Donald Trump’s trade policy relies heavily on tariffs, as a tool to protect US domestic industries, reduce the country's trade deficits, and exert political leverage.

His recent imposition of 25.0% tariffs on imports from Canada and Mexico and a 10% levy on Chinese goods, has reignited fears of a global trade war, and with good reason.

Tariffs create trade barriers, potentially increasing costs for businesses and consumers.

Retaliatory measures by Canada, Mexico, and China have already been announced, further escalating tensions.

For instance, Canada imposed 25.0% tariffs on US goods worth $20.0 billion, with more measures likely to follow unless politicians can find a negotiated settlement

These kinds of actions can disrupt global supply chains, reduce international trade volumes, and hurt global GDP growth.

Some studies predict that under a strict tariff regime the GDP of the US could shrink by -0.64% per annum, while China's may decline by -0.68% in 2025.

President Trump's strategy is one of short-term pain for long term gain.

He and his team believe that the shock tactics of imposing high tariffs on key trading partners will ultimately bring them to the negotiating table and allow the US to cut a better deal when it comes to global trade.

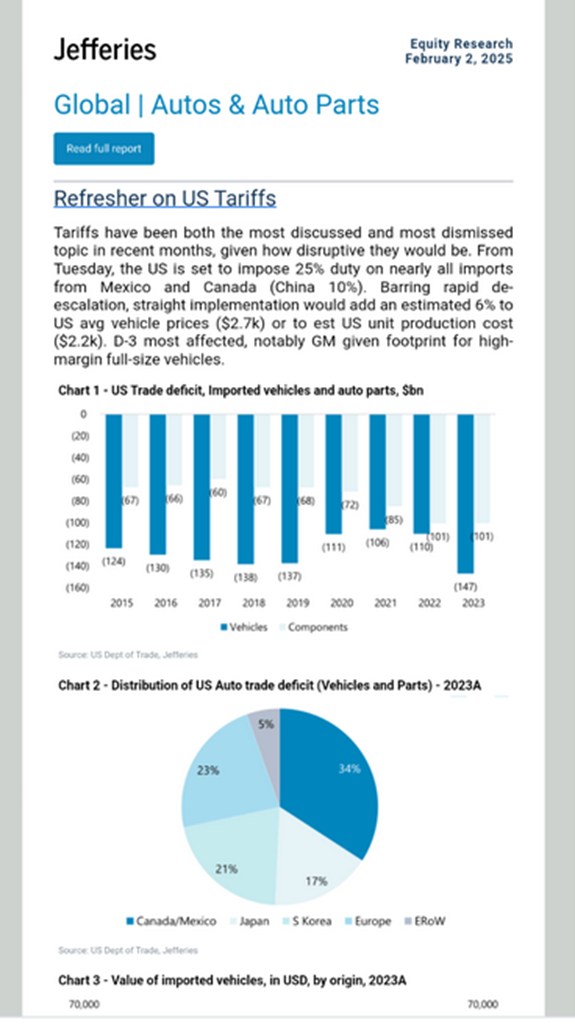

However, it could be a very painful exercise with no guarantee of success. US investment bank Jefferies published a timely reminder about the effects of tariffs this week.

Source: Jefferies Research

Jefferies believe tariffs on imports from Mexico, Canada and China, could increase the cost of average vehicle prices, in the US, by as much as +6.0%.

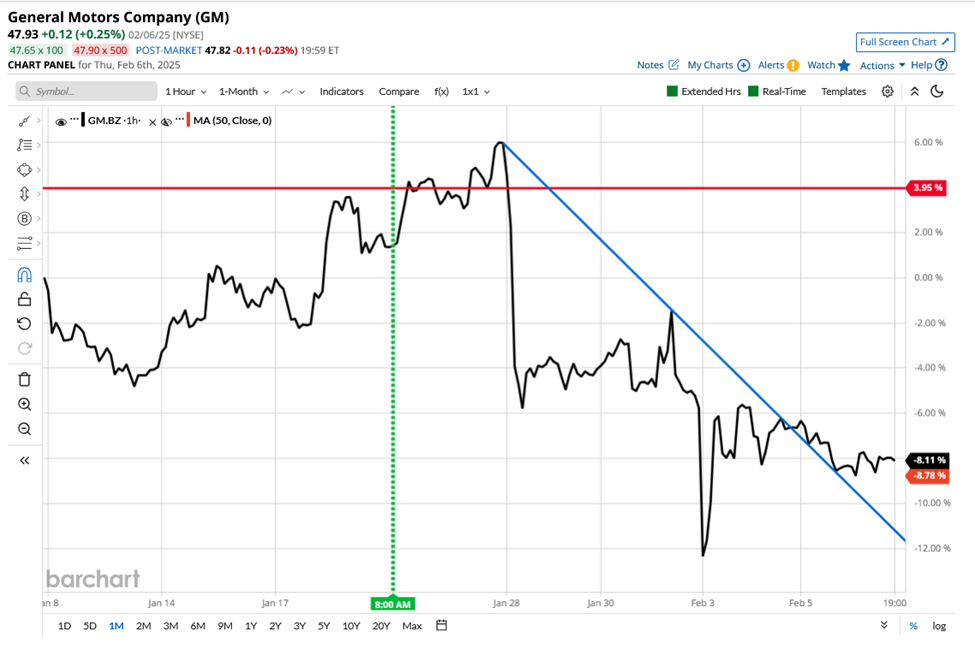

Here's what that meant for the price of General Motors (GM US) the Green dashed line represents when President Trump took office.

