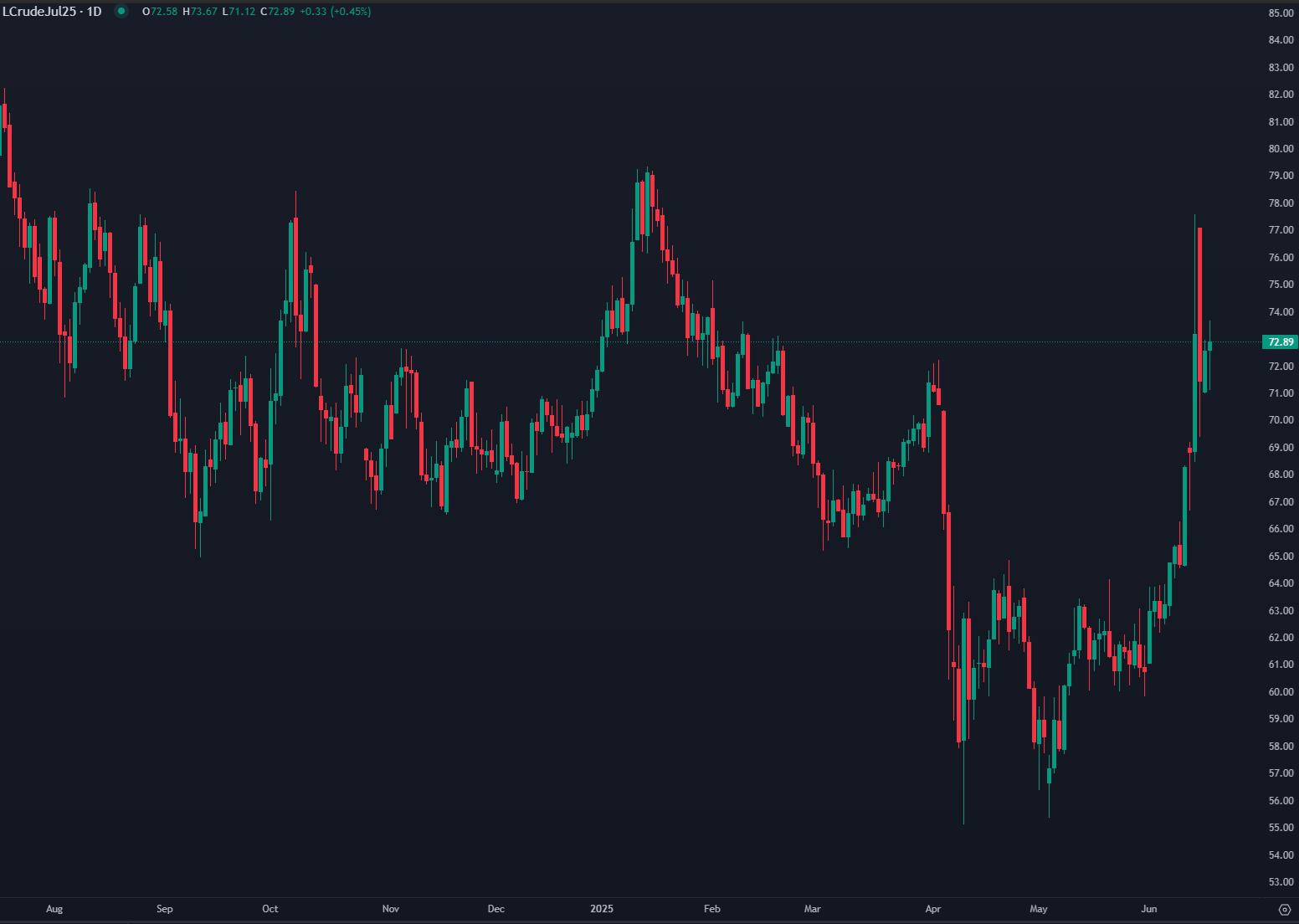

WTI oil prices climbed in early Tuesday trading, holding above the $70 mark at the start of the European session. The rise in prices reflects heightened geopolitical tensions following an escalation in the conflict between Israel and Iran, as Israeli missile strikes intensified, targeting public buildings in Tehran. Recent reports suggest that Iranian authorities may be open to negotiating a ceasefire, raising hopes of a de-escalation. This would ease market fears of a worst-case scenario — namely, the closure of the Strait of Hormuz — which could severely disrupt cargo flows, including oil shipments, from the Persian Gulf. Despite traders' reactions remaining relatively muted, today's gains in crude prices signal underlying uncertainty. The situation holds significant potential to cause widespread disruption, not only to global oil trade but also to the broader geopolitical balance. In the event of further escalation, the oil price could rise considerably more.

Ricardo Evangelista, ActivTrades

Source: ActivTrader

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.