As we approach the end of the year, investors are thinking about the key investment themes that will dominate 2024 and how they can profit from them.

While there is a consensus that the monetary policy tightening cycle is nearly complete in most advanced economies, opinions diverge on the extent of rate cuts that major economies might undertake in the coming year.

Let’s delve into what to anticipate from the monetary policies of the 3 significant developed countries and take a look at some potential actionable insights for capitalising on each scenario.

The Fed might cut interest rates 3 times in 2024

During its latest monetary policy meeting, the American central bank decided to hold its key interest rates in the 5.25% to 5.5% range. Alongside this decision, the Fed also shared its latest economic projections.

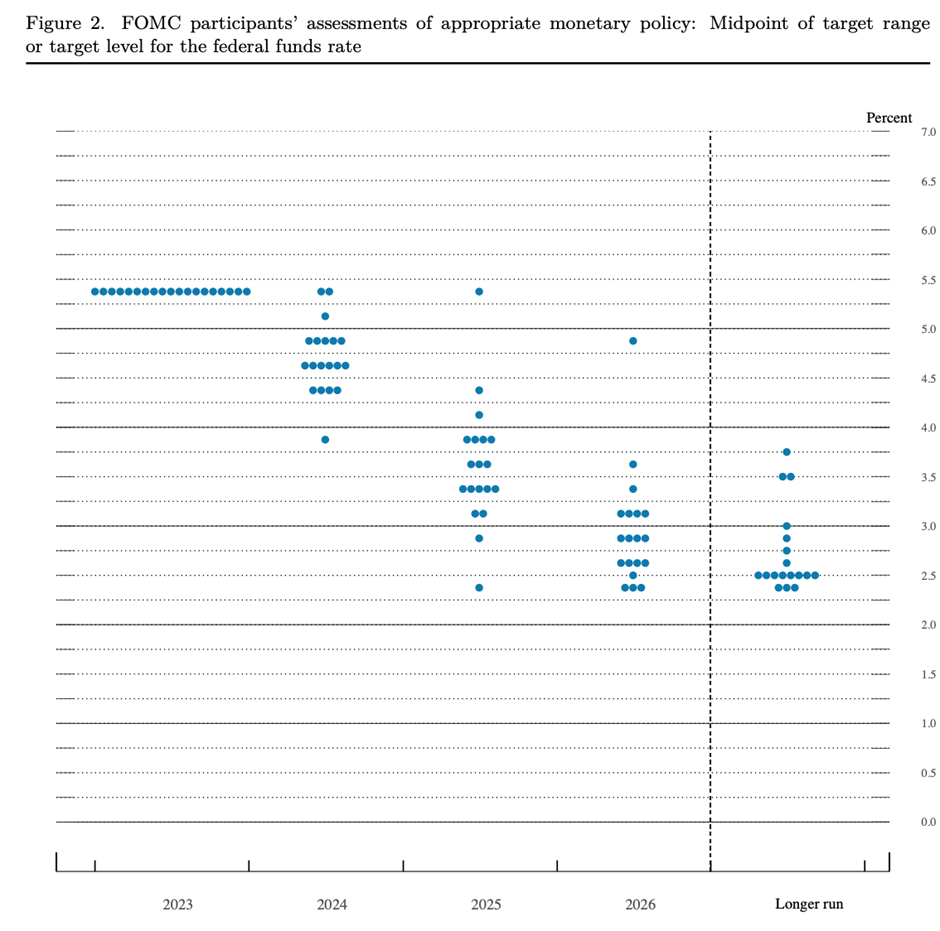

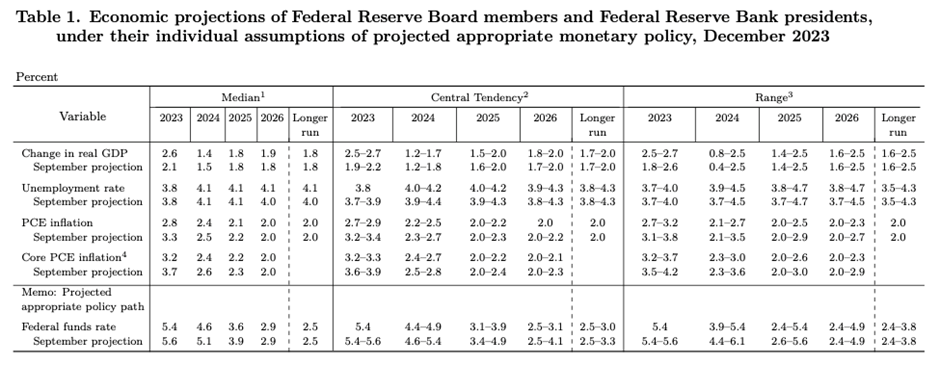

The widely recognized dot plots have revealed a notable adjustment with the median federal funds rate for 2024 now standing at 4.6%, in contrast to the earlier projection of 5.1% made last September, which implies an expectation of 3 interest rate cuts in the coming year.

Moreover, the median growth projection for 2024 has been revised to 1.4%, slightly lower than the previous estimate of 1.5% from last September, and the median Personal Consumption Expenditures (PCE) inflation projection for 2024 is now at 2.4%, down from the initial projection of 2.5% in September.

It is crucial to emphasise to both traders and investors that while the dot plots and economic forecasts presented by FOMC members offer valuable insights into the changing economic landscape and possible shifts in monetary policy, they essentially represent the opinions of Federal Reserve officials regarding their expectations for the upcoming year.

These assessments are not set objectives but rather reflections of individual perspectives, subject to various uncertainties. It is therefore essential to approach these projections with a degree of caution, recognizing that economic conditions can evolve differently than anticipated, and the actual outcomes may vary from these expressed opinions.

Jerome Powell underscored during the press conference the recurring phenomenon wherein the economy has frequently defied the expectations of both economists and market participants. This acknowledgment serves as a foundation for the Fed's commitment to data dependency, with a primary focus on monitoring key indicators of inflation, employment, and growth figures.