Source: Barchart.com

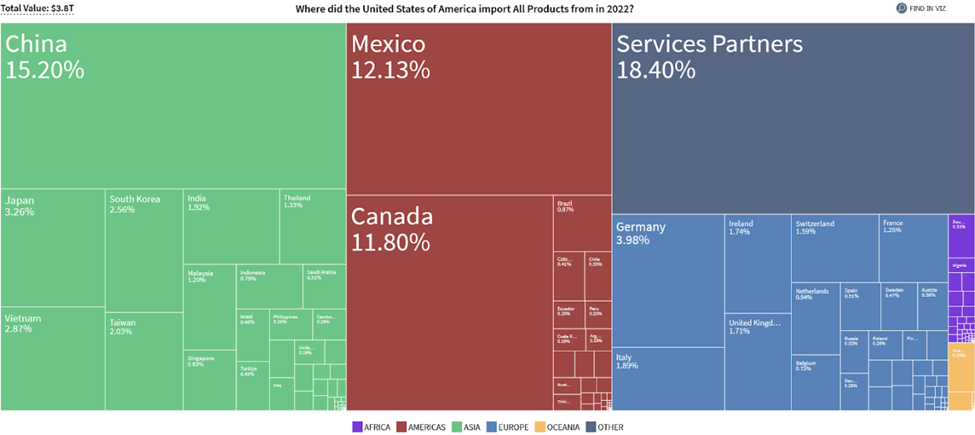

We can get some idea of what's at stake in the wider economy by looking at this heat map of US imports by country of origin, taken from the Atlas of Economic Complexity, this is 2022 data, but for our purposes its probably sufficient.

Source: The Atlas of Economic Complexity

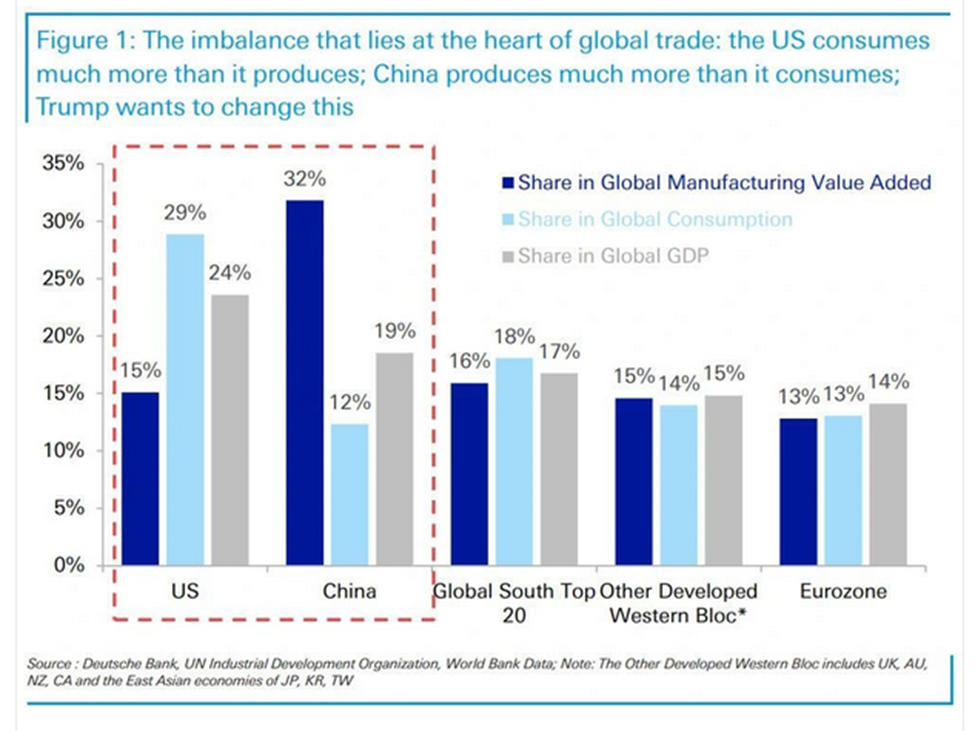

Deutsche Bank has also tried to capture the essence of what's driving President Trump's economic policy, in this chart:

Source: Deutsche Bank

Impact on Stock Markets

New tariffs have triggered significant volatility in financial markets.

Following the announcement of their introduction major indices like the Dow Jones and S&P 500 dropped sharply due to fears of reduced corporate profits and higher consumer prices.

Though they have bounced as the start dates of tariffs have been delayed, or as in the case of Columbia, other nations have negotiated a deal with Washington.

