“Quality is not an act it’s a habit”

That quote is attributed to Aristotle, the ancient Greek philosopher who lived more than 2300 years ago.

He was something of a polymath, who made contributions to many disciplines, including physics, biology, psychology and logic.

And he is said to have written two hundred treatises, or papers,of which just 31 survive today.

But was he right about quality?

Or more specifically does his comment about quality apply to the modern day equity market?

When we talk about quality in terms of markets and trading we are most likely talking about factor investing.

Factors can be thought of as investment styles, factors identify and then track the characteristics of groups of stocks that share certain behaviours or traits.

By identifying and quantifying these unique characteristics, it's possible to build better portfolios that should outperform, and or prove to be more resilient in times of financial stress, or that's the theory.

Quality is one such factor, other examples include low volatility, value, growth and momentum.

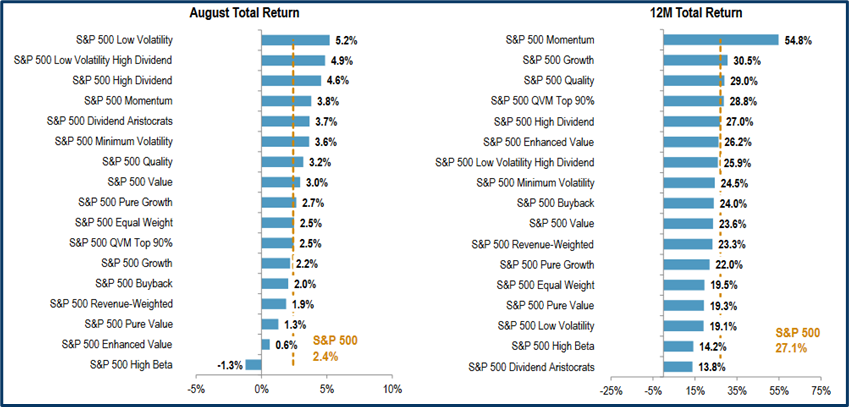

In the chart below we can see how these factors performed during August 2024 and the 12 month to the end of last month.

Source: S&P Dow Jones Indices

Outperformance

It's interesting to note that four factors have outperformed the S&P 500 over the last year, one of those by a margin of more than 100% which is an impressive feat, but also says a lot about what has been driving returns in US equities in recent times.

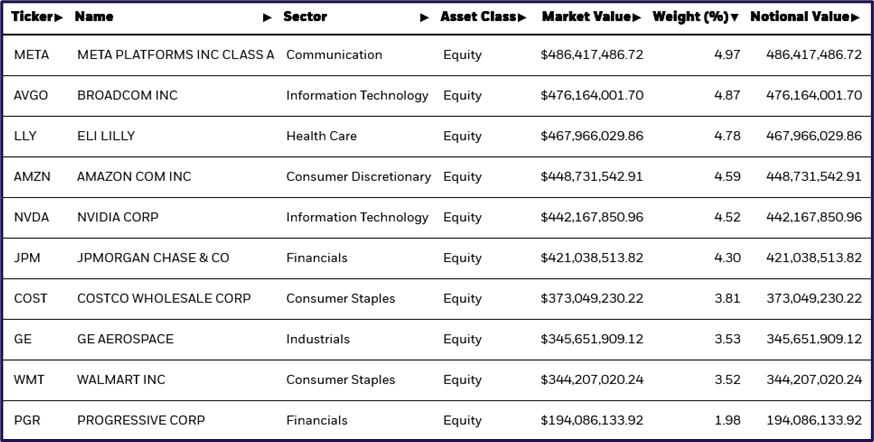

The table below contains the top 10 holdings of MTUM US, the iShares MSCI USA Momentum Factor ETF.

It’s perhaps no surprise to find the like of META , Broadcom Amazon and Nvidia in the mix here, but you might not have expected to find JP Morgan, Costco and Walmart in the list.

Source: iShares

The ETF has a total of 127 separate holdings among stocks that meet the momentum criteria.

Putting momentum to one side for a moment.

The quality factor was the third best performer over the 12 months to the end of August, and was one of the select few to outperform the S&P 500 in that time frame.

Albeit by a far narrower margin than momentum managed.

