I often talk about looking for signals and listening to what the market is telling you. before acting. Particularly around trade entry and exit, and trend changes- rather than blindly jumping in or out of a trade.

Sometimes it can be difficult to separate the signal from the noise, and even if you can you still need to interpret the signal correctly.

However, on other occasions, the story just writes itself. You don't have to think too hard about what the market is saying because it's right there in front of you.

Arming Yourself

Take the conversation that I had on Tuesday ( 20-01-2026) with a member of the Idea Factory, who trades an opening range breakout strategy, via options.

I highlighted Ulta Beauty ULTA US as a potential candidate for the strategy.

He responded that options prices in $600 stocks are such that it's “super hard “ to trade them.

Taking that on board, I cast my net a bit wider, looking for something with a lower price and momentum

ARM Holdings ADR, ARM U,S jumped right off the page at me.

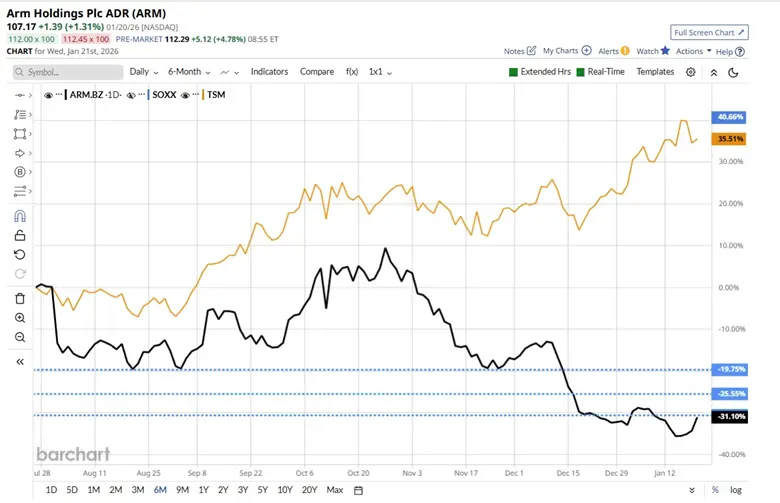

The chart below shows a long-standing downtrend in the stock price, and a recent move above that downtrend line. The stock was up +4.0% in the pre-market and testing towards horizontal resistance.

Source:Barchart.com

What’s more, ARM had dramatically underperformed its peers.

For example, in the chart below, we see ARM in black, vs SOXX, the iShares Semiconductor ETF, in blue.

ARM is down -31.0% while SOXX was up +40.0% over the preceding 6-months.

Source:Barchart.com

It's a similar story when you compare ARM with another well-known “agency” stock in the semiconductor space. Taiwan Semi TSM US had outperformed ARM by +66.0% in the period under observation.

Source:Barchart.com

It was abundantly clear to me that ARM was likely to play catch-up, and as we can see below, that process has started.

ARM closed up by +6.30% on Tuesday and was up by a further +6.61% in the pre-market on Wednesday.

Source:Barchart.com

More obvious than not

In fact, recently there have been plenty of examples of the market intimating what’s coming next.

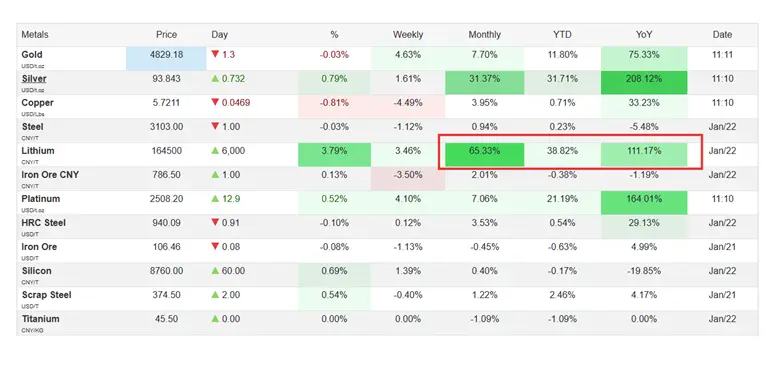

A case in point is Lithium refiner Albemarle ALB US.

The clue about Albemarle was written in letters that were 2 meters high- so it was hard to miss.

Though I am sure that plenty of people managed to do so.

You can see that clue in the table below, highlighted in the red box.

Which captures the monthly, year-to-date, year-over-year percentage change in Lithium prices.

