GOLD

Gold prices remained stable during early Thursday trading, as the US dollar also traded flat and fears over an escalation of the banking crisis continued to recede. The price of bullion has dropped more than 2% in relation to the one-year-maximum touched during the previous week, when fears that the turbulence felt in the banking sector could spread spooked the markets, driving haven demand for gold and downgrading expectations over the pace and scope of the Fed’s rate hiking cycle. Since then, there has been an improvement in risk sentiment, with investors feeling more reassured that a serious crisis in the financial sector is not imminent. This dynamic created a double set-back for gold, with higher treasury yields and a strengthening of the dollar penalizing prices, which also suffer due to less safe-haven related demand.

Ricardo Evangelista – Senior Analyst, ActivTrades

Source: ActivTrader

EUROPEAN SHARES

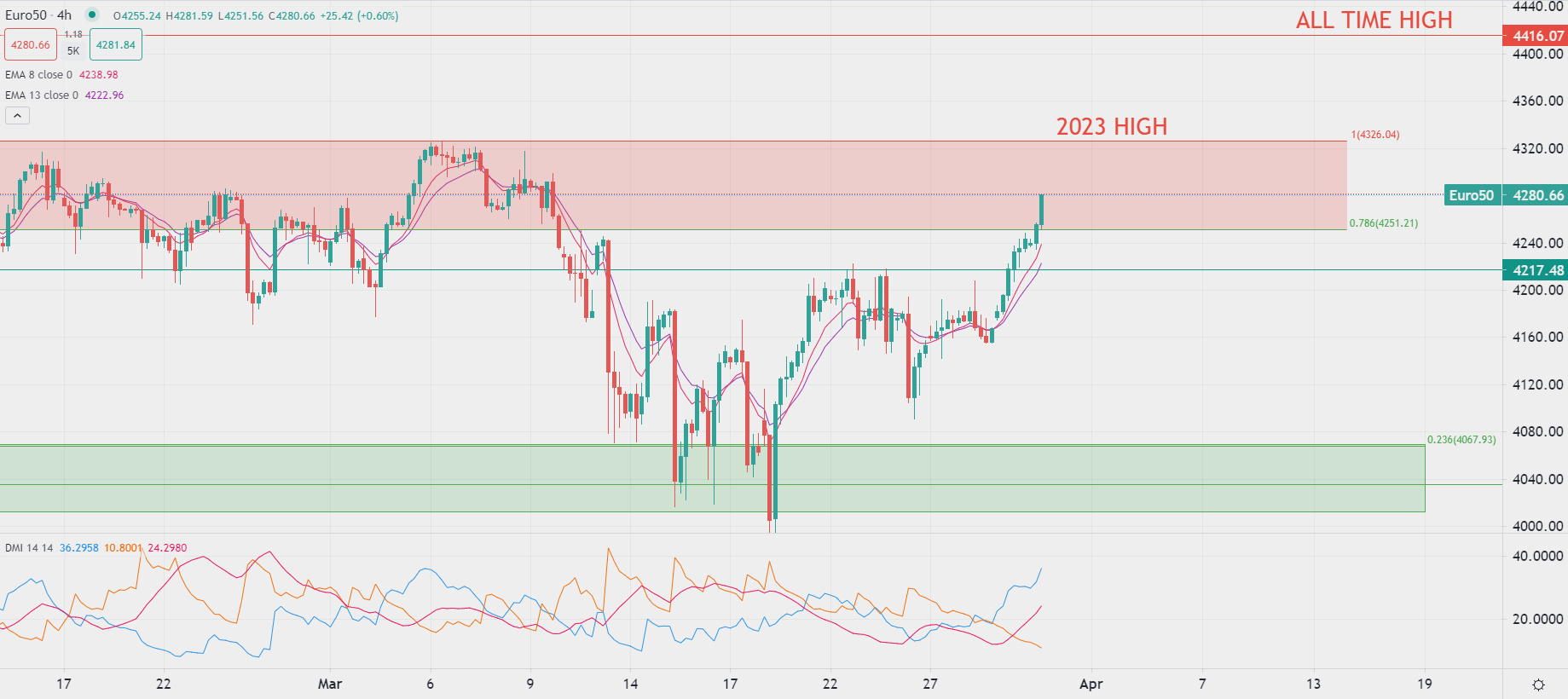

Share markets continued to edge higher in Europe, extending gains registered yesterday evening on Wall Street, as investor appetite for risk is on the rise before the end of the quarter.

Benchmarks from London to Milan were in the green on Thursday, led higher by all sectors, but with the best performances being brought by real estate stocks so far.

Market sentiment remains relatively positive, and investor confidence remains high despite the recent turmoil brought by the financial sector, as appetite for risk gets supported by the prospect of dovish pivots from central banks, providing a good excuse to push stock indices higher just before the end of the quarter. However, the current rally is being built more on expectations rather than facts and proper actions, which means benchmarks could be under the threat of a sharp drop if central banks (especially the Fed) were to disappoint investors.

More market volatility is likely to be on its way today as traders wait for the new German CPI print, the Eurozone Economic Confidence, US GDP and jobless claims while speeches from Fed officials also loom later in the afternoon.

The STOXX-50 now trades well above 4250.0pts at 4280.0pts and seems to be on its way for a 100% retracement of the short-term bear trend started at the beginning of the month.

Pierre Veyret– Technical analyst, ActivTrades

Source: ActivTrader

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.