We have had one of the oddest starts to a New Year that I can remember.

Macro and Geopolitical factors have made nearly all the running in the markets, aided and abetted by volatility in precious metals.

Earnings season, which promised to deliver so much to early 2026, has largely been overshadowed by events elsewhere.

According to Factset Research: with 59.0% of S&P 500 companies having reported Q4 2025 earnings, 76.0% have posted positive earnings surprises compared to Wall Street estimates.

Whilst 73.0% of reporting companies have released a positive revenue surprise.

What's more the S&P 500 is on track to deliver +13.0% growth in earnings for the quarter, and if achieved,it will come with the market sitting on a multiple of 21.50 times earnings. Going someway to justifying the indices current PE multiple.

That earnings growth is spread across 9 out of 11 S&P 500 sectors, with only the Healthcare and Consumer Discretionary sectors not participating.

In fact, 5 out 9 industries, within the Consumer Discretionary sector, have reported a year over year earnings decline, which is n’t great.

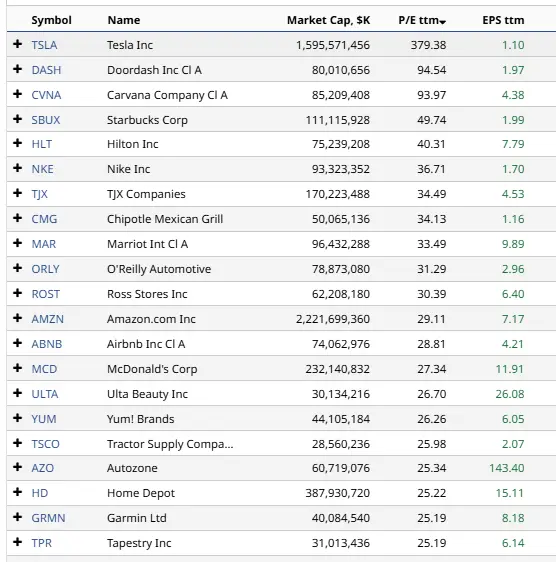

S&P 500 Consumer Discretionary stocks with high (> 25) PE ratios

Source: Barchart.com

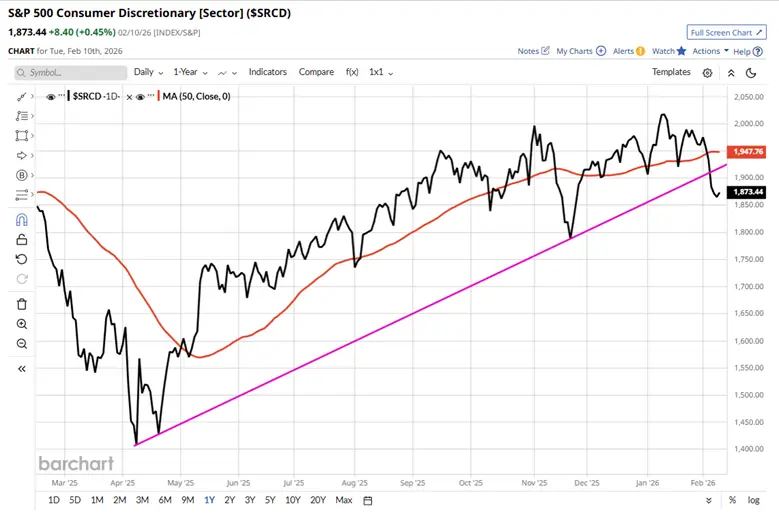

And looking at the chart of the sector index, it could be that its breaking down through trend support that

dates back to April 2025, and which, has its roots in the lows posted back then.

Source: Barchart.com

Under Pressure

Whilst Consumer Discretionary stocks could be under pressure from recent earnings updates and poor relative performance There are other sectors and industries that are feeling pressure, on both their share prices and their businesses.

