Earnings season is upon us once more, as companies queue up to report their 4th quarter 2024 results.

We have already seen some earnings releases, however, earnings season officially gets underway on January 15th, when several major US banks, including JP Morgan, the world's biggest, report.

Earnings season can set the tone for market sentiment going forward. Particular if guidance from reporting companies deviates from expectations.

Individual share prices, and even those of whole industries, can move on big beats, misses or unexpected changes in forward guidance, on revenues etc, from a company’s management team.

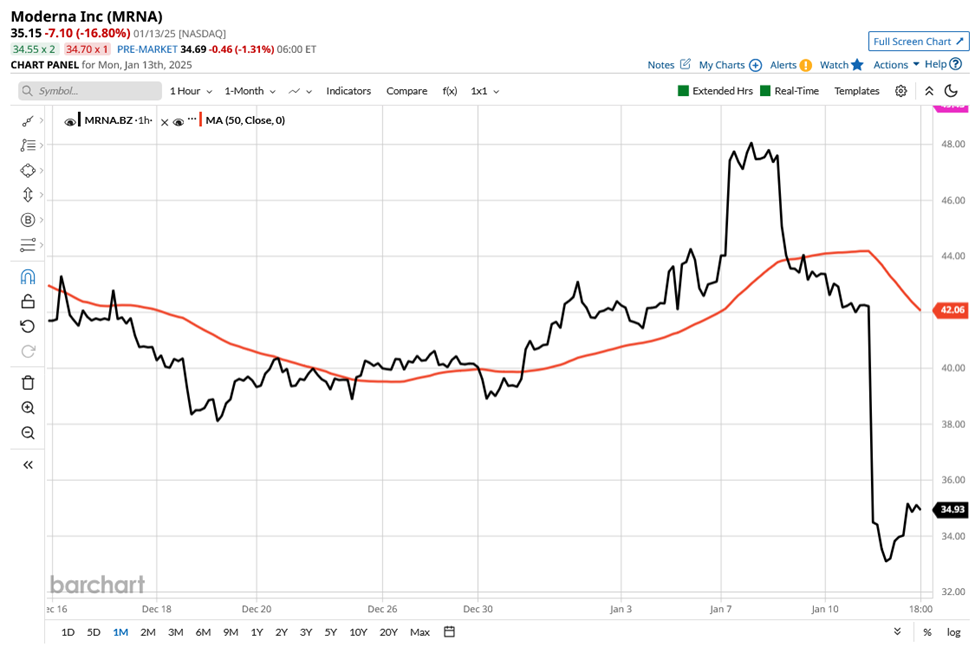

We have already had an example of what can happen if a stock price, if guidance is unexpectedly lowered, when Moderna, Ticker MRNA shaved a billion dollars off of its revenue forecasts.

The chart tells its own story.

Source: Barchart.com

What should traders and investors be on the lookout for during Q4 24 earnings?

Let’s start by looking at what the market is expecting from stocks that are reporting.

Some Key Earnings Metrics for the S&P 500 Over Q4 2024 Earnings:

- An expected earnings growth rate of +11.70% ( the highest since Q4 2021)

- An expected revenue growth rate of +4.70%

- An expected net profit margin of+12.0%

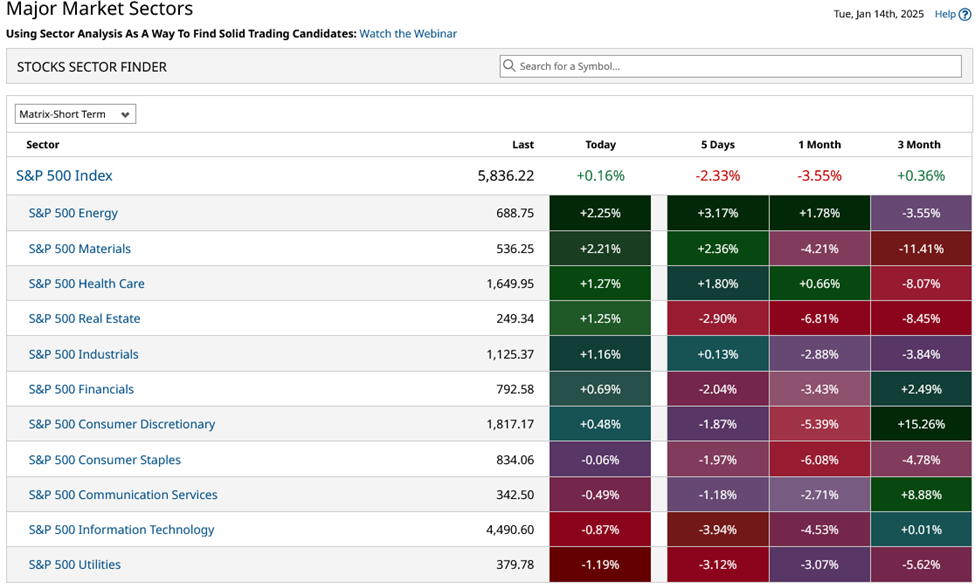

Sector Performance:

