What is swing trading, scalping in trading and day trading? These are all different ways of trying to make a profit from predicting the way the financial markets move. The three strategies mentioned each have aspects in common with one another as well as unique elements.

Traders can choose from various advanced strategies for both short and medium-term styles. Since they involve different risk levels and require varying amounts of skill, there are plenty of issues to take into account when deciding which one to use. We’ll be looking at all the different options to see when each one might be most suitable. This means looking more closely at the definitions, as well as the pros and cons.

Bear in mind that this guide to advanced trading strategies is solely for educational purposes only. Find out about day trading for beginners, how to start a scalp trading strategy and what swing trading strategies involve.

What Is Day Trading and How Does It Work?

Let’s start by looking at how to start day trading. Also known as intraday trading, this is where the trader buys and sells on the same day, looking to take advantage of any short-term price movements. The main benefit of day trading stocks and other assets is that there is no overnight risk, since the asset is sold before the day ends.

In terms of risks and challenges, this is a trading style that requires fast execution and a lot of discipline. High-risk decisions need to be made quickly, which can lead to traders making significant profits or suffering heavy losses in a short period. It needs a reasonable amount of time dedicated to it, since technical analysis is needed, and then some time needs to be spent carrying out the trades.

What is pattern day trading, and how does it differ from regular day trading? You might see this term used, but it doesn’t refer to a different kind of trading. Rather, pattern day trading is defined as when someone carries out day trading regularly, making several day trades over a short period. This type of trading is regulated by authorities in the US, but it can be carried out freely in other countries without any restrictions.

Scalping Trading Strategy Explained

What is scalping in trading, and how can it be carried out effectively? The second type of trading strategy is based on a high number of trades being carried out very quickly, with the aim of grabbing profits from small price swings. The trader might buy and sell an asset in a matter of hours, or even minutes.

A scalping strategy typically involves using tools like automated systems and technical indicators. When scalping stocks or trading like this in other markets, quick decision-making is vital. This fast-moving nature means that it’s a demanding type of trading that isn’t right for everyone. It requires a lot of time to get right, as traders need to analyse the market carefully before choosing the right moment to enter and then exit their trades.

What Is Swing Trading? Strategy Overview

A swing trading strategy is based on longer timescales than the previous alternatives. In this case, the trader hopes to benefit from swings in the asset’s price over days or weeks. This can be done by buying when the price is low and expected to rise, or by short-selling a price that the trader believes will fall. Ideally, the trade is then closed with a profit made.

Trend analysis is used to calculate which positions to open, looking at areas like price movements and current momentum. Support and resistance levels are crucial when analysing what swing trading strategies to use. It’s also worth noting that trend trading might sound similar to the other approaches, but this involves longer-term holding of assets, which could mean months or even years.

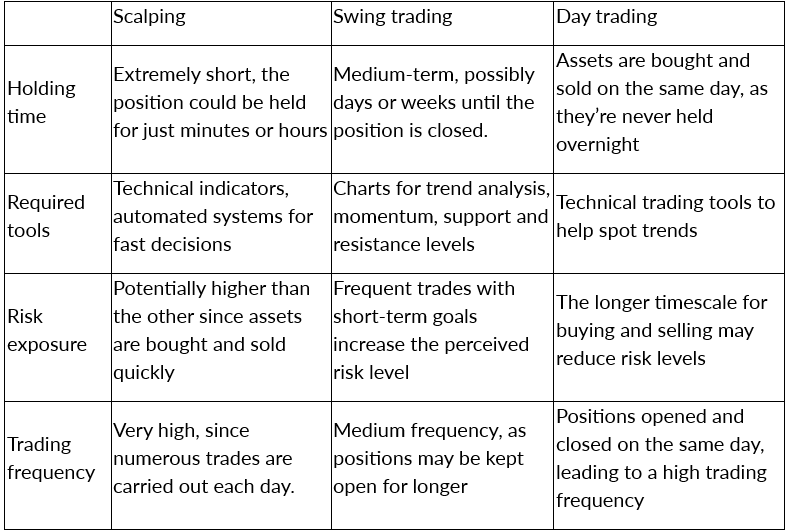

Scalping vs Swing Trading vs Day Trading: Key Differences

If we look now at the three different trading strategies, it’s clear that there are some major differences between them. These areas are crucial for helping traders work out which approach suits them best.

Knowing how they vary helps you choose which one is right for you. We can break down the main differences into the following areas.

