Thanks for the memory

In the first part of this short series of articles I looked at some of the deals and stock price moves, that are making me increasingly wary of the market.

That, despite my best intentions to remain pragmatic, and not have an outright view, beyond what the price action is telling me.

However, when you see headlines and comments, such as those below, about memory chip maker SK Hynix, it can’t help but give you pause for thought.

“SK Hynix achieved record quarterly results thanks to a pickup in both volumes shipped and its selling prices.

On the conference call, an SK Hynix executive said that capacity for high-bandwidth memory, dynamic random-access memory, and NAND (or flash) memory chips are all essentially “sold out” for 2026.

Separately, management said that both its own and customer inventory levels have declined because of the speed of deploying AI infrastructure”

Source :Sherwood news

Now don’t get me wrong, in one sense that’s obviously great news for the company, although running at full capacity obviously means that potential new orders could go elsewhere.

However, on the flip side it also says something about the level of demand for one of the key components in AI processors, and that’s high end memory.

Source : Google Finance

TrendForce, an independent research firm, that specialises in the semiconductor sector, made the following observation on memory chip markets this week:

“According to TrendForce’s latest memory spot price trend report, regarding DRAM, buyers are snapping up quotes immediately, sending spot prices soaring. DDR5 chips have surged 30% this week, as overall supply remains tight and major module houses like Kingston continue to limit shipments.

Meanwhile, in NAND, limited spot supply led to only sporadic trading, with prices expected to climb further as the market tightens:”

The SK Hynix stock price has risen by +38.0% in the last month, but even that pales in comparison to moves seen in US listed names in the memory sector, over the last 6 months, led by Sandisk SNDK US.

Source: Barchart. Com

Short term gain long term pain

Short squeezes in a stock, or a supply chain can be good news for share prices in the short term. but definitely not over the longer term, as far as the supply chain is concerned.

This is not an isolated incident either, we have a similar situation developing among Auto manufacturers whose products are reliant on chips made by Chinese owned Nexperia.

Nexperia is headquartered in Nijmegen, in the Netherlands.

The Dutch govt recently seized control of the company, and its assets, in Holland, on national security grounds.

As a result a large question mark now hangs over the availability of the specialist chips that the firm makes, which help to control modern cars and other vehicles.

And of course we have the ongoing, though currently deferred, trade spat, between the US and China.

In which China’s main weapon is access to rare earth metals, of which it is the world largest supplier.

A quick search on Perplexity AI, inquiring about rare earths, revealed the following:

Key Applications

Rare earth metals, comprising 17 elements, are vital for producing magnets, batteries, cameras, lasers, and display screens, as well as in electric vehicle motors, wind turbines, and advanced medical imaging devices.

Strategic Importance

Defense and aerospace sectors rely on rare earths for guidance systems, jet engines, radar, sonar, and night vision equipment. Governments prioritize securing rare earth supplies due to their importance for national security and the risk of overreliance on a single producer, which is currently China.

MP Materials MP US is one of a number of rare earth miners and processors that saw huge gains in their stock price, thanks to that trade dispute, and the promise of US Govt investment in a strategically important sector.

Source Perplexity AI search

Source:Barchart.com

The MP stock price has subsequently cooled off, not least because Presidents Trump and XI agreed to defer the imposition of additional tariffs for a year, at their recent meeting in Busan, South Korea.

Show me the money

Other things that concern me right now include private markets, and private credit, there are creaking sounds coming from both.

The insatiable need for cash of the AI chat bot operators and the question market about where that money will come from?

Source: CNBC

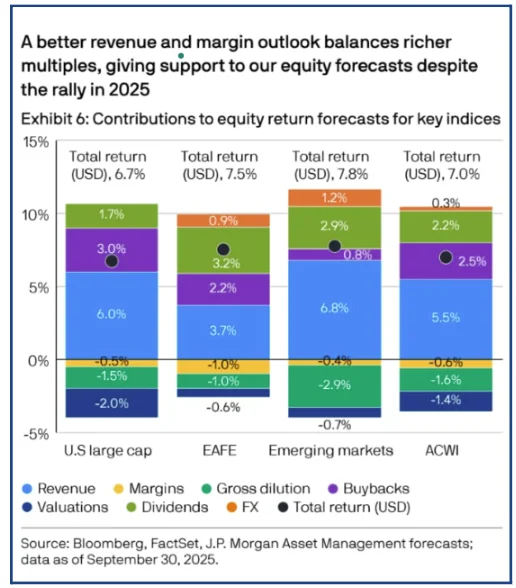

The slide below, from JPM AM, highlights the sources of and contributions to total returns, across regional markets.

Source:JP Morgan AM

I am struck by the relatively modest contribution of margins, but also by the impact of share buy backs.

I am thinking out loud here, but what happens ro stock prices if the cash that pays for those buybacks, gets eaten up by AI capex?

That is spending on data centre construction, and cloud computing etc. Which doesn't seem completely impossible when you see comments like this:

“Data centers are the backbone of the digital services that individuals, businesses, and governments rely on. Globally, data center investments are projected to reach nearly $7.0 trillion by 2030.

More than $4.0 trillion will be allocated to computing hardware. With more than 40 percent of this spending expected to occur in the United States”

Source: Mckinsey & Co October 7, 2025

Dont Panic

Here’s the thing it isn’t time to panic just yet.

However, it is time to recognise that things are different now in the market than there were just a couple of months ago.

I am fond of saying that sentiment changes on the margin and I think those changes are visible right now.

And, that, the overall tone of the market has moved from outright bullish to cautiously bullish at best.

A subtle but significant change, and one that traders should take note of.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.