One of the best things about having a week away from the markets is that you come back with a fresh perspective, a clear/clean mindset, and a metaphorical new set of eyes, and a thought process that’s free of preconceptions.

You open up your trading platform and it's a blank canvas that’s waiting to be filled in.

That's what I did this morning when I wrote my first report since October the 9th, and as I looked down through my watchlists and charts I started to see contradictions within them.

Equities

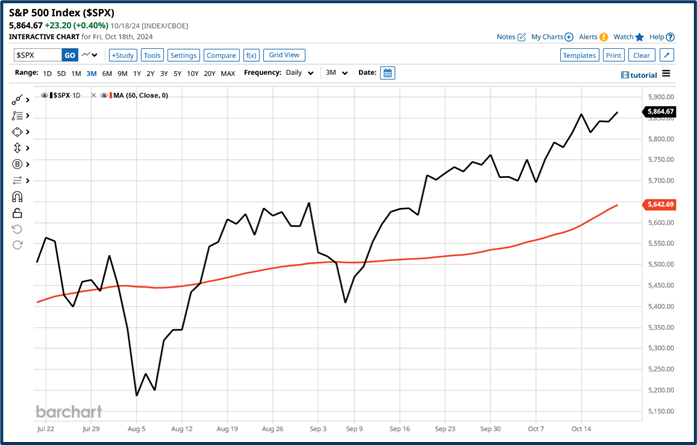

Let's start with the S&P 500 which is now trading with a 5800 handle and looks likely to test at 6000 before too long and maybe before year end. Earnings season is underway and by and large it's been positive so far, and stocks like Netflix NFLX and United Airlines UAL, have seen their share prices explode higher after beating analyst’s expectation.

Source: Barchart.com

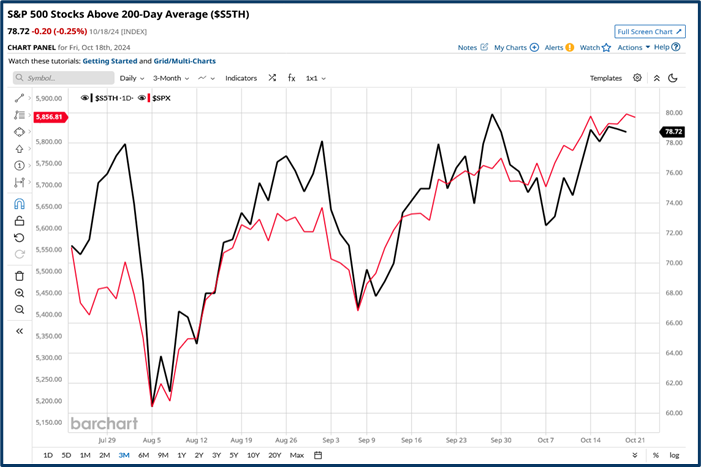

Some 79.0% of S&P 500 stocks are now trading above their 200 day MA line and in teh chart below we can see how that metric is closely correlated to the performance of the S&P 500 index itself. which is drawn in red.

Source: Barchart.com

Gold

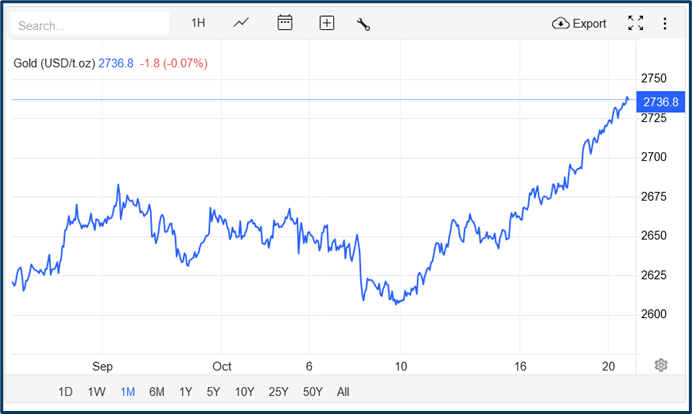

At the same time the price of gold has also been rising and is now around $2736 per ounce.

Gold has rallied by +4.40% since October 9th and is up by +14.0% over the last 3-months, which compares very favourably to the +6.43% gain seen in the S&P 500.

Source: Trading Economics

So that means that risk assets (equities) and safe havens are rising in value at the same time.

Which is unusual in a market that has spent much of the last decade flip-flopping between overtly Risk-on and Risk off behaviour.

The Dollar

The next chart to catch my eye was the Dollar Index, which in late September was testing back to 100 but which now looks comfortable around 103.64.

The narrative driving the dollar lower was that inflation was bested and the Fed would continue to cut interest rates.

Source: Trading Economics

A narrative that naturally weakened the dollar, because risk capital flows to where it can find the best returns.

