The second reminder from the market this week has been about opportunity costs.

Opportunity costs are the things we have to forgo, if for example, we are fully invested in the market or we are looking elsewhere, when trading opportunities present themselves.

It's been all too easy to focus on US markets in recent weeks, as the Magnificent 7 and other tech-related names, lead the market higher and suck in investors cash.

It’s also been too easy to fall under the spell of the likes of Nvidia and AMD and to blot out pretty much everything else.

And if I’m honest even when I have been looking for alternates, I have still found myself focusing on the US a ignoring the UK and Europe.

Costly oversight

Being blinkered wasn't just an opportunity cost it was a mistake. And an expensive one too.

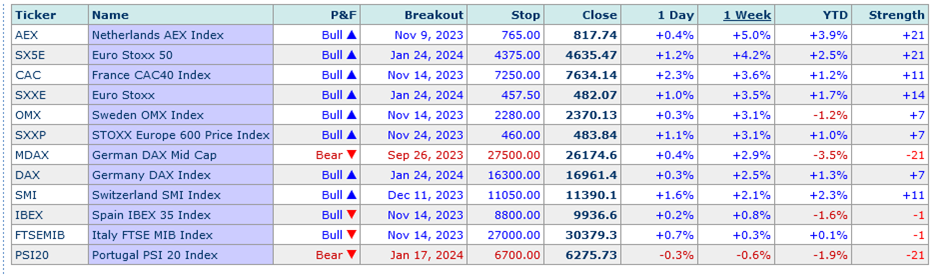

We can see that, in the tables below which show the performance of leading European equity Indices, ranked by weekly % change, descending.

Source: Investors Inteligence

And, the constituents of the Dutch AEX index, also ranked by weekly % change, descending.

Source: Investors Inteligence

Not in the limelight

European markets have had much less publicity over the last 12 months than their US peers. And the temptation has been to look at poor economic data from across the continent, and the sombre pronouncements of the ECB, and conclude that all is doom and gloom.

And though that may be the case at a domestic level, many of Europe’s leading companies are exporters, who are not reliant on the EU for much of their revenues.

And many of these are doing very nicely thank you a prime example is ASML, which makes machines that are critical to silicon chip production, and which reported earnings last Wednesday, since when they have rallied by more than +14.0%.

A move that helped to kick start a +5.0% rally in the Dutch AEX index

Source: Investors Inteligence

Tunnel vision

Although I usually encourage traders to focus on, and concentrate their trading, in instruments that they know, and watch regularly, that can mean missing out.

And to some extent I am kicking myself for doing just that, because I noted and commented on the ASML earnings, in the trading discords I mentor in.

However, I did so in the context of the US markets, rather than considering what they would mean for the AEX index.

A case of tunnel vision if ever there was one.

The bullish update from ASML, and the price action that followed, was a no brainer.

As was the knock on to the AEX 25, in effect this was free money gone begging.

I won’t be making that mistake again, and I will regularly be looking beyond the US markets from now on.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.