ETFs offer a popular approach that allows for diversified investing or trading at a low cost. However, questions such as "why invest in ETFs" and "how many to own" need to be answered first.

This guide will look at the advantages and possible disadvantages of ETFs, and cover the different options on the market. You will find out how to choose an ETF that fits your goals and what to do to get started.

ETFs: What Are They and How Do They Work?

An exchange-traded fund (ETF) is an investment fund where a basket of assets is traded on stock exchanges. ETFs can be made up of assets such as stocks, commodities, or bonds. Many focus on a specific industry, sector, or geographic region.

In this way, investors can get broad exposure to the area they’re interested in, rather than having to invest in just one company’s stock or a single bond.

Why invest in ETFs? Our in-depth guide helps you understand everything you need to know about ETFs.

There are different ways to invest in an ETF, with the following being the main options.

- Purchase shares in an ETF directly on an exchange.

- Buy mutual funds from the fund company.

- Use an ETF CFD (contract for difference ) introduces the idea of speculating on the price movement of an ETF rather than owning the asset.

Using leverage makes investing in ETFs more volatile, which means this approach may be better suited to some traders than to others.

How to Invest in ETFs Through a Broker Like ActivTrades

The process of investing in an ETF is easy with ActivTrades. Start by signing up as a new user on the site and then choosing which platform you want to use. Don’t forget that you can carry out demo trading with virtual funds until you feel ready to deposit and use real money.

Follow the steps below to get started quickly:

- Select an ETF. This is where you look through the available options and choose the ETF that is right for you. Consider the assets included in each ETF and how they fit the kind of portfolio you have in mind.

- Analyse the performance. The best way to assess the performance of an ETF is to look at the market index it’s been designed to track or replicate. See how well it does this and whether the underlying index gives returns you’d be comfortable with.

- Understand the costs and fees. The spreads and fees of your chosen ETF need to be taken into account to understand how cost-effective it is.

- Look for the expense ratio. This figure tells you the annual fees you need to pay, while the bid-ask spread lets you see the difference between the buying and selling prices.

- Carry out a risk assessment. Are the underlying index and assets stable enough to suit your needs? You should also look at the asset liquidity to understand if there is a risk concerning any possible lack of liquidity when the time comes to sell.

- Buy an ETF. Open an account with ActivTrades and add funds, then place a market order or limit order to buy the ETF you want.

- Place a trade. If you want to go long or short with an ETF or ETF CFD, choose your margin and leverage on the platform. Don’t forget to use tools like stop-loss orders and take-profit orders to make sure that you close the trade at the right time.

Which ETF to Invest in Based on My Strategy?

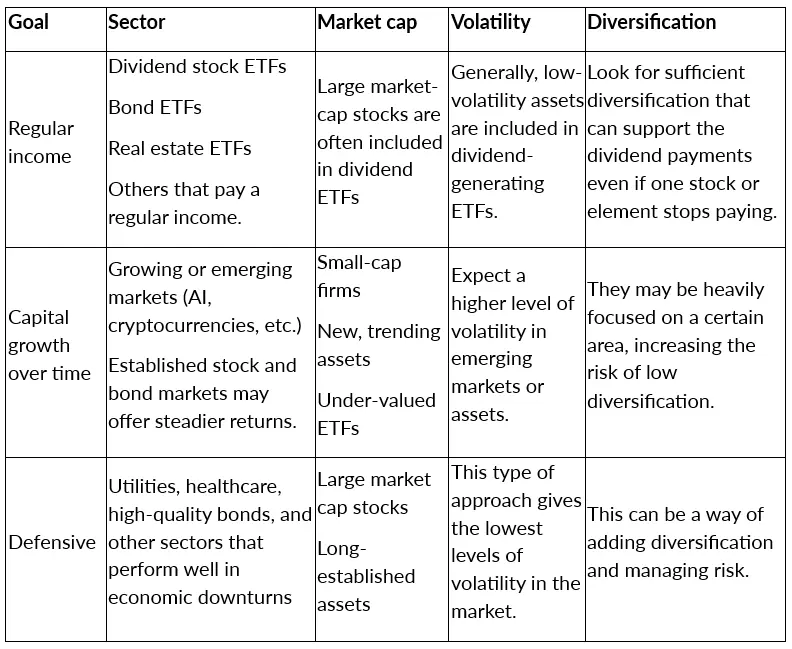

What ETFs should I invest in to get a suitable return? With many different options on the market, you must work out your goals and how you plan to reach them.