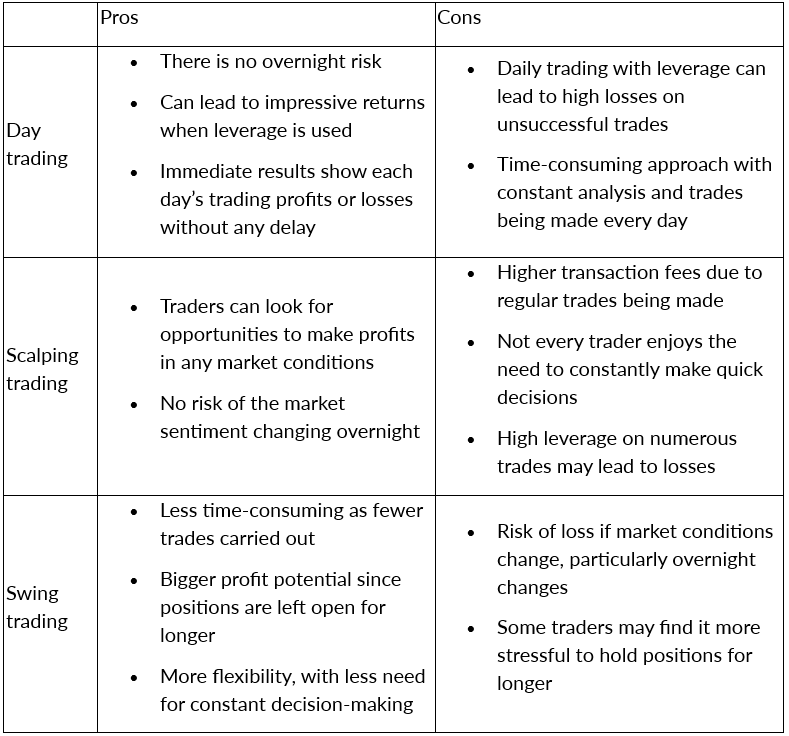

Pros and Cons of Each Strategy

Each of these trading strategies has a series of pros and cons we need to consider when working out which one to try.

Best Platforms for Day Trading, Scalping Trading and Swing Trading

All of these strategies that we’ve looked at can be carried out without any fuss on the various ActivTrades-supported platforms. These are ActivTrader, MetaTrader 4, MetaTrader 5, and TradingView. Each is suitable for different trading strategies and can support you when using these advanced strategies.

ActivTrader is an intuitive and flexible platform that provides access to many global financial markets, with over 1,000 CFDs and a selection of powerful tools. This variety means that it fits any of the strategies we've looked at, but may be particularly useful for swing trading, where you look for different assets to trade over time.

MetaTrader 4 is one of the most trusted trading platforms, regarded as a solid option because of its wealth of tools and high level of security. A variety of markets can be accessed on this platform, including Forex, commodities and indices. Day trading here is a solid option, thanks to the large variety of charts available.

MetaTrader 5 is an updated platform that retains many of the good points from MetaTrader 4 but adds extra features and tools to the previous version. It allows one-click trading, with real-time price delivery and rapid execution, which makes it ideal for the fast pace of scalping and day trading.

TradingView offers an alternative platform where the advanced charting tools let you choose from 12 different charts. You can then adjust the likes of time frames and spreads to get a fully personalised trading experience. This allows a sensible approach to day trading, where you need to be prepared and know when it suits you to open and close the position on the same day.

Day Trading, Scalping Trading and Swing Trading FAQs

Which Type of Trading is Best for Beginners?

Swing trading is generally considered to be more appropriate for newcomers, since it’s less time-intensive and can be carried out with fewer risks. However, you could look into scalping or day trading for beginners if you feel that these strategies fit your skills better.

Do I Need to Carry Out Technical Analysis for Day Trading, Scalping or Swing Trading?

Some element of technical analysis is generally used in each of these types of trading. Swing trading is arguably less intensive in this respect, since it requires a lower frequency of trades.

Is Scalping Trading a Full-Time Job?

For many traders, the time-consuming nature of scalping means that they carry it out as a full-time job. Yet, others see it as a part-time activity. Of the three main trading strategies we’ve looked at, a scalping trading strategy is the one that generally requires a greater time commitment.

Which Approach from Day Trading, Swing Trading or Scalping Trading Gives the Biggest Profits?

Each of these strategies gives traders the opportunity to make profits. The skill and commitment shown determine how successful they are. While scalping and day trading are based on a larger number of trades, swing trading involves fewer trades but with potentially large profits on each of them.

What Trend Indicators Are Used in Swing Trading?

Moving averages and volume indicators are among the key pieces of data that help make decisions on swing trading strategies. These indicators are used to work out the latest trends and momentum shifts.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.