Source: Trading Economics

I am sure you recognise a breakout when you see one

Source:Trading Economics

Source:Barchart.com

Albemarle's new price highs

Source:Barchart.com

Copper plated

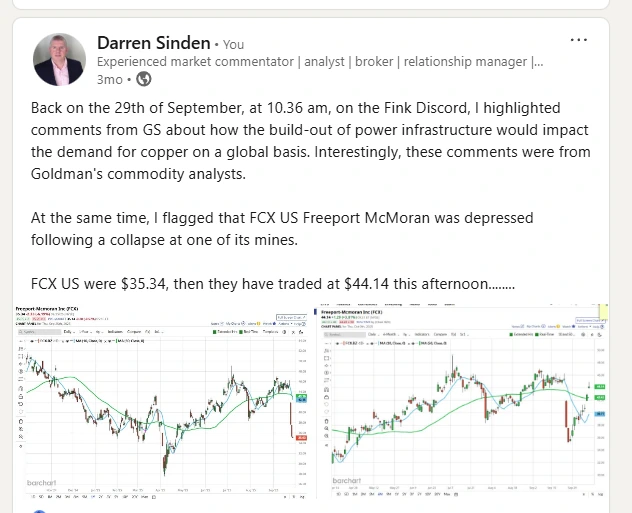

We can see a similar story in Freeport Mcmoran FCX US, one of the world's biggest copper miner,s which has rallied by 45.0% since I highlighted the stock back on December 1st

Source:Barchart.com

However, the story had been in play since September, as the LinkedIn post below shows.

Source: Darren Sinden / LinkedIn

We can see one of the major drivers for the re-rating of FCX US below. And that is the rally in copper since early August 2025.

Source:Trading Economics

Market Intelligence

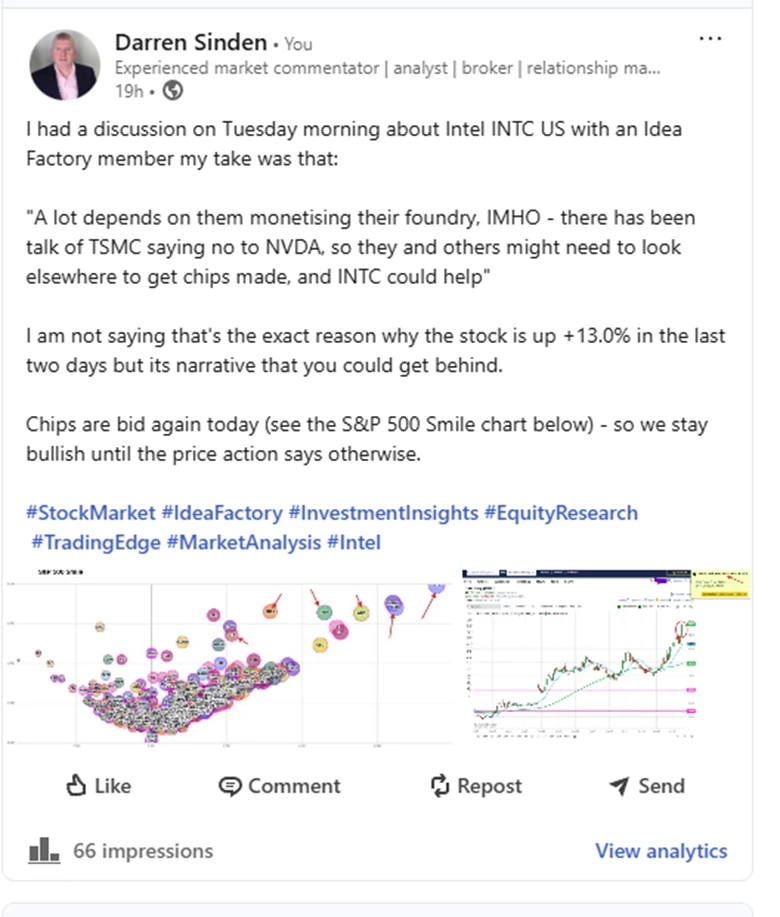

Coming back to semiconductors, how about this opportunity at Intel INTC US.

Source: Darren Sinden / LinkedIn

In fact, Intel has been knocking it out of the park this week, but that is part of a longer-term bull trend as well.

Source:Barchart.com

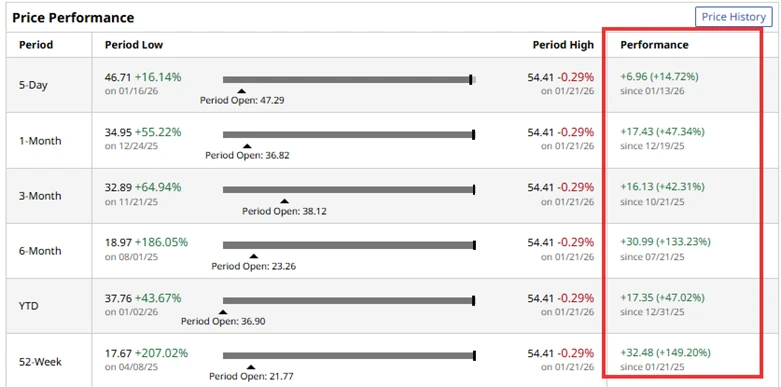

That trend is highlighted in the table below.

Source:Barchart.com

Make your life easier

The purpose of this article isn’t for me to show off about how well I have done with my idea generation.

Although clearly I have had a good run.

Instead, these examples are meant to show other traders, like yourself, how you can unearth high probability trades, just by listening to the markets and being open to what they are telling you.

Of course, you still need to join the dots and manage your trade. If you open one.

But by slanting the odds of success in your favour - by going with, and not opposing the market, and the flow of information coming from it, you can make your life a whole lot easier.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.