Despite the observed decline in inflation, Jerome Powell cautioned against prematurely declaring victory and acknowledged that it may take a long time for inflation to return to the central bank’s target of 2%. Over the year, the CPI rose 3.1% in November compared to 3.2% in October - a significant relief after its highest level since November 1981 reached in June 2022 at +9.1%.

Still, the Fed chair expressed the readiness of the Fed to implement additional monetary restrictions if deemed necessary. But he also declared that the Fed’s policy rate is likely at or near its peak in this tightening cycle.

This nuanced stance reflects the Fed recognizing the complex and dynamic nature of economic variables and emphasising a commitment to adjusting policies as needed to ensure price stability and maximum employment.

According to the CME FedWatch Tool at the time of writing, market participants believe that the first rate cut is likely to occur in March or May. They are 10.3% who believe in a monetary policy easing compared to current rates in January, 69.5% in March, 94.7% in May, 99.5% in June, 99.9% in July, and 100% in September, in November and in December 2024.

What should you focus on in the case of rate cuts?

An important factor to weigh when thinking about what to buy in times of rate cuts is to assess the broader context.

You should always distinguish between cutting interest rates due to recessionary concerns and doing so because inflation has either returned to 2% or is nearing that threshold, as the reason behind rate adjustments can significantly impact market dynamics and the effectiveness of certain investment strategies.

For example, investing in home improvement retailers or real estate-related companies becomes an attractive option when interest rates are in decline. The decrease in borrowing rates serves as a catalyst for the sector. As interest rates lower, the costs associated with borrowing decrease, creating a potential incentive for more individuals to invest in enhancing the aesthetics and functionality of their homes.

This favourable financial environment may also encourage professionals in the construction industry to undertake more projects, ultimately contributing to an increased demand for products related to home furnishings and essential construction materials.