Banks are looking at quality stocks

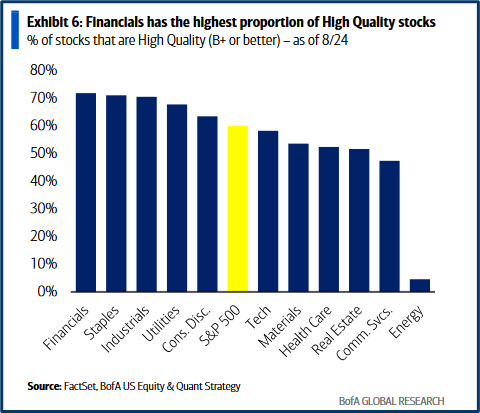

Strategists at Bank of America recently published a research note that made the case for quality stocks and the quality factor. Though they also shifted the goal posts slightly when they did so, to take account of the way markets trade in the 2020s.

Source: Bank of America Research

The bank’s strategy team highlighted the large number of stocks, that fit the quality criteria, to be found within the financials sector. See above.

And also flagged up that the Real Estate sector is also full of “quality stocks”.

With 70% of the sector’s market cap now falling into this designation, in the banks view.

Unlike with most factors, there is no hard and fast definition of what makes a quality stock.

However, to be considered, a company should have a low level of gearing, or borrowings, and a track record of consistent earnings, and they are likely to be a “safe, profitable, expanding and well-managed company”.

Sector performance

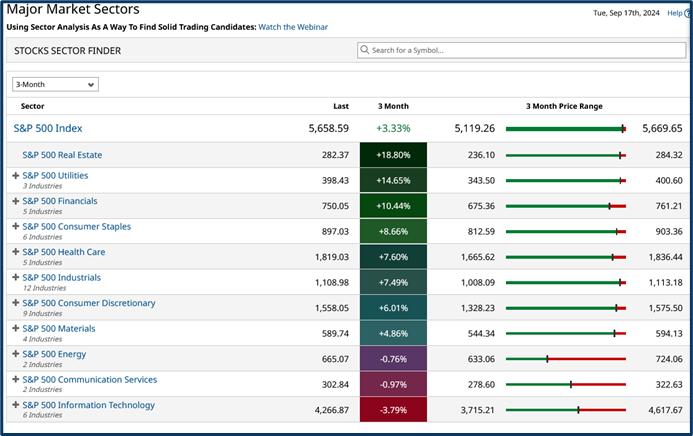

If we look at the performance of the S&P 500 sectors over the last three months.

We see that Real Estate has been the top performer adding +18.80%in that period whilst the Financials have risen by +10.44%.

S&P 500 Sectors 3-month performance

Source:Barchart.com

So could Bank of America be on to something?

History will be the judge of that over the longer term.

But, in the short term, as traders, we can perhaps try to leverage these ideas to highlight potential trading opportunities.

Here Is an example of the sort of thing that may be available to us

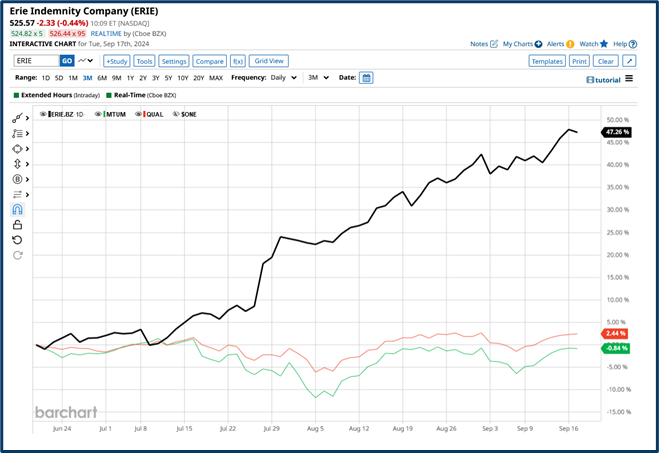

Erie Indemnity ERIE US is a stock that few people have really ever heard of, and yet it will join the S&P 500 on September 23rd.

The stock is holding company for a variety of insurance businesses, and as such it is in the financial sector and it qualifies as a quality stock.

Source:Barchart.com

The chart above shows the percentage change in ERIE US, over the last three months(in black). and plots that against the performance of MTUM US (green) and QUAL US (red), the momentum and quality ETFs.

Eire’s performance has blown them both out of the water.

What’s more a large proportion of these gains came after an MA crossover appeared in the Erie price action in mid-July, which is highlighted below.

Source:Barchart.com

So in theory in least it would have been possible to have identified the opportunity.

Retail traders enjoy few outright advantages over professional and institutional traders.

One advantage that we do have is flexibility, the ability to think outside the box, to look holistically at the market for opportunities, and to adjust our strategy accordingly. Which is just what this article is designed to highlight.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.