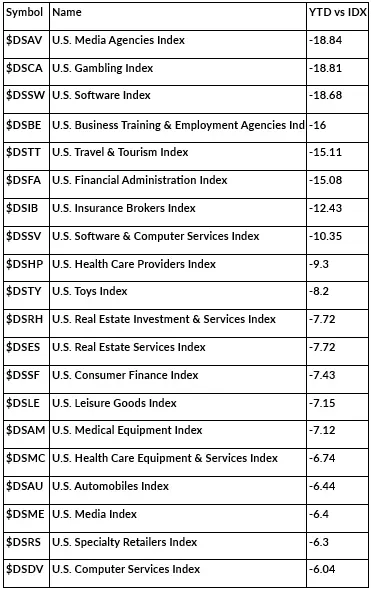

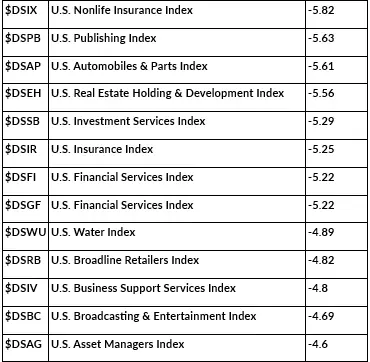

The table below shows US sector and industry indices that have underperformed the S&P 500 index over the year to date.

This list is filtered to show only those sectors which have underperformed the S&P 500 by -4.00 or more.

Sectors that have been hit the hardest are those sectors that are perceived to be vulnerable to AI.

And in particular the latest round of agentic AI agents, some of which have been shown to be able to act autonomously in clerical and administrative tasks.

The famous Californian venture capitalist Marc Andreessen, once famously quipped that

“software was going to eat the world”.

Some investors have recently been asking whether AI is about to eat the software industry, whole?.

US sector and industry indices, that have underperformed the S&P 500 index over the year to date

Source: Barchart.com

You can see why those investors and traders might be concerned about the effects of AI, in this chart of Microsoft MSFT US. One of the world's largest software companies.

Microsoft shares traded up by +6.27% in October 2025.

However, by the first week of February they trading down by as much as -24.79%.

Source: Barchart.com

Microsoft has spent years and billions of dollars building its businesses and “moats”, the barriers, customer relationships, and technical know-how that keeps its competitors at bay.

However, the new generation of Agnetic AI/Agents can seemingly be coded and deployed for very little upfront cost, by either individual end users or corporates.

And once these news tools are installed and established, they could do away with the need for software that you subscribe to or licence.

In the year ending June 2024, Microsoft generated $54.90 billion in revenue from commercial office and cloud services/subscriptions

So you can see how much money could be at stake.

The future isn't here yet

Right now the market is extrapolating forward and no large corporate software business is immediately under threat, but that may not be the case in the future.

Of course adversity creates opportunity and never more so than when the market is in the mood to

“throw the baby out with the bath water”.

A rather old fashioned but descriptive phrase, that means that the market hasn’t drawn a distinction between good and bad stocks, and has treated all of them equally, and some would say poorly.

