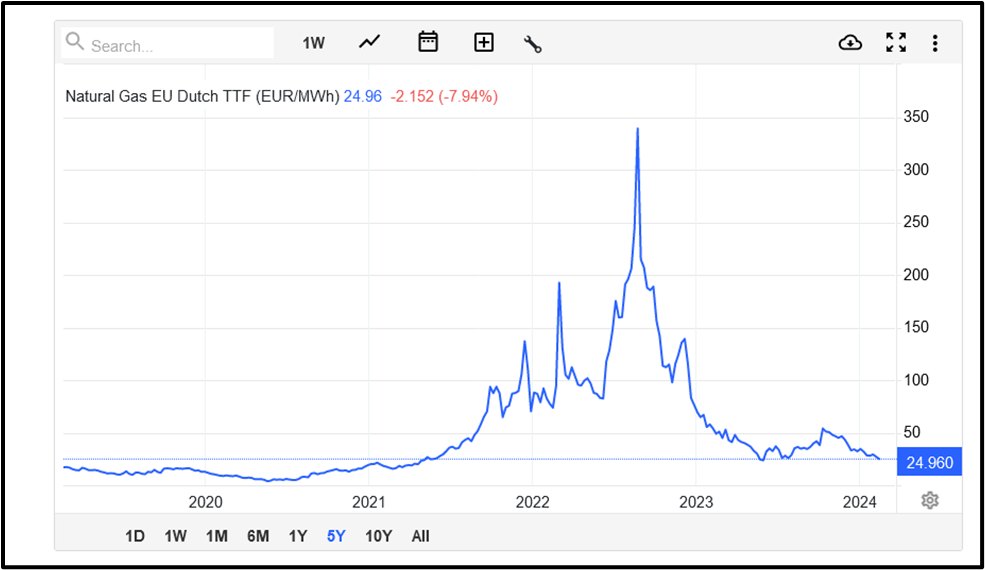

The manufacturing sector has been under pressure for most of the last two years; it had scarcely found its feet after Covid and associated lockdowns, before Russia invaded Ukraine, sending global energy prices, particularly natural gas, soaring as we can see below.

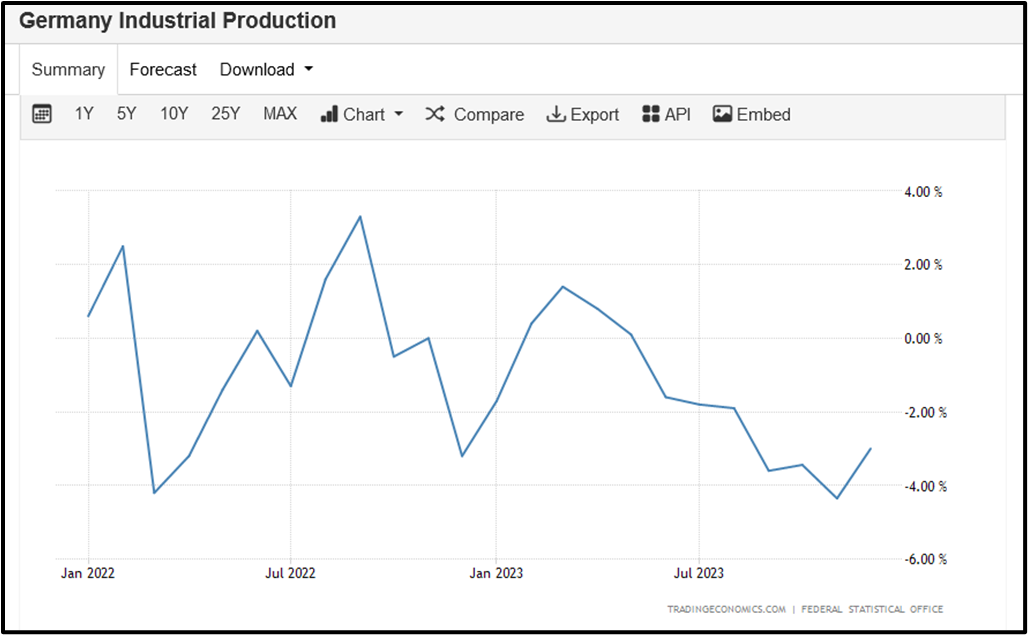

Rising electricity prices hit German industrial stocks hard

High gas prices translated directly into higher power prices for industry.

Manufacturers of course are large-scale consumers of power.

