De ja vu is the feeling that you have been in your current situation before, the sense that you have been there seen it, done it, even if you haven't. Is it the resurfacing of a long-lost memory or an echo of future events?

Well, it might be time to ponder on that, because we appear to have slipped back to 2021.

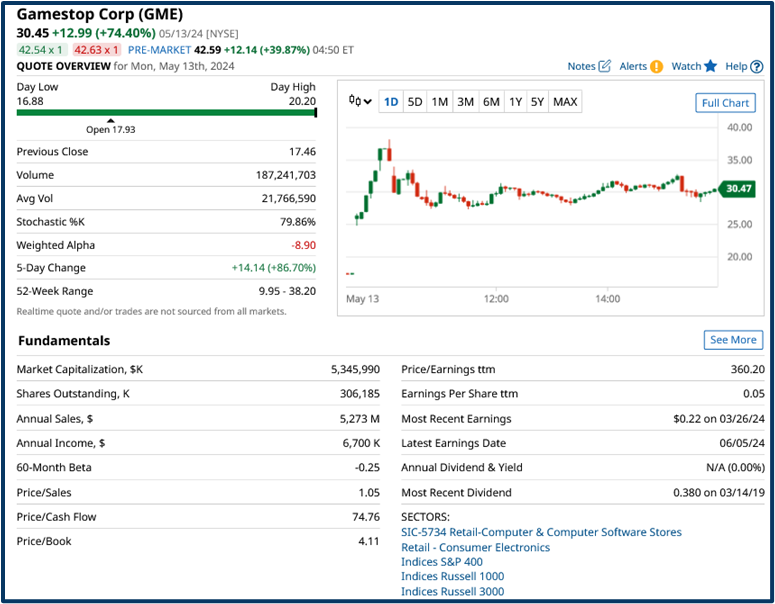

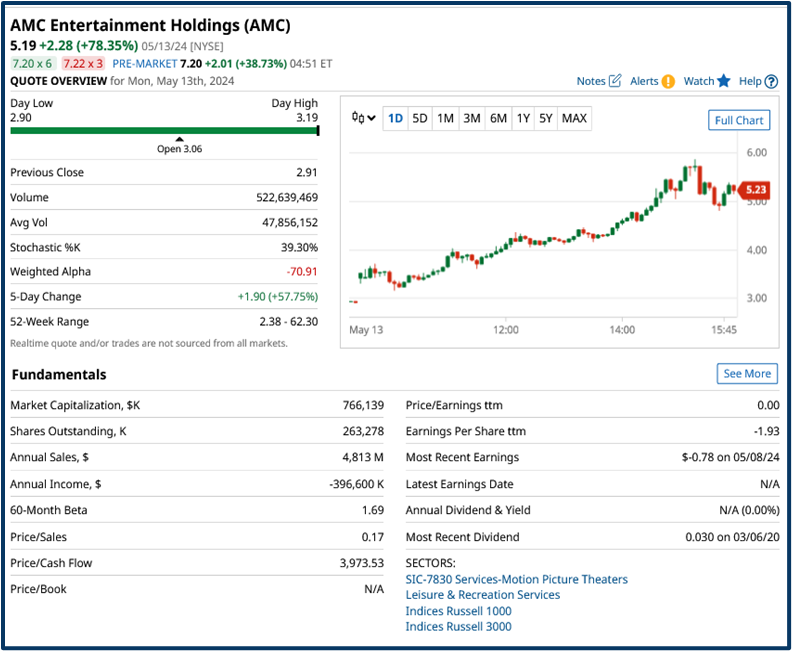

I say that because of the two stock quotes below which show Gamestop GME US and AMC Entertainment AMC US.

Source: Barchart.com

Both stocks experienced a +74.0% rally in Monday's session (13-05-2024) and each of them is up by around +39.0% in the pre-market on Tuesday.

Source: Barchart.com

Why?

Well quite simply one of the most widely-followed influencers, in the world of US stock trading, appeared on social media this week, after a couple of years of hibernation

Keith Gill, or Roaring Kitty as he is known, didn't post an in-depth analysis of the prospects for AMC or Gamestop, or comment on the state of the US economy.

Instead, he posted a picture of a man leaning forward in a chair.

An image that is itself a meme for the idea that things are getting serious or interesting.

It didn’t make much sense back in 2021 either, but it's hard to ignore the results.

Short Selling and Short Squeezing

Of course one of the themes of the original meme stock rally was the “crowd” taking on the short sellers.

These were often hedge funds and other professionals and institutions who had a bearish view on unprofitable and struggling businesses, like Gamestop, AMC, Hertz etc.

