If you have a certain experience trading stock, you’ll have realized by now that each company can be classified into a stock market sector. Depending on the current market and economic dynamics, some sectors have more growth potential than others. By understanding how sectors work and by knowing how to identify the best opportunities within them, you can optimize your investment approach. So, let’s take a look at how to best take advantage of stock market sectors in your strategy.

Understanding stock market sectors

A stock market sector is a classification system that organizes companies into groups based on their business activities within similar industries or sectors of the economy.

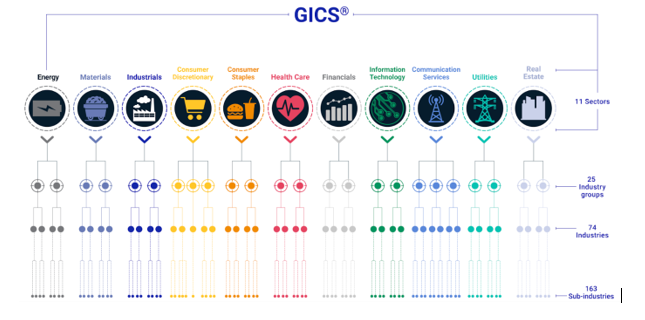

The Global Industry Classification Standard (GICS), developed in 1999 by S&P Dow Jones Indices and Morgan Stanley Capital International (MSCI), serves as the official framework for categorizing companies into 11 distinct stock market sectors, 25 industry groups, 74 industries, and 163 sub-industries as of March 17th of 2023.

Global Industry Classification Standard - Source: MSCI

Why should you trade stock market sectors?

Firstly, trading stock market sectors offers the advantage of focusing on sectors with higher growth potential, taking into account the current economic cycle, conditions and dynamics. By strategically allocating investments to these promising sectors, investors can maximize their returns, as different sectors have different growth potentials at different times.

Secondly, if you decide to trade market sectors rather than individual stocks, you can have greater exposure to a single industry through different types of companies, which can allow you to achieve a higher level of diversification.

In addition, trading stock market sectors provides the flexibility and adaptability to navigate changing market conditions. This allows you to easily adjust your portfolio's allocation to sectors that are expected to perform well in a new environment, optimizing your portfolio and potentially seizing emerging opportunities.

Moreover, sector-specific investment vehicles are accessible, offering a cost-effective means to gain exposure without the need for individual stock research and selection.

Finally, focusing on specific sectors allows you to develop specialized knowledge and expertise in those industries, giving you an edge in identifying undervalued companies and recognizing industry-specific trends. Maybe your job is already giving you an area of expertise, and trading stock market sectors can also give you a chance to use this knowledge to make more informed trading decisions.

How to identify stock market sectors’ trends

Gaining an understanding of market cycles and the performance of different sectors throughout various economic stages is essential for investors to make well-informed decisions.

During a recession (Stage 1), the economy faces a slowdown, leading central banks to lower interest rates in an attempt to stimulate growth. This period can be challenging for the stock market, with equities often undervalued.

In the crisis stage (Stage 2), the economy experiences negative growth, and interest rates may remain low. The market sentiment is depressed, creating an opportunity for investors to find bargains in the stock market.

As the economy gradually improves, the recovery stage (Stage 3) begins. Unemployment rates decline, and signs of improvement emerge.

During the expansion stage (Stage 4), central banks raise interest rates to control inflation. This phase is characterized by widespread growth across sectors, with companies reporting high profits and wages increasing. It is generally a favorable period for most sectors, and market sentiment is positive.