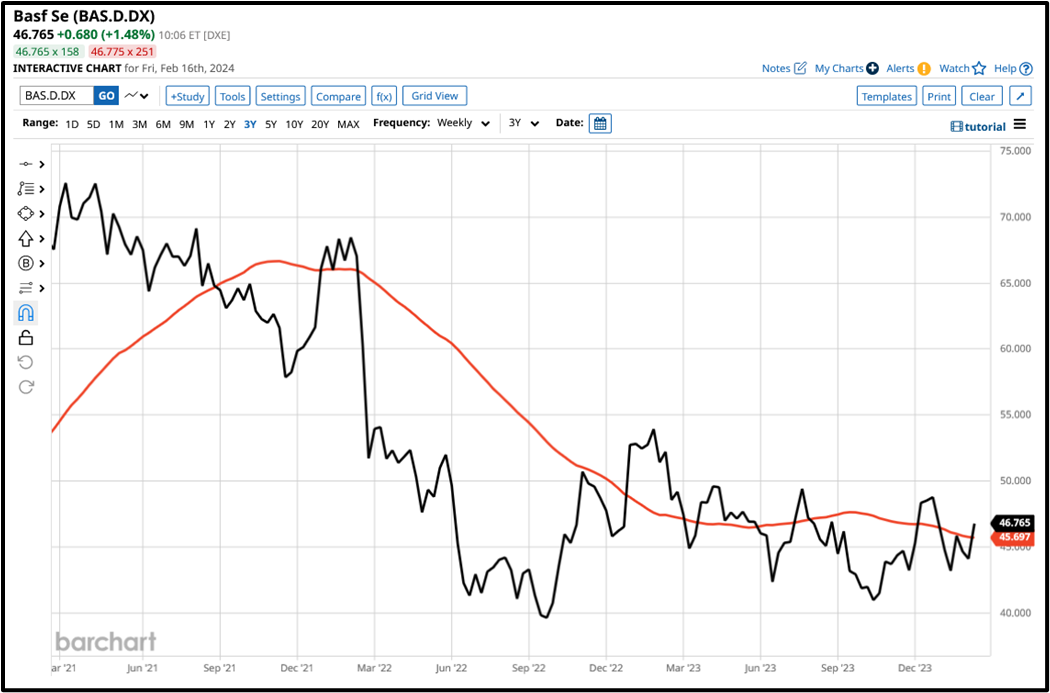

Higher power prices led to a decline in industrial production in countries like Germany where industrial giants such as BASF (BAS) shuttered plants and laid off staff due to rising costs.

Source: Trading Economics

We can see what happened to the BASF share price during this period, in the chart below.

Source: Barchart.com

A possible turning point

However, things may be looking up once again for the manufacturing/industrial sector.

According to data from S&P Global Market Intelligence output in the manufacturing sector rose for the first time in 8 months in January despite the shipping and supply chain issues in the Red Sea.

The broadest measure of Global Manufacturing PMI, collated and published by JP Morgan, also moved move back into expansionary territory, with a reading of 50.00.

Source: Trading Economics

Analysts at Morgan Stanley believe they can detect the green shoots of recovery with PMI data in Europe and the US improving, suggesting that we will avoid a hard landing and a protracted recession.

Though Europe is lagging behind the US in this regard.

Even Manufacturing PMI data from China has been in positive territory since November and industrial production has moved back into line with pre-Covid levels.

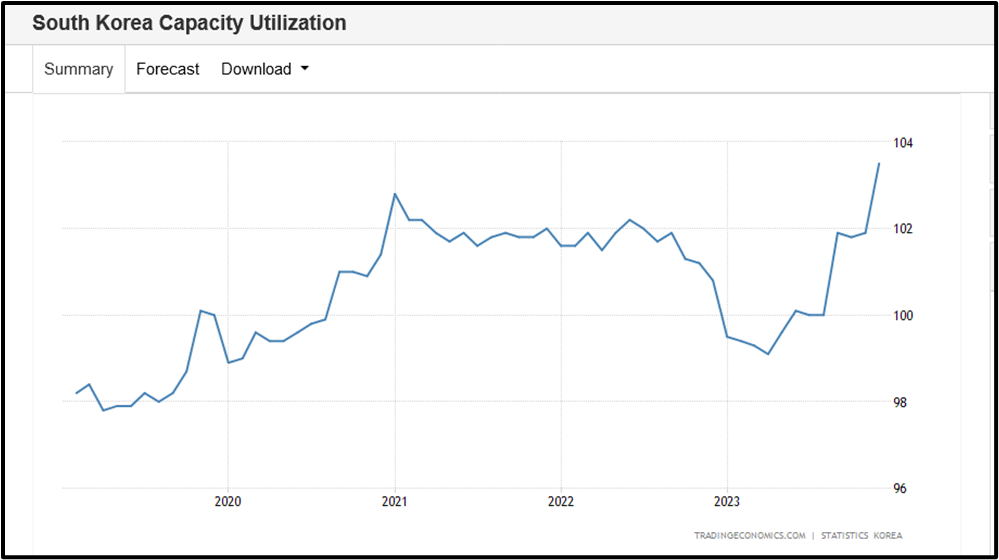

We have also seen a pick up in South Korean capacity utilisation, which is at its highest levels for a decade. that rise coincides with a bump in GDP from manufacturing, in the Southeast Asian economy.