And in FX that often means the currency with higher interest rates. You may recall that sterling rallied versus the greenback in September for that very reason i.e. differing interest rate trajectories in the UK and US. Though I note that cable is back at $1.30 right now

Interest rates

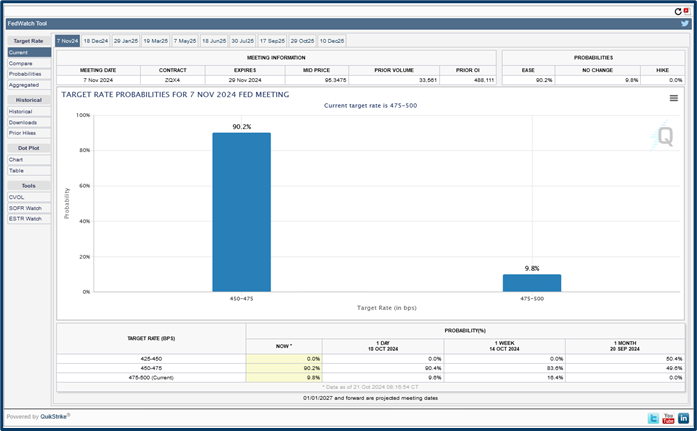

Let's turn to US interest rates. There seems to be little doubt that Jay Powell and his colleagues will cut rates at their November 7th meeting, with Fed Funds Futures pricing at 90.0% likelihood of a 25 basis point cut.

Interestingly there is no longer any sign of a second 50 basis point cutfrom the Fed, which was being touted in some quarters, just under a month ago.

Source: CME Fedwatch

The table below the chart, of rate cut expectations, above, shows us how quickly sentiment has changed.

On September 20th the market was pricing in a greater than 50.0% chance of another half a percent cut by the Fed, but by the 14th of October that had evaporated to 0.0%.

So US interest rates are coming down but the expectations are now for a more measured decent.

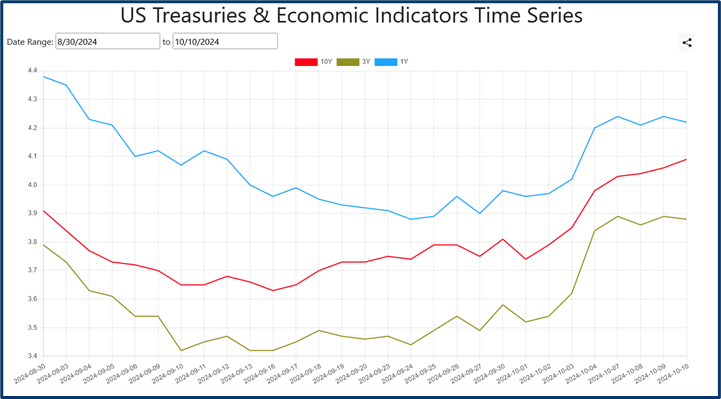

However that doesn't explain the next chart which shows the yield on selected US govt bonds. in this case 10, 3 and 1 year maturities.

Their yield is a representation of US govt borrowing costs over the term.

I note that all three of these rates have turned markedly higher during October, even as the market looks for further interest rate reductions from the US central bank.

Divergence like this is not a good sign.

Lower interest rates were meant to help ease the debt burden in the US.

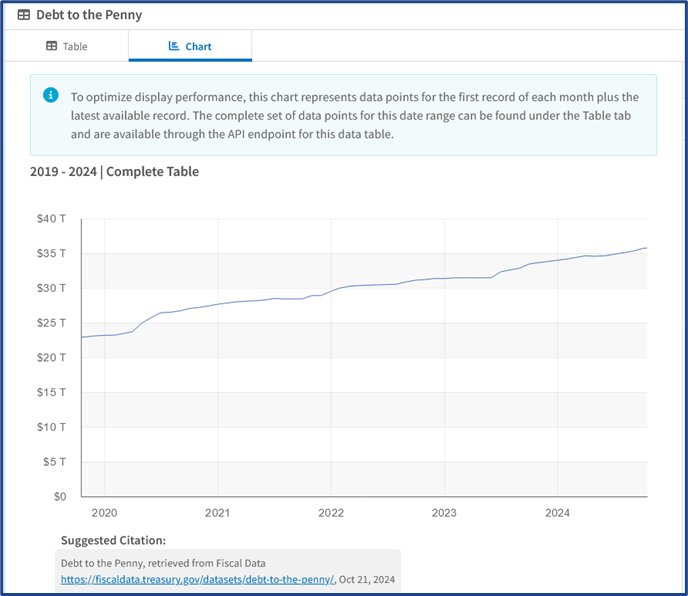

National debt in the US is on its way to $36.00 trillion and has risen by more than $11.00 trillion in just 5-years. The cost of interest payments on US government debt in 2023 reached $875.0 billion.

Source: Debt to the penny

What’s more US government spending shows no signs of slowing down, with the deficit (the difference between revenue and expenditure) in the fiscal year 2024 hitting a shortfall of $1.80 trillion.

Spending pledges have been made by both Republicans and Democrats in the the run up to the US election, on November 5th, and no one seems to be talking about dealing with the growing debt burden.

My takeaway from all this is that the markets are sending a warning signal.

Money is moving to safe havens such as gold and the dollar, as the bond markets signal that they want a bigger reward IF they are to continue to bankroll the US debt pile.

And the level of the reward, that the bond market demands, could continue to rise further, even as base rates in the US come down.

Simply because the risk of lending to the US government is growing in the eyes of the market .

Equity markets seem to be happy enough to look the other way right now. However, eventually something will have to give,

We are not going to see a US default, howevedr the new President might be inauagarated into a White House that's facing much higher borrowing and debt servicing costs.

Which could well clip their wings and leave them with much less room for manoeuvre, when it comes to spending and fiscal policy.

And none of that sounds like good news for equities to me.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.