In such a market scenario, home improvement retailers and companies associated with real estate stand to benefit from the heightened consumer interest in enhancing their living spaces. The potential surge in demand for home-related products and services can position these companies for growth and increased market share, making them appealing investment options amid declining interest rates.

Furthermore, the positive impacts of lower interest rates extend beyond the home-related sector to influence the broader realm of general consumer discretionary spending.

As the expenses tied to borrowing decrease, households experience an augmentation in their purchasing power. This newfound financial flexibility empowers individuals to redirect funds towards a wide range of discretionary expenditures, such as leisure activities, travel, dining out, entertainment, and the purchase of non-essential items.

As lower interest rates create an environment where individuals are more inclined to indulge in non-essential spending, it will contribute to increased economic activity within the general consumer discretionary spending sector.

In this context, businesses catering to non-essential consumer needs stand to benefit from the uptick in consumer spending with a focus on companies with strong financials and solid market leadership and reputation, as they are likely to offer interesting opportunities.

Another interesting option when interest rates are declining could be to focus on growth stocks like big tech companies, which heavily rely on borrowed money to support their growth.

As interest rates decrease, the cost of borrowing diminishes, providing tech companies with more cost-effective financing options. This financial advantage becomes a catalyst for sustaining their growth initiatives, whether through research and development, acquisitions, or other strategic investments.

Investors looking to capitalise on this trend may find growth stocks in the technology sector appealing, as they tend to exhibit resilience and innovation in response to evolving market conditions.

However, there are various other sub-sectors or sectors that investors may find intriguing, including cybersecurity, Artificial Intelligence, health, renewable energies, and more.

As we’ve repeated many times in our articles and guides, it’s always important to allocate time to thoroughly research potential investment opportunities within these sectors to identify companies operating in niche markets, possessing a stable financial foundation, and/or exhibiting strong leadership, for instance.

The ECB and the BoE are not talking about interest rates’ cuts yet

The European Central Bank (ECB) and the Bank of England (BoE) have taken a notably different approach to their monetary policies compared to the Federal Reserve. Both institutions have emphasised that inflation remains elevated, indicating there is ongoing work required to bring it back to their targeted 2%, thereby tempering overly optimistic expectations of rate cuts from investors.

In its second consecutive meeting, the ECB opted to maintain key interest rates at their current levels in December – the deposit facility rate at 4%, the main refinancing operations rate at 4.50%, and the marginal lending facility rate at 4.75%.

Despite a recent decline in inflation from its October level of 2.9% to 2.4% in November, as reported by Eurostat, the ECB anticipates a short-term inflation uptick and a more gradual decline in 2024.

The ECB's inflation forecasts project an average of 5.4% in 2023, followed by 2.7% in 2024, 2.1% in 2025, and 1.9% in 2026. Underlying inflation, excluding energy and food, is expected to reach 5% in 2023, 2.7% in 2024, 2.3% in 2025, and 2.1% in 2026.

Furthermore, the ECB has opted to "advance the normalisation of the Eurosystem’s balance sheet," indicating a shift toward tightening its monetary policy. This decision indeed suggests that all available tools for shaping the trajectory of the ECB's monetary policy are now in a "tightening mode".

With potential risks that could impede Eurozone growth or heighten inflation in the coming year, combined with current projections from the Eurosystem staff, ECB officials refrained from discussing any rate cuts during this meeting, deeming it premature at this stage.

Regarding the BoE, its Monetary Policy Committee decided to keep interest rates unchanged for the third consecutive meeting at 5.25%, but 3 members were in favour of a 25 basis point hike.

