FOREX

The US dollar regained the front foot during early Thursday trading, following the trajectory of rising Treasury yields. Also offering support to the greenback were the words of Neel Kashkari, a senior Fed official, who hinted at a 50 basis points rate hike in March. Later today we’ll have the release of eurozone inflation figures, and those are now the main focus for currency traders. Recently released data from France and Spain showed an unexpected acceleration in the rise of consumer prices, which some see as an omen for the wider numbers being released later Thursday. A higher-than-expected inflation figure could strengthen the euro and support the belief that the European Central Bank (ECB) may need to increase interest rates more than initially anticipated.

Ricardo Evangelista – Senior Analyst, ActivTrades

Source: ActivTrader

EUROPEAN SHARES

EU shares fell back on Thursday, following the bearish global trend for equities as risk aversion prevails. investors have become increasingly risk-averse due to the uncertain short- to mid-term economic outlook and prospects of tighter monetary supply globally, and are taking cash out of riskier assets.

Although hawkish stances from central banks are getting well priced-in to the markets now, investors who were initially expecting a quick pivot on rates are now struggling to assess the impact of higher rates for a longer period on corporate profits and the economy as a whole. That said, the macro front is likely to remain dominant, and many are awaiting today’s CPI release in the Eurozone as well as the minutes of the last ECB policy meeting, which could bring even more volatility to both equity and FX markets.

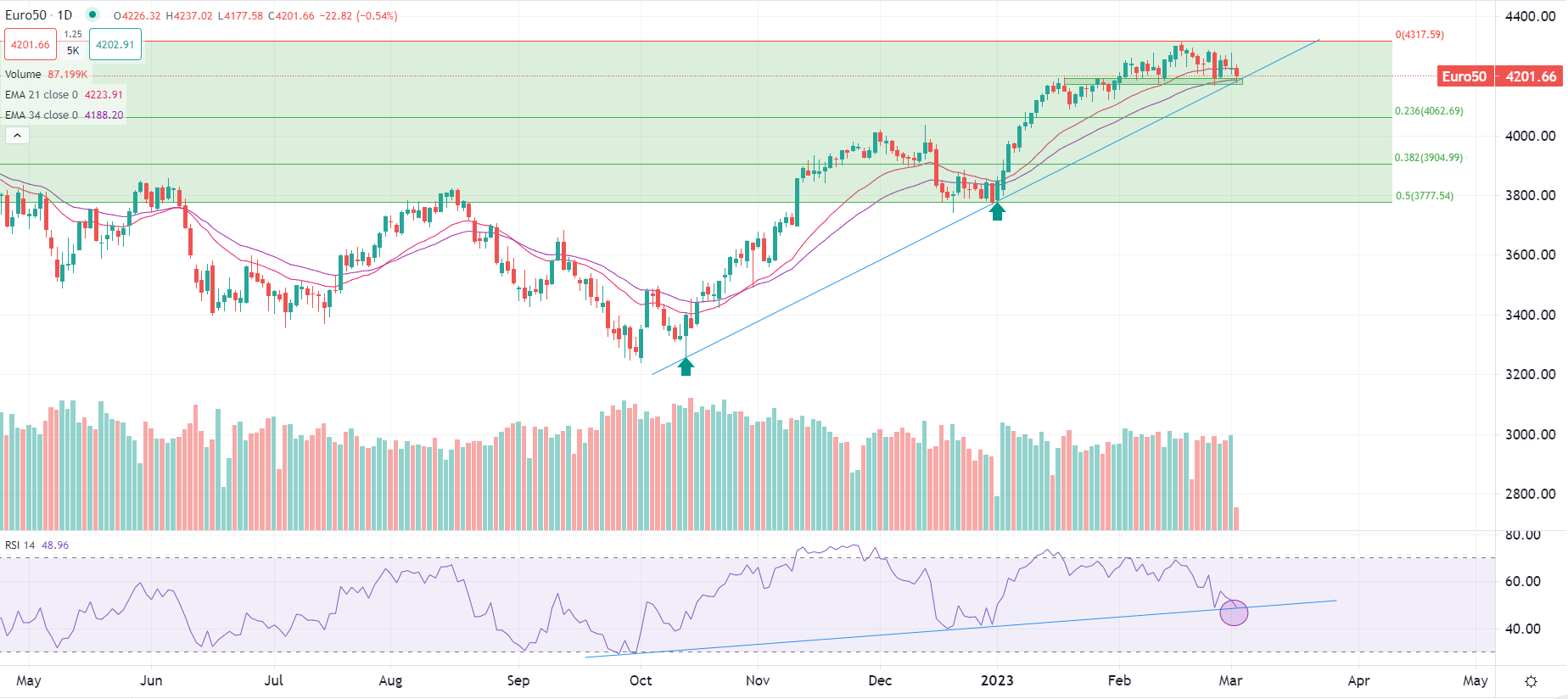

The STOXX-50 is testing its major support zone around 4,200.0pts where a break-out could become significantly dangerous for prices as it would invalidate the mid-term bullish run started in last October.

However, with still bull traders defending this zone, no anticipated breakout is shown by the RSI indicator and volumes remaining unusually low for a breakout, and we don’t see this as the most likely scenario from a technical point of view.

Pierre Veyret– Technical analyst, ActivTrades

Source: ActivTrader

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.