Macroeconomic data is the lifeblood of the FX markets.

FX is traded in pairs, FX rates value one currency against another.

If the market favours currency A, then that will increase in value, at the expense of currency B.

True, capital flows from international trade, and other sources, can affect FX and currency values.

However, the biggest driver in FX markets is sentiment, and the principal driver of that sentiment is macroeconomic data.

Disparities in economic performance, interest rates and other key indicators, such as employment and inflation, inform traders' opinions about the prospects for a currency.

Moreover its not just the headline data points that matter.

The rate of change in a data point and whether that change tallies with the market’s expectation are also crucial.

Deviations from those expectations can create significant price swings.

Particularly where interest rates, inflation and employment data are concerned.

The macroeconomic calendar

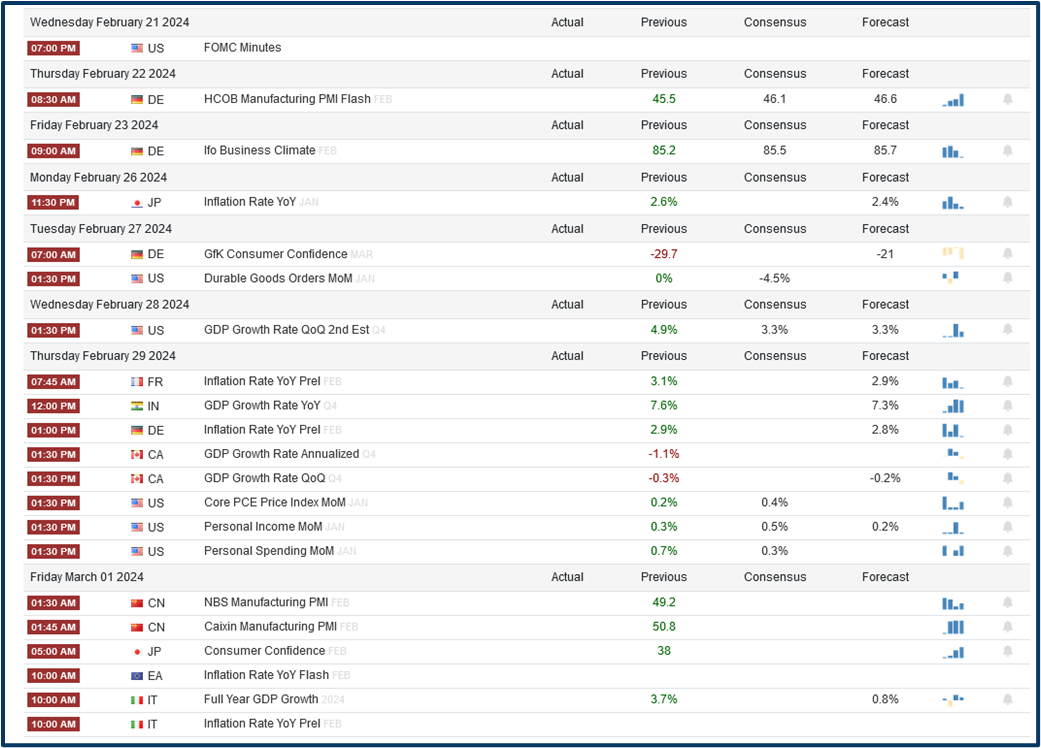

Macroeconomic data is released in a known schedule, that forms the macroeconomic calendar.

The calendar can contain hundreds of anticipated releases, however there is a hierachy among the data which are typically rated as low, medium or high impact.

Factors that determine a data points rank, include, the size of the economy that’s reporting thae data point, and the historic sensitivity of the FX market, to previous releases of the data.

Surpisingly there are also trends in macroeconomics data points, which swing in and out of fashion among traders.

For example, inflation data has been in vogue over the last 12 to 18 months, as the market has factored in the peak of the interest rate cycle, and the possibility of future rate cuts.

High Impact data tends to be the most widely followed and top of that tree are the monthly US employment situation or Non-Farm-Payrolls reports.

Non-Farm-Payrolls records job creation rates, average earnings, hours worked, and the employment and unemployment rates.

The data is released monthly in arrears, typically on the first Friday of the month. Though that can sometimes var,y based on how US public holidays fall.

An example of the macroeconomic calendar- filtered for high impact data from major economies

Source: Trading Economics

Macroeconomic data is the beat of the FX Market

In the fast-paced world of FX trading, where currencies dance to the rhythm of global economic forces, macroeconomic data sets the beat, helping to guide market participants about future trends in the ebbs and flow of an economy.

This data, encompassing a wide range of indicators like inflation, GDP growth, unemployment, and trade balances, business activity surveys and more.

And it provides valuable insights into a nation's economic health, ultimately influencing the value of its currency.

Understanding the link between currencies and their underlying economy

Currencies are said to reflect a country's economic health. Its FX rates, and their movements, show how that economy is performing, and how itis viewed by the market, relative to its peers.

Robust economic data, characterized by strong GDP growth, low unemployment, and stable inflation, typically translates into increased demand for a currency, bolstering its value of the foreign exchnages.

Conversely, weak data, can be indicative of economic sluggishness or instability, and that can trigger currency depreciation, as investors seek safe havens and less risky assets elsewhere.

Central Banks and interest rates

Central banks play a pivotal role in shaping the economic landscape through the use of monetary policy tools, most notably interest rates.

By adjusting interest rates, they aim to steer inflation and economic growth towards their desired levels.

Market participants anticipate data releases for any clues about the the likelihood of any central bank intervention, and or, interest rate adjustments.

This is because interest rates play a significant role in currency valuations. Higher interest rates tend to attract foreign investment, strengthening the domestic currency as demand rises.

Investor Sentiment the ebb and flow of confidence

Macroeconomic data can sway investor sentiment towards different currencies.

Positive data releases, that paint a “rosy” picture of a nation's economic prospects, will likely instill confidence in its currency, attracting foreign investment/capital flows, which should push the value of the local currency higher.

On the other hand, negative data, that raises concerns about economic challenges, can trigger risk aversion among investors. Prompting them to sell the local currency and look for safer assets elsewhere, driving down the value of the local currency.

Risk on and risk off flows are a reflection of these changes in market sentiment.

A stream of new information in a dynamic market

Through the analysis of data releases and their potential effects on exchange rates, traders can identify potentially lucrative trading opportunities.

For instance, a stronger-than-expected inflation report might signal an imminent interest rate hike by the central bank.

Traders could buy the currency in question, in anticipation of rate rises , potentially profiting from any appreciation seen ii the currency, as expectations of interest rates rises increase.

As the old market adage has it “buy the rumour, sell the fact”

Trying to stay ahead of the curve

FX markets are dynamic and ever evolving, as such, staying informed about upcoming data releases and their potential implications, is an important part of a trading strategy.

In fact, many traders plan their trading week around the calendar of data releases. Combining That schedule with technical, and or fundamental analysis, and plan their strategy accordingly.

Traders that have a plan in advance of key data releases, may find it much easy to navigate the complexities of the FX market, and to do so with greater confidence.

Not being taken by surprise, or at least having an expectation about what a surprise would look like, and what it could mean for particular FX pairs and crosses, can make taking informed trading decisions that much easier.

Shooting from the hip, or making kneejerk trading decisions rarely works in FX markets, in my experience.

After all as the popular military maxim has it “failing to prepare, is preparing to fail”.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.