Different ETFs may suit you, depending on your investment and trading goals. By looking at three of the most common investment goals, we can see how different ETF types can help achieve them.

It’s possible to choose various investment goals, which could lead to you selecting different types of ETFs from the categories we’ve looked at. the SP 500 ETF covers the main US stock index, while the Gold ETF covers the value of this precious metal. The United States Oil Fund is based on the price of this commodity.

Yet, it’s likely that you have a main goal that you want to put most of your effort into achieving.

How Many ETFs Should I Own in My Portfolio?

Since it’s easy to buy and maintain ETFs, you might decide to choose more than one. This is fine, but what kind of limit should you put on the number of these investments that you take out?

By choosing just a few ETFs well, you obtain diversified investments without introducing over-diversification or redundancy. Over-diversification is a potential issue if you choose too many ETFs, as you might spread your money out too thinly over too many areas.

Redundancy means having several ETFs covering the same assets. You might find that the same company’s stock is included in regional and sector-specific ETFs. This may be more exposure than you would like. You might decide to introduce other assets to your portfolio instead.

Some new traders ask: “How many ETFs should I have in my portfolio overall?” Many investors decide to choose just two or three ETFs, which gives them exposure to major markets like global bonds, the US stock market, and international stocks.

Even experienced investors will typically stick to this sort of number, with possibly one or two specific holdings in other sectors they believe will grow. Newcomers may like to build their portfolio one at a time, rather than rushing in to buy several ETFs at once.

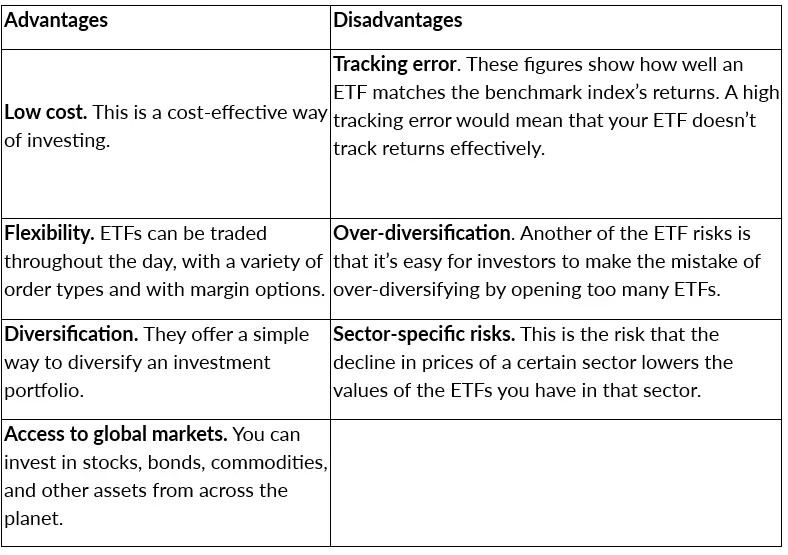

Advantages and Disadvantages of ETFs

What are the main benefits of investing in ETFs, and what potential drawbacks should you be aware of? This list of the pros and cons of ETFs covers the points you should be aware of before making your first move.

Why Are ETFs More Tax Efficient?

Tax efficiency is one of the main reasons investors decide to invest in ETFs. They’re designed to reduce taxable events, with low turnover and the “in-kind" redemption process that allows holders to redeem them for the underlying shares rather than a cash return.

If you’re wondering, “Should I invest in mutual funds or ETFs for tax purposes?”, ETFs are generally more tax-efficient because of the way they’re set up. However, index mutual funds that are passively managed with a low turnover may also achieve a high level of tax efficiency.

FAQs – Should I Trade ETFs?

Are ETFs Suitable for Long-Term Investors?

Yes, these financial instruments can be used to build a diversified portfolio that grows over time or provides regular dividends.

Can ETFs Be Used for Trading Purposes?

Yes, ETFs can be bought and sold during the day, allowing traders to try to spot price trends that they can profit from.

Does an ETF Require a Large Investment?

No, these funds are designed to allow investors to get started with a small amount of money, if that suits them.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.