Im this article I am going to continue with the theme of interpreting the signals that the market sends out. And how we can turn those into actionable trading ideas.

Looking at and interpreting the price action is a very useful skill to develop.

However, it’s only one part of a bigger puzzle that all traders are continuously trying to solve.

Another piece of this jigsaw is the ability to surface and interpret relevant news flow, and to be able to recognise its likely impact on stock prices.

To explain what I am talking about, here are some recent real world examples:

Headlines:

“Salesforce subsidiary awarded $5.64B Army contract “ 26-01-2026 Ticker CRM US

“Corning announces up to $6.0B agreement with Meta for optical fiber and solutions” 27-01-2026 Ticker GLW US

Similar announcements, very different reactions

On the face of it these look like similar announcements, both are related to contract wins, each is of similar value and both contracts are with reputable customers, from a business perspective.

However, the reactions of the respective stock prices couldn't have been more different.

Salesforce CRM US is shown in black and Corning GLW is shown in pink in the chart below

Source:Barchart.com

Why did Corning’s stock price take off, whilst Salesforce's didn't?

Well for a start Salesforce has a market cap of $215.0 billion. While Corning’s market cap is more modest at $81.40 billion, even after Tuesday's (27-01-2026) +15.58% rally.

Salesforce has annual sales of just under $38.00 billion, whilst Corning’s sales stood at $13.12 billion last year.

Corning’s contract win was equivalent to 45.0% of its 2025 sales. Whilst the new Salesforce contract was worth around 14.75% of its 2025 sales, not insignificant, but not transformational either.

Then we need to consider the context a $5.64 billion contract from the US Army should not be sneezed at.

However,the question is, can Salesforce find other customers, in the same field, to sell its products and services to?

The answer to that is maybe?

It could perhaps win similar contacts from the US Navy or Airforce for example.

However, Meta Platforms' order for Cornings fibre optic cables, for use in Meta’s data centres, puts Corning front and centre, in one of the hottest markets around.

It all comes down to excitability

With every piece of corporate news flow we read, we need to determine whether the news will excite the market, and how excitable the traders are, in that stock.

I shared the Corning news in my chat groups at 13.16 pm London time, on Tuesday 27th.

When the stock was up around +6.50% ,at just under $101.00

Corning went on to trade at a high of $113.85 intraday, and printed above $117.00 in the pre-market session on Wednesday.

Interestingly, Corning’s Q4 2025 earnings, which came out later on Wednesday morning, were slightly disappointing, and the stock traded back down to $106.00.

Tuesday’s bubble may not have burst, but it certainly looks to have been deflated.

This isn't just a one off situation either

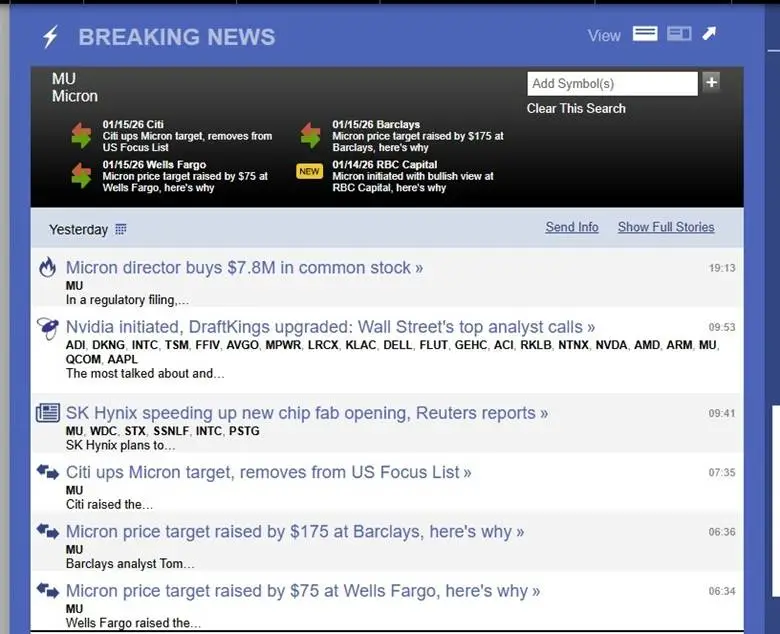

Here is another example of reading news flow correctly can be beneficial and this time it involves high end memory chip maker Micron MU US, and dates from the 16th of January.

Micron is in another hot sector, namely computer memory and data storage.

You may recall that Micron’s Korean rival, SK Hynix, recently announced that it had sold all of its available production out to 2027.

Sector peers like Sandisk SNDK, Western Digital WDC, and Seagate STX, have all enjoyed meteoric stock price rises, over the last 12 months.

Against this background, news of a corporate insider, purchasing stock at Micron, was noteworthy indeed.

Source:The Fly.com

So that was the news flow in Micron, alongside some colour, on whether the announcement was likely to excite the market.

And here is a clue about the excitability of traders in Micron.

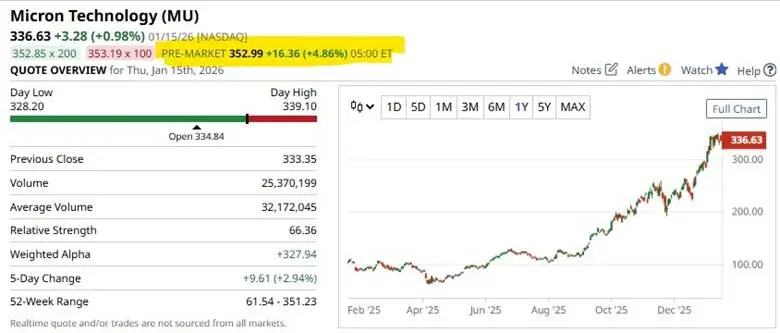

In the pre-market on Jan 16th, the stock was trading up +4.86% at $352.99.

So yes, Micron traders were getting excited, and no wonder.

An investment of $7.80 million, by a company insider, was a massive vote of confidence in the business.

Source:Barchart.com

The outcome

In just 12 days since January 16th Micron stock has rallied to trade at $410.00 a gain of more than + 25.00% trough to peak.

Would you have stayed in for the whole move?

Well that's hard to say as everyone's circumstances and trading plans are different, but looking at the line chart below there wasn't and hasn’t been any obvious reason to sell them, has there?

Source:Barchart.com

Remember “the trend is your friend” particularly when it's combined with a stop loss placed well above your entry price to safeguard your running profit. It's not a foolproof strategy, but it's a useful one for longer term trades or positions that you decide you want to keep open beyond your normal time horizons.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.