Top Performing Sectors by Expected Earnings Growth:

1. Financials Expected Earnings Growth of +39.5% (led by Banks industry at +187.0%)

2. Communication Services Expected Earnings Growth Rate of +20.8%

3. Information Technology Expected Earnings Growth Rate of +13.9%

4. Consumer Discretionary Expected Earnings Growth Rate of +12.8%

5. Utilities an Expected Earnings Growth Rate of +12.5%

Weakest Sectors by Expected Earnings Growth

- Energy Expected Earnings Growth Rate of -26.4% (the largest expected decline among all sectors)

- Materials E:xpected Earnings Growth Rate of -4.6%

Data from: Factset research

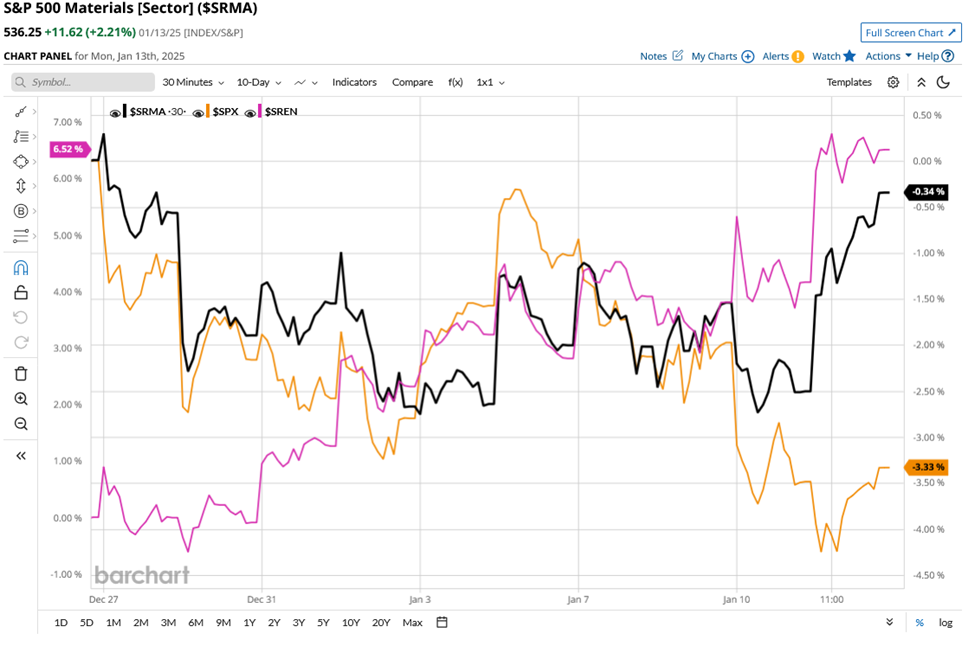

It's interesting to note that both Materials and Energy were top performing sectors in recent sessions.

Source: Barchart.com

And, that both of these sectors have outperformed the S&P 500 (shown in orange) over the last 10 days.

Source: Barchart.com

That outperformance is no guarantee that earnings from stocks in the Energy and Materials sectors will come in ahead of analysts expectations. However, it does suggest to me that the market could reward any that do beat, particularly if they are able to raise forward guidance as well.

What happened in Q3 2024?

Looking back to Q3 2024 earnings for the S&P 500 we find that about 20.0% of the index constituents provided earnings guidance for Q4. And the majority of those issued negative guidance or guidance that was below expectations, with only half as many stocks offering positive, or better than expected guidance.

Guidance and Revisions:

- 106 companies provided earnings guidance for Q4 2024

- 71 companies issued negative guidance (a higher number than the 5-year average)

- 35 companies issued positive guidance

- Earnings estimates decreased by- 2.70% (smaller than the historical average)

Against that background analysts reduced their Q4 earnings expectations for the S&P 500 stocks, and perhaps understandably so.