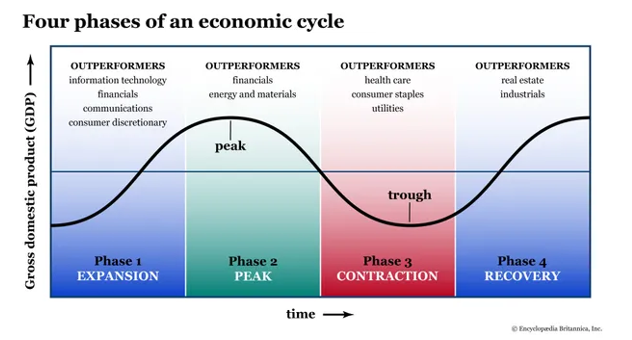

Here is another way of visualizing economic cycles:

Economic cycles can vary in duration and intensity. It is therefore important to consider both short-term and long-term factors when assessing a sector’s performance, as well as the possibility of unforeseen events that may significantly impact the sectors.

Let’s focus on sector analysis to better understand the two types of stocks: cyclical and non cyclical.

A sector or stock is considered cyclical when economic cycles highly influence its price, such as the entertainment, automotive, construction, and consumer durables industries, among others.

During favorable economic periods, cyclical companies tend to experience above-average earnings. However, in the event of an abrupt economic downturn, these companies are more prone to facing a decline in share price.

A non-cyclical stock or sector, also called defensive, is characterized by its low sensitivity to economic fluctuations. These companies tend to exhibit stable performance regardless of the economic cycle.

In times of economic downturns, non-cyclical shares or sectors, such as the health, consumer staples, utilities, and consumer non-durables industries are often favored by investors due to their resilience and ability to generate consistent results.

How to trade stock market sectors

Overall, trading stock market sectors offers traders and investors a certain level of diversification, the ability to capitalize on market trends and economic dynamics, the possibility of exploiting specialized expertise in certain domains, as well as flexibility and access to sector-specific investment vehicles.

By incorporating sector trading into your investment strategy, you can enhance your chances of reaching better investment outcomes and minimizing your risk. But you still need to determine first how to trade stock market sectors and how to choose the right industries to invest in.

You can either invest in single stocks of different industries, or you can invest in funds such as ETF (Exchanged-Traded Funds) or sectorial indices that can offer you broader exposure to one or more industries. You can also decide to invest in different sectors through global indices that gather many different sectors such as the Nasdaq, the CAC 40 or the FTSE 100. It is also possible to use derivatives such as CFD (Contracts For Difference) to trade stocks, ETF, or indices.

When deciding in which sector to focus on, you can use different types of market analysis, such as technical analysis, fundamental analysis, behavioral analysis or quant analysis among the most popular ones.

To gain better knowledge about the different stock market sectors and their characteristics, fundamental analysis is more relevant. This type of market analysis involves evaluating the financial health, performance, and growth prospects of companies within specific sectors, as well as global economical, political, and social factors of different industries and countries.

When using fundamental analysis in stock market sector trading, there are two common approaches: the top-down approach and the bottom-up approach. These techniques can be used to determine the most promising sectors or companies to focus on, which can be helpful in the choice of your ETF for instance.

The top-down approach starts with an analysis of the broader macroeconomic factors and market trends before narrowing down to specific sectors and individual companies. So to construct your portfolio, you’ll first have to assess the overall economic conditions of a given country, identify sectors that are likely to benefit from the prevailing economic conditions, and choose the most promising companies within the selected sectors.

The bottom-up approach focuses on analyzing individual companies first and then builds the portfolio based on the strength of their fundamentals, as it is possible that companies can perform well even if their sector or the global macroeconomic environment is not doing well.

Technical analysis will be more useful in determining the best timing for your entry and exit. The method focuses on analyzing historical price and volume data to forecast future price movements and involves studying prices, chart patterns, and various technical indicators to make better trading decisions.

When deciding on which stocks to invest your money in, also remember that there are different types of stocks depending on the size of their market capitalisations (blue chips vs penny stocks), on their perceived growth potential (growth vs value stocks), and on their sensitivity to cyclicality (cyclical vs defensive stocks) for instance.

It is also important to take into account your trading strategy and style, as well as your investment horizon, as someone using a scalping strategy might not focus on the same types of stocks or sectors as an investor using swing trading or position trading.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.