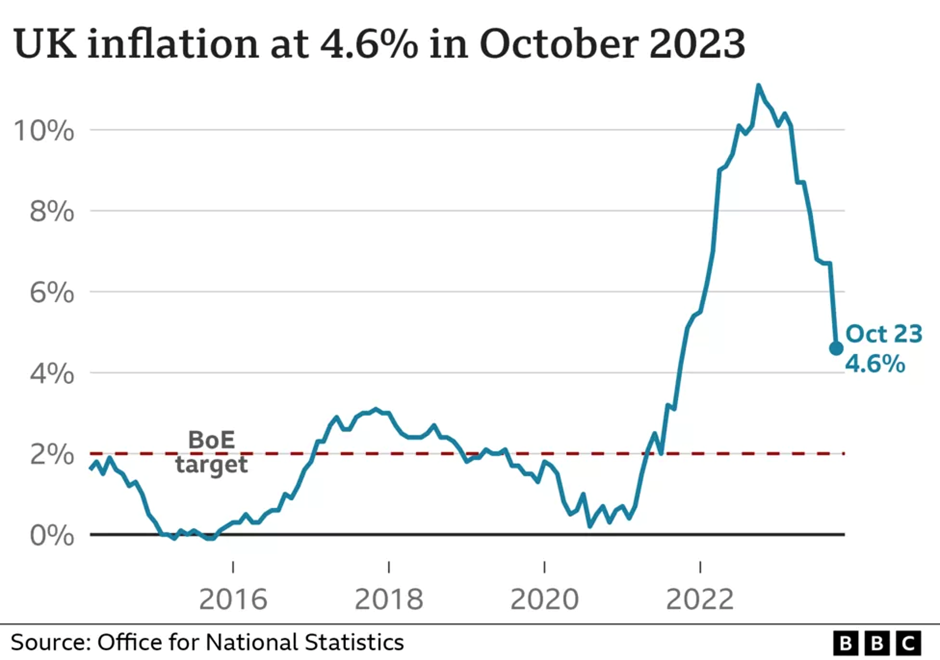

Even though the 12-month inflation of the CPI index went down from 6.7% in September to 4.6% in October 2023, it is still far from its target, mostly due to soaring food and energy prices, as well as elevated service price inflation.

Should inflationary pressures intensify, the central bank would escalate its monetary policy tightening. However, at present, the Bank of England declared that it anticipates maintaining a restrictive monetary policy over an extended period of time to reestablish inflation at its 2% target.

What should you focus on in the case of unchanged interest rates?

As both the ECB and the BoE are likely to keep their interest at current level, rather than cut them like in the United States, traders and investors could consider investing in assets that might benefit from currency high interest rates.

Financial stocks usually experience growth when interest rates are high, as they often exhibit increased profitability through higher net interest margins, which represent the difference between interest income earned on loans and interest paid on deposits. Additionally, financial institutions may exhibit strengthened balance sheets and improved earnings, factors that often appeal to investors.

Bonds could also be an interesting option if interest rates remain high, as they offer attractive fixed-income yields. In a highinterest-rate environment, bonds can provide investors with relatively high coupon payments with a relatively low level of risk, as they are generally considered a conservative investment vehicle.

This option is especially appealing to investors seeking stable income streams and capital preservation over time. Investing in bonds at the end of a tightening cycle could also be interesting if interest rates fall afterwards, as the prices of previously issued bonds will increase when newly issued bonds offer lower coupons.

If interest rates persist at their current levels over an extended period, it could introduce a sense of uncertainty regarding economic growth. In such an environment, investors frequently favour safe-haven assets like Gold, as they try to hedge against potential risks and market volatility. The precious metal is also known for its ability to preserve wealth over time.

Also, with the Federal Reserve leaning towards interest rate cuts, there is a likelihood of the U.S. Dollar (USD) weakening. This tendency typically lends support to Gold prices since international buyers would need to spend less money than previously for the same amount of Gold.

Lastly, it's important to note that various geopolitical risks could support the prices of the precious metal in the coming year. Developments related to the conflict in Ukraine, the armed tensions between Israel and Palestine, and the outcomes of numerous general elections scheduled for the next year (including those in the United States, Mexico, India, South Africa, Russia, etc.) are among the factors that may impact the precious metal market.

For more information about how central banks’ actions influence the different asset classes, read our guide Investing and Trading: The Role of Central Banks in your Asset Allocation.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.