GOLD

Gold prices are hovering just below the $2,000 mark as European trading begins. The bullion price found strong support earlier in the week, as expectations that the Fed's rate hiking cycle had ended consolidated amongst investors. The resulting mood led to a two-and-a-half-month low for the greenback and saw treasury yields drop, in a dynamic that benefited the non-yielding precious metal. However, the subsequent publication of hawkish Fed minutes cooled this enthusiasm, and the release of strong labour data on Wednesday compounded the sentiment of uncertainty as investors hesitated to call the next Fed monetary policy move. With the 'higher-for-longer' view lingering and receding expectations of a rate cut in the first half of 2024, the upside for gold prices may be limited.

Ricardo Evangelista – Senior Analyst, ActivTrades

Source: ActivTrader

EUROPEAN SHARES

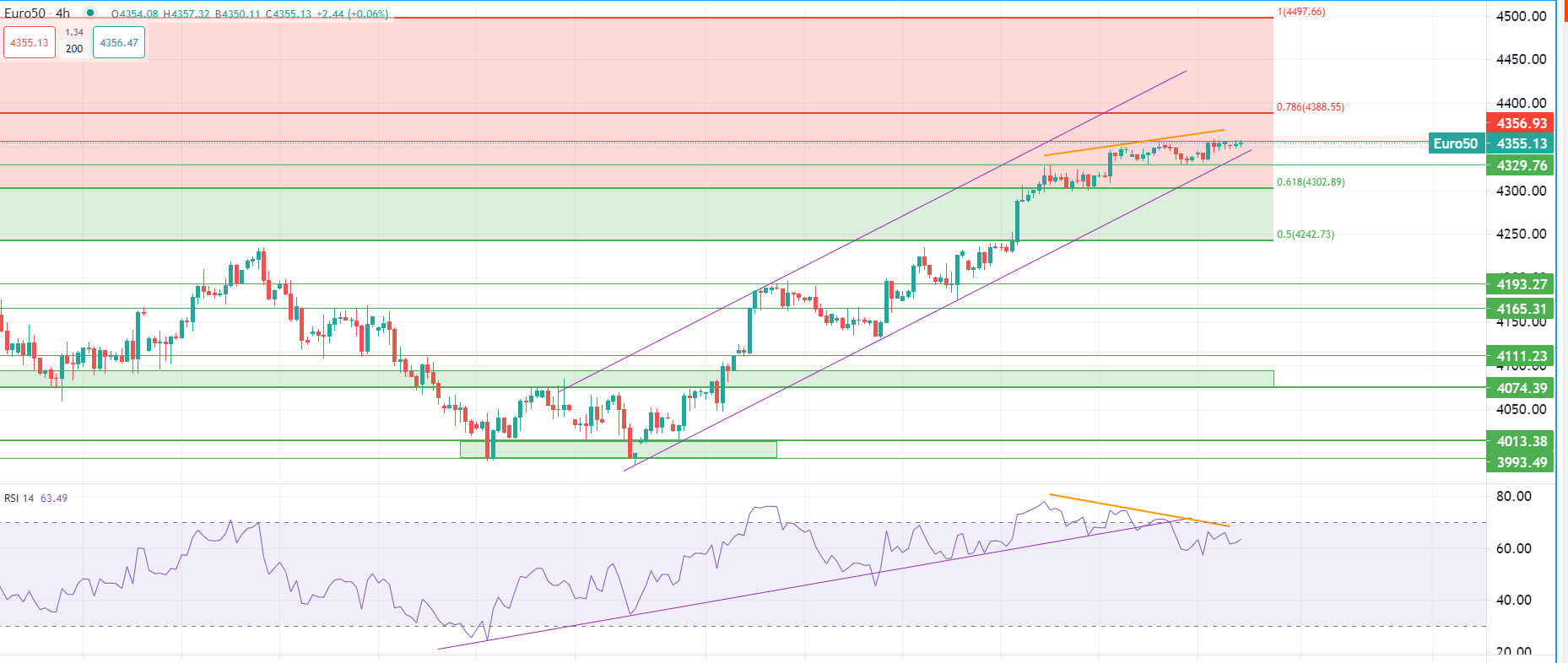

European benchmarks opened without clear direction on Thursday after mixed macro data failed to bolster market sentiment ahead of a long weekend in the US.

Lower transaction volumes and decreased market volatility traditionally occur during the long Thanksgiving weekend, when US investors stay away from their trading desks.

In addition, the recent batch of mixed macro data with poor PMI figures from France and better-than-anticipated ones from Germany didn’t help lift or drop market sentiment in the region.

The pan European STOXX-50 index opened mixed, with gains in healthcare, basic materials and energy offset by losses in consumer non-cyclicals and tech shares.

The market is trading with muted volumes, close to its major short-term resistance around 4,350.0/4,355.0pts as the bullish momentum keeps cooling.

Despite another slew of incoming European macro data today, with the Eurozone PMI alongside speeches from ECB and Bundesbank officials, we don’t expect the market to register any sharp or directional price action for the end of the week.

Pierre Veyret – Technical analyst, ActivTrades

Source: ActivTrader

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.