Source: Trading Economics

To some extent, European industrial stocks have already discounted or priced in this upturn. For example, if we look a Siemens AG (SIE), one of Germany’s largest companies, whose stock price has risen by 22.50% over the last six months in fact it printed a three-year high early in February.

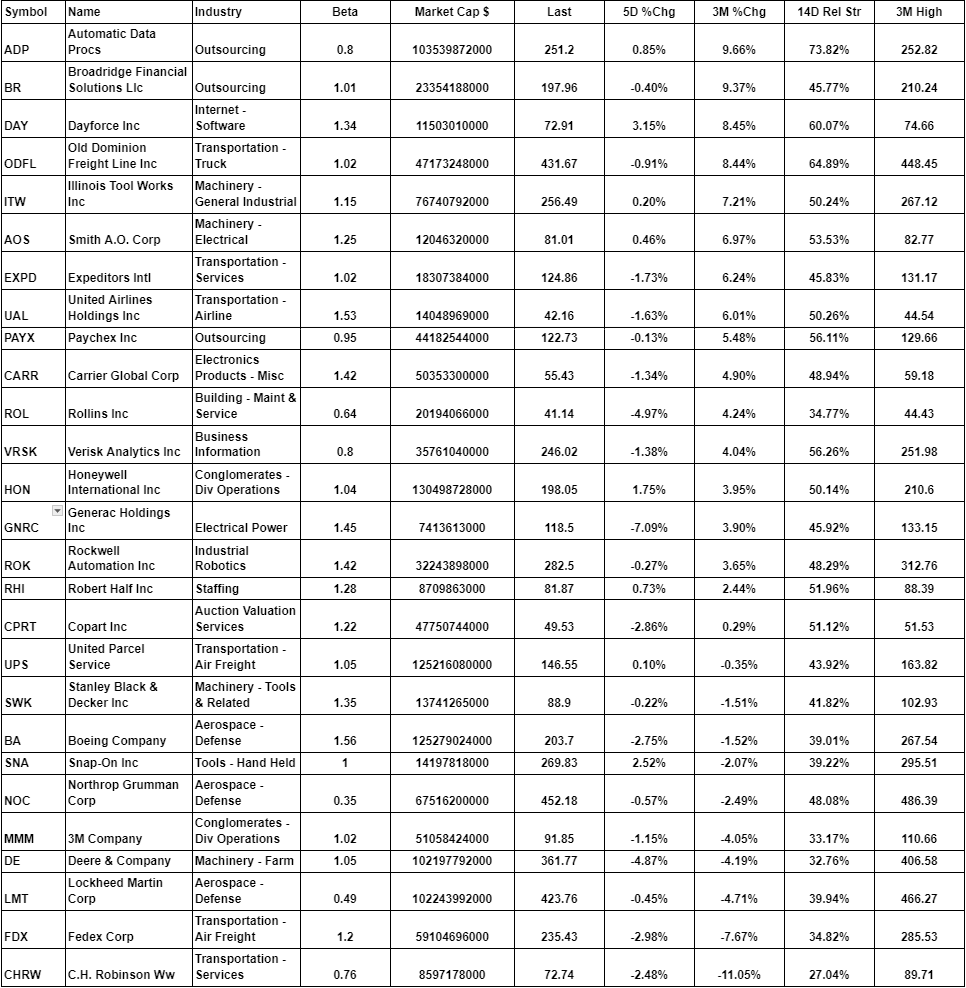

In the US the industrials sector has added +13.0% in the last three months though I note that 27 out of the 80 stocks in the sector have underperformed the index with returns of +10.0% or less over the quarter.

I have listed these stocks in the table below, showing their 5-day and 3-month percentage changes, as well as their current RSI 14 readings, the stock beta, or sensitivity to changes in the S&P 500 index, and their 3-month price high.

Could some of these stocks benefit from an improving outlook among manufacturers?

Underperforming stocks S&P 500 Industrial sector over the last quarter

Source: Barchart.com

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.