However, there is a history of US companies “under promising” and “over delivering” when it comes to earnings. So, the cut to analyst earnings forecasts may just have lowered the hurdle to earnings beats, making that hurdle easier to get over.

Market Sentiment:

Wall Street analysts are projecting a +14.10% increase in price of the S&P 500 index over next 12 months.

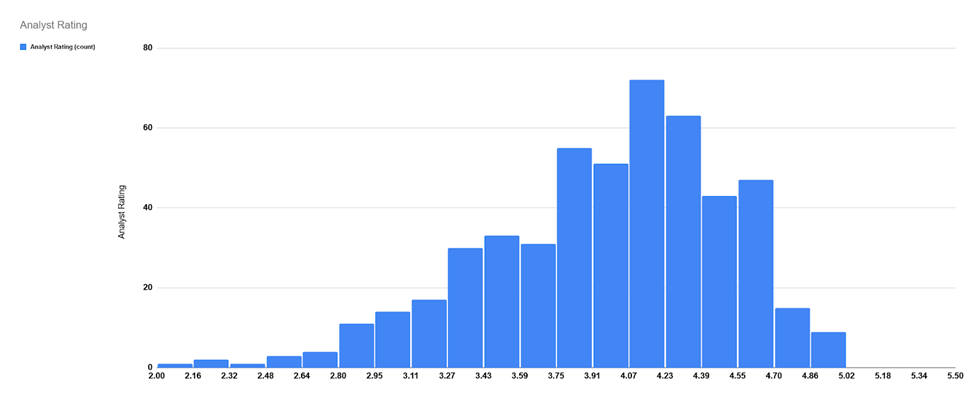

In terms of their ratings on index constituents we get the following breakdown:

Analysts' ratings on the S&P 500 stocks:

The chart below shows the distribution of analysts' recommendations among t5he S&P 500 stocks the average ratings are shown on the horizontal axis and each column display the numbers of stocks that fall into each ratings bucket or cohort on the vertical axis.

5 = Strong Buy 4 = Buy 3 = Hold 2 = Sell 1 = Strong Sell

Source: Barchart.com/DarrenSinden

Wall Street analysts are bullish of the S&P 500 and its individual constituents.

There are 260 stocks with an analyst's rating score of 4.0 or higher, meaning they are seen as buys or strong buys by analysts.

Another 173 stocks score between 3.0 and 3.90 and therefore are rated as hold. Though those that score closer to 4.0, are on the cusp of a possible buy recommendation.

Positive earnings and guidance often result in broker upgrades and raided target prices of course the opposite is also true.so watch this space.

However, the longer that bullish sentiment and ratings persist then the higher inventors' expectations rise and the easier it is for reporting companies to disappoint or miss those expectations.

Things to be aware of this earnings seasons

If it's delivered, this will mark the 6th consecutive quarter of year-over-year earnings growth for the S&P 500.

The Bank sector’s (expected) strong performance is largely due to “easy” comparisons with weak earnings a year-ago.

Lower oil prices have contributed to the Energy sector's decline in earnings and valuations, with average oil prices in Q4 2024 -$8.0 below those seen in the fourth quarter of 2023. Oil prices have been rising again in recent days, however.

The Information Technology sector shows strongest expected revenue growth among S&P 500 sectors, at at an estimated 11.10%