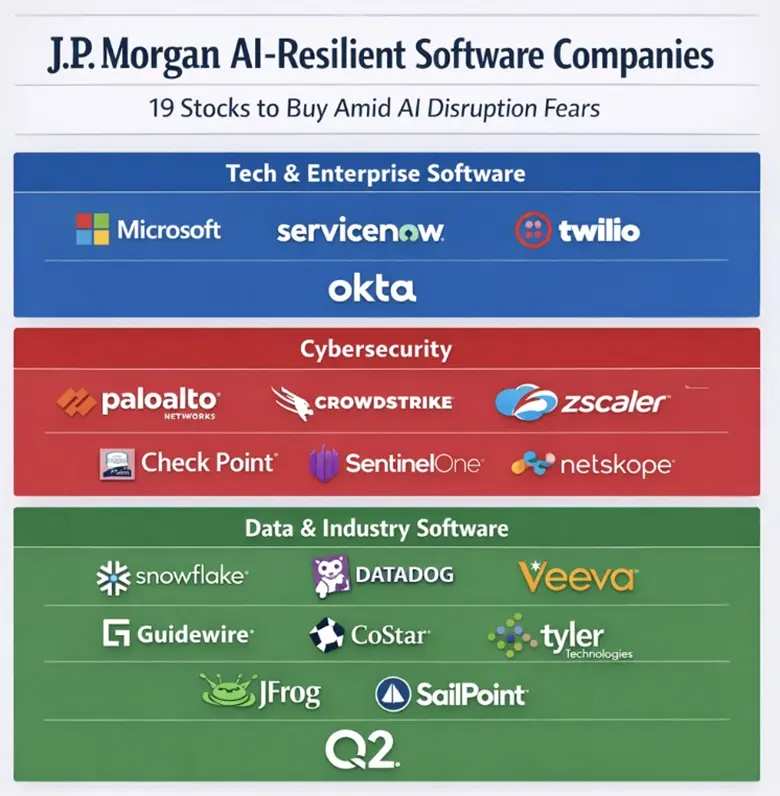

US Bank JP Morgan is of that mindset.

And the bank has drawn up a list of 19 software stocks which their analysts believe will prove to be

AI- Resistant. (See the table below).

“Given the positioning flush, overly bearish outlook on AI disruption of software and solid fundamentals, we believe the balance of risks is increasingly skewed towards a rebound,”

said the bank's sector analysts.

Source : X/JP Morgan Research

Every dog has its day

One of the names on JP Morgan’s list, Datadog DDOG US, rallied +13.74% in Tuesday’s session(10-02-2026) having posted higher than expected earnings.

Of course that could just be a one off.

However, it’s true to say that when sentiment is all one way, in a stock or sector, and that stock or sector impresses on the upside (against expectations) there can often be fireworks in the price action.

Source: Barchart.com

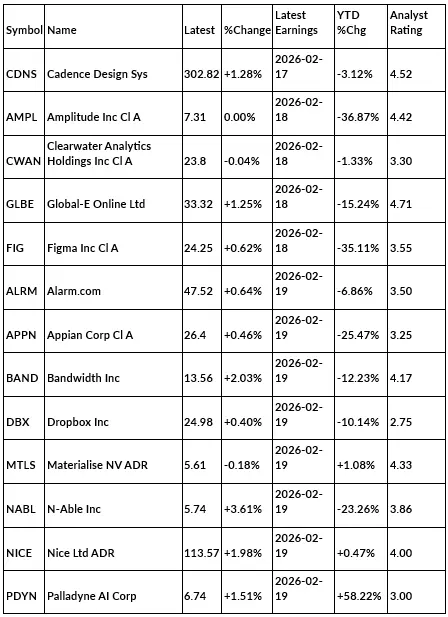

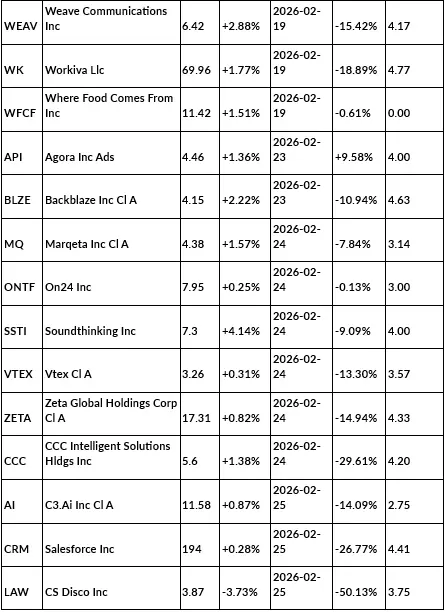

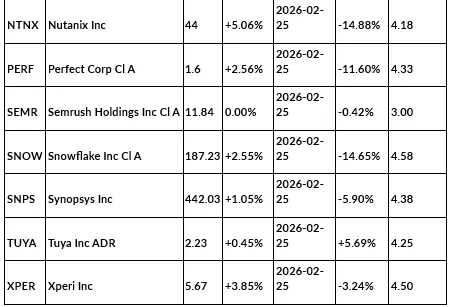

A selection of software stocks still to report earnings, their YTD percentage change and the analysts consensus rating out of 5.0.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.