To some extent, these short squeezes became self-fulfilling as the publicity they garnered from both mainstream and social media, dragged in more retail investors driving the price of the meme stocks higher.

Of course, the short sellers often had deep pockets and weren’t initially deterred.

And if they held the nerve and maintained their solvency, then they stood a good chance of making money over the longer term. Though there were casualties among hedge funds on the way through.

Best Performer

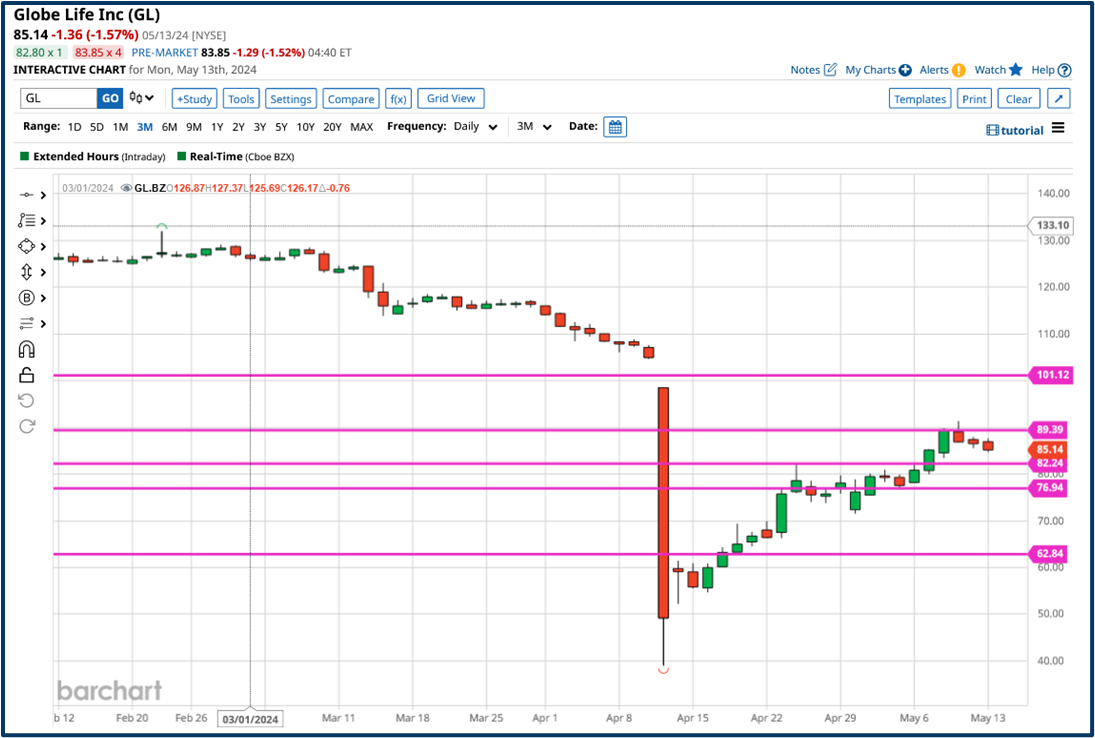

Interestingly the best-performing stock in the S&P 500, over the last month (as of the close on 13-05-2024) was a stock that had itself been subject to a short-selling raid from a firm calling itself Fuzzy Panda Research.

Who had allegedly uncovered evidence of malpractice and even fraud at the insurer, Globe Life GL US.

The Globe Life stock price plunged from $105 per share to less than $40.00 on April 11th when the news broke, see the chart below.

Source: Barchart.com

To be honest I have no idea whether there was any substance to the allegations made by Fuzzy Panda.

However the size of the subsequent downside move in Globe Life stock suggests there wasn't much pushback from other investors.

Opportunity is everything

To some extent, that's academic. Because what interests the trader is the opportunity that extreme price action can create.

In this case, a gap to fill $60.0+ above the then current share price.

In one of the trading discords I mentor in, I flagged the short-selling raid in GL US soon after the US Open on April 11th. At the time they were still trading just above $90.00

I mentioned the stock the next day as well saying it was “A perfect example of why it’s much harder to rally than sell-off.”

I also suggested that the GL US price action on April 11th had been “An excellent example of intraday momentum”

Given that the stock price had fallen a further -$50.00, even after the short selling news was out and highlighted.

Stock prices are subject to their version of “gravity” which can drag them down very quickly and prevent them from flying high again.