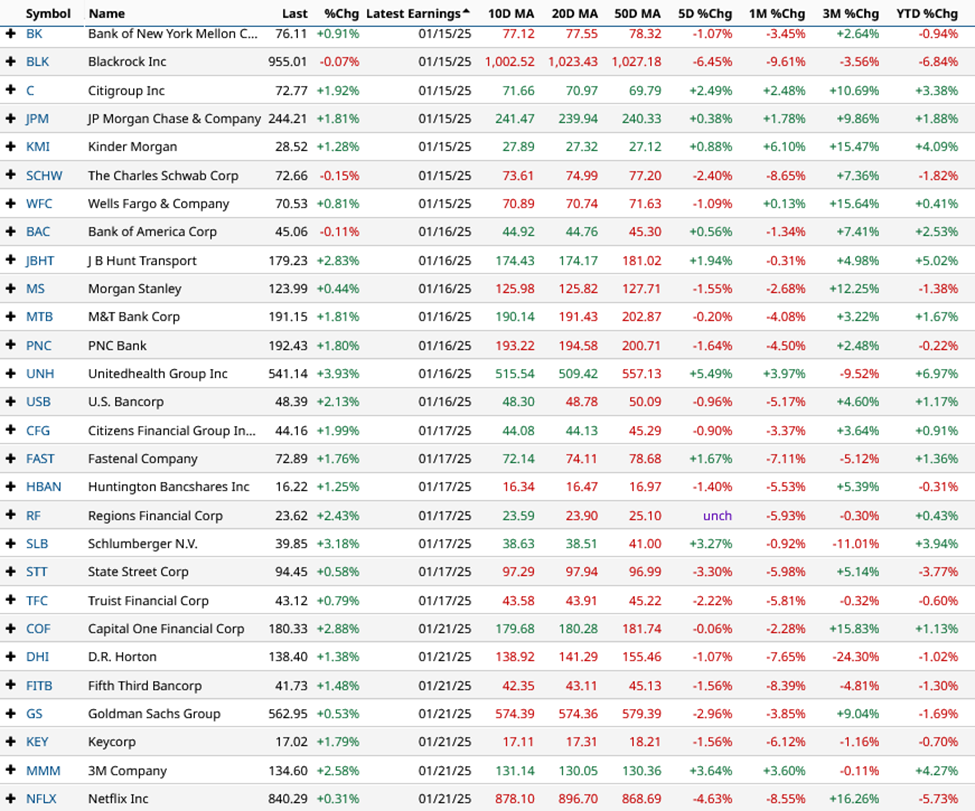

Which S&P 500 stocks are reporting in the next week?

Source: Barchart.com

Earnings and revenue beats are great, but they are backward looking, however if they are combined with better forward guidance then that can be a recipe for a decent bounce in the reporting company's stock price of course as ever we need to bear in mind how much the stock price has moved ahead of the figures. In many cases a big run up in the stock ahead of earning can mean it's better to travel than arrive.

The more hype around stock or sector the more room for disappointment or at least for everything to be priced in.

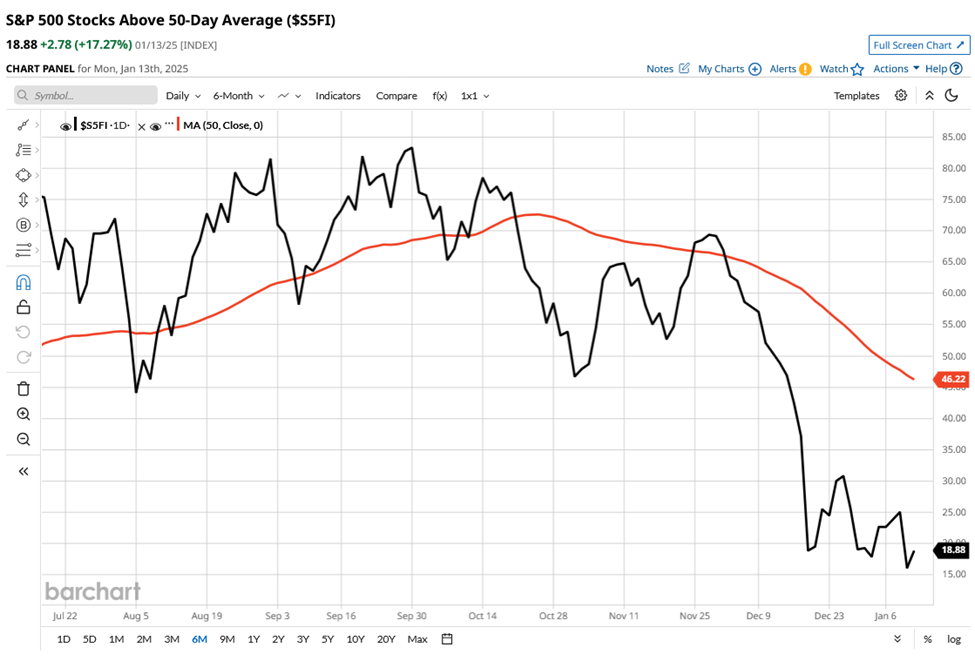

Stocks that break and stay above the 50-day Moving average, in the week to 10 days ahead of earnings can often be good bets, notwithstanding any of the above.

Source: Barchart.com

However, with less than 19.00% of S&P 500 stocks in that position right now, we can’t rely on that indicator unless we see a significant rally into Q4 2024 earnings that is.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.