Analysts estimate that every 5.0% increase in U.S. tariff rates could cut S&P 500 earnings per share by 1.0 to 2.0%, potentially reducing the index's valuation by as much as -5.0% over the course of a year.

Additionally, tariffs may re-ignite inflation, while slowing economic growth, creating a challenging environment for investors and consumers alike.

We can get a feel for the intraday ranges, within the S&P 500, since Donald Trump took office in the chart below, which I have drawn as a barchart to emphasise the size of the swings, rather than saying anything specific about direction.

Though of course, we have also had to deal with the impact of DeepSeek in that time. The Chinese AI has perhaps become a metaphor for what's at stake, as America, and its biggest trading partners bump heads.

Source: Barchart.com

Broader Economic Effects

Tariffs could fuel inflation in the U.S. as businesses pass higher costs onto consumers. Meanwhile, global markets are bracing for prolonged instabilit, as other nations prepare countermeasures or try to divert exports to alternative market places.

This aggressive trade policy risks undermining international cooperation and further fragmenting global trade systems.Trump’s tariff-driven trade strategy has far-reaching consequences for global commerce and financial stability, amplifying economic uncertainty while straining international relations.

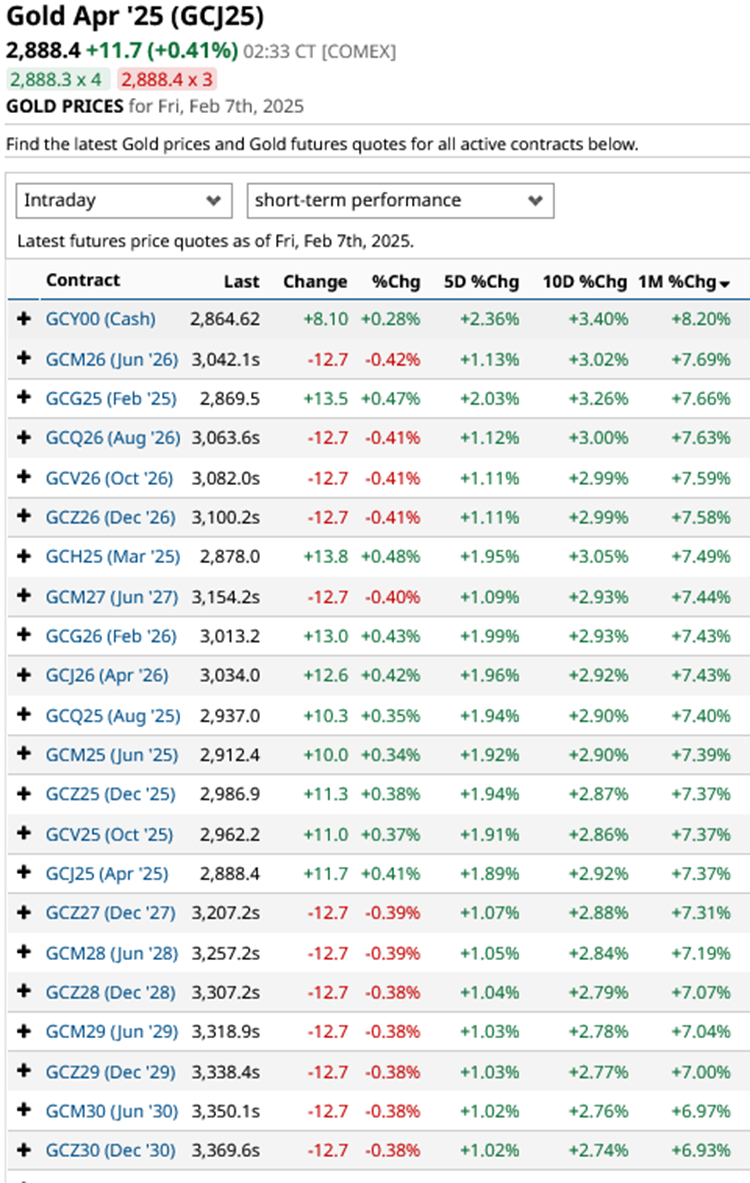

We can see how gold prices have moved higher across teh futures curve over the last month (right hand column in the table below) driven by a squeeze on supplies of deliverable bullion in the US and concerns about the economic impacts of tariffs.

Source: Barchart.com

However, don't think that President Trump is just randomly shooting from the hip because he isn't

Morgan Stanley has been writing about the “new world order”, what it calls a multipolar world since midway through 2023.

Multipolar refers to the idea that there is more than one focal point globally, and that comes about through changes in the status quo, as the relationship of the Rest of the World (or ROW) with the US changes, as the United States repositions itself.

By, for example, asking other NATO members to meet the cost of European security, redrafting or tearing up existing trade agreements, withdrawing from international organisations and treaties and becoming far less dependent on imported energy.

In extreme cases the US could effectively withdraw from the world, interacting far less frequently with other nations, to focus on its economy, finances and internal issues instead.

President Trump probably won't go that far, not least because 29.0% of the S&P 500’s revenues are earned abroad which is far too much to just throw away, isn’t it ?

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.