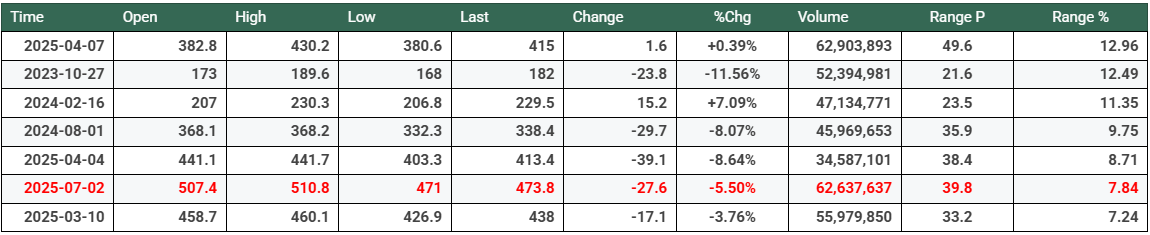

NWG LN Largest Daily % Range over the last two years

Source: Barchart.com/Darren Sinden

A statistical analysis of Natwest's High, Low, Open, Close data, over the past two years, tells us that the move/range, seen on July 2nd 2025, was a 4.57 standard deviation event.

That’s something we should see approximately once every 900 years, so it's a pretty infrequent event, although as we can see in the table above, moves of this kind are not alien to the Natwest share price, which is intriguing in itself.

So I am going to keep watching Natwest to the downside because it feels like unfinished business to me.

However, I will be doing so in the knowledge that I am doing that (at least partly), it’s because I want to be vindicated beyond the original downside move. And in part because, even though I am a great believer in not worrying about the “why it happened” in trading, preferring to focus on the “what happened” instead.

The July 2nd move was unusual enough to get and retain my attention.

But do you know what, I am not going do? I am not going to let it become an obsession.

There may not be a bigger downside move.

I may never find out why they fell 40p in a matter of a few hours on a single trading day, and if I don't get to the bottom of it, I will just have to accept that.

The market is like the tide running over a beach; eventually, even the best-built sandcastles are washed away, and only the flat sand remains, which is just how it should be.

Though, of course, beach goers still have their memories.......

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.