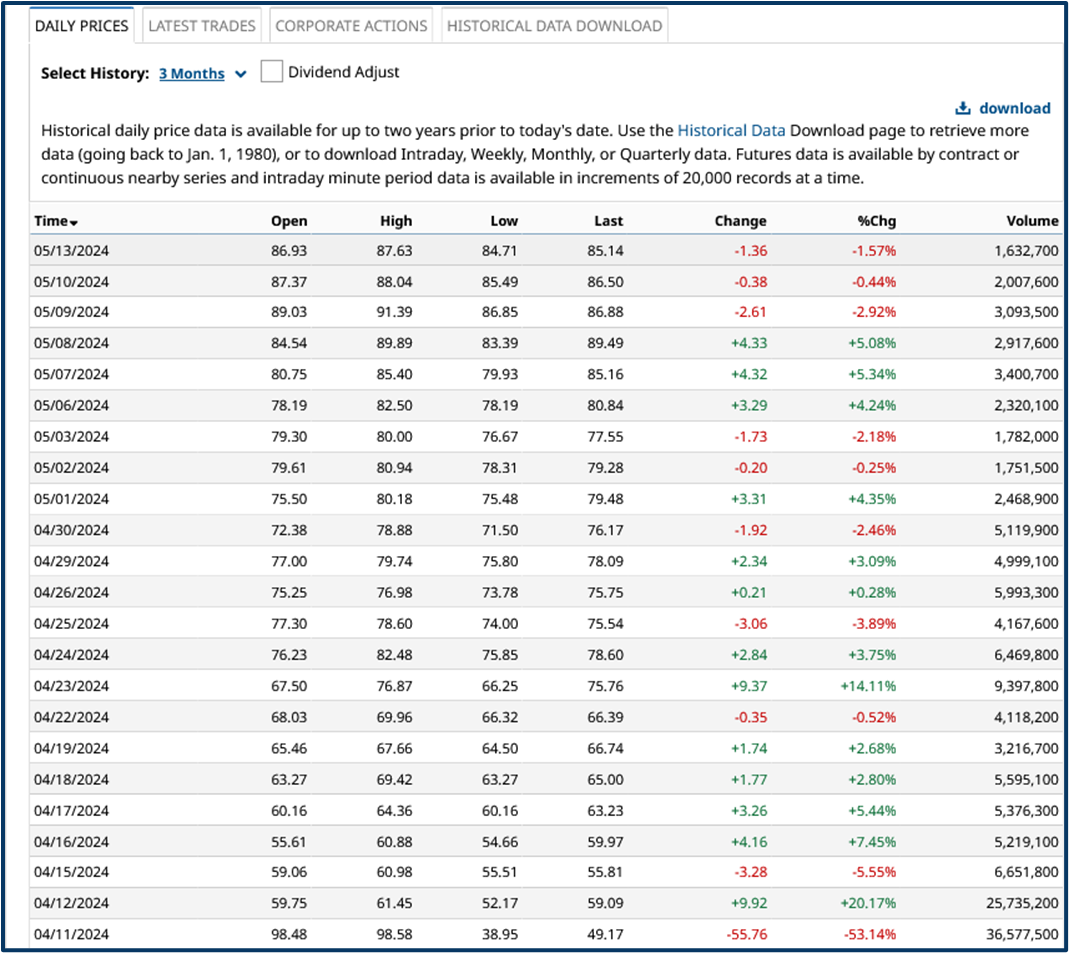

On the radar

Globe Life stayed on my radar over the next week, and caught my eye again on April 17th, as they “poked their head above the parapet”, as I put it in the chat.

That parapet was $62.00, a prior high on the 60-minute chart.

I also suggested having “half an eye on the stock for the dead-cat bounce”

An unpleasant turn of phrase to be sure, but one that reminds us that even lost causes can bounce back if they have fallen too far and too fast.

The table below shows the daily price action in Globe Life, over the period in question. They didnt rally in a straight line and their gains were far from uniform.

But rally they did, trading as high as $89.49 on the 8th of May

Daily Price Action GL US

Source: Barchart.com

What's the takeaway from all this?

Well, I think there are several:

● Firstly be pragmatic, not dogmatic as a trader. Go with the flow or momentum.

● Don't oppose a trend or look to pick tops or bottoms, rather wait for the market to tell you when a move is overblown.

● Don't be afraid to switch from longs to shorts or vice versa.

● Traders should be agnostic to direction, and focus more on momentum, volume, and changes in sentiment, which ultimately dictate price.

● Be mindful of the power that influencers and social media can wield in modern markets/society. But don't become a slave to them.

● Form your own view and be guided by what the price action does, and not just by what the chatbots and the memesters say.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.