Was the Japan 225 index really down by double digit percentages on Monday last, while the yen rallied on the carry trade unwind?

Source: Trading Economics

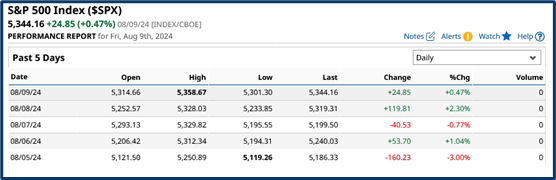

And did the S&P 500 really fall to its biggest daily loss in 12 months as tech investors took flight?

Source: Barchart.com

The answer to all of this is yes and yet if you look around for signs of panic they are few and far between.

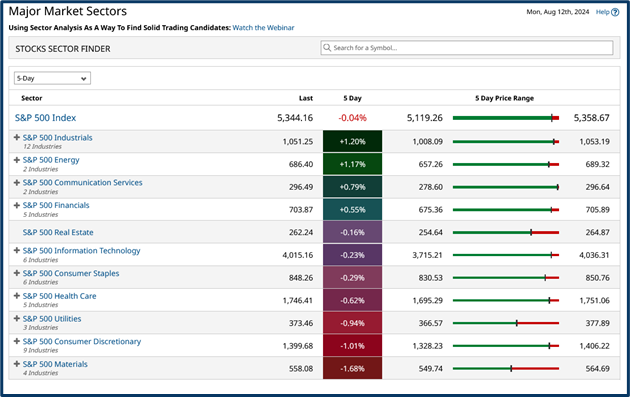

Consider the table below which shows the one week performance of the S&P 500 and its constituent sectors. The index finished flat on the week and almost all sectors ended up closer to their highs than their low points.

Source: Barchart.com

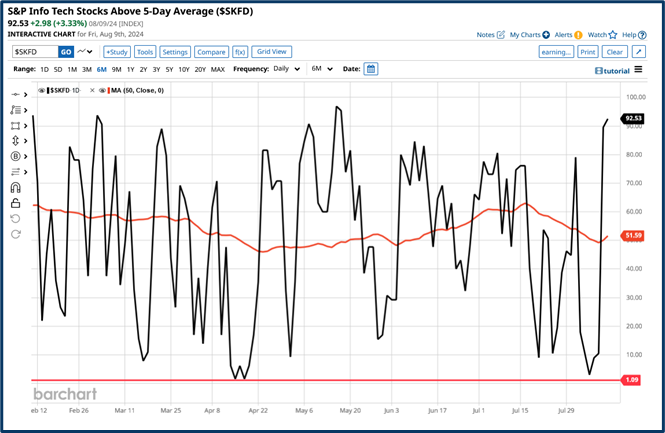

Sentiment towards key sectors such as IT rebounded strongly.

With the % of stocks in the sector trading above their 5-day moving averages finishing the week at 92.53%. Having hit a low of just 2.98% on the 5th of August.

Source: Barchart.com

It was similar story for the Nasdaq100 index, which saw its 5-day MA % rebound sharply as well.

However, longer dated metrics for the index didnt respond so favourably, as we can see below.

Source: Barchart.com

Can we just pretend that last week's wobble never happened?

It’s tempting isn't it?

But we cant just sweep it all under the carpet because Monday was the physical manifestation of a change in the narrative among equity investors.

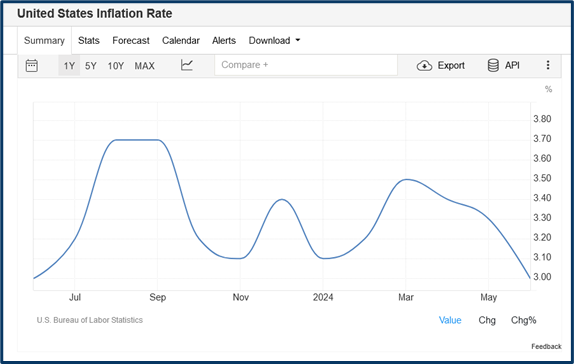

The narrative switched from one in which interest rates cuts were a logical end point to the battle with inflation. To one in which they were a much needed emergency measure as the US economy raced towards recession.

Source: Trading Economics

Is the US heading towards a recession?

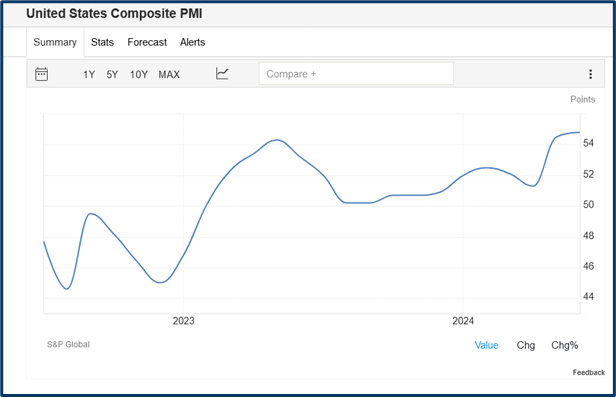

Not obviously when you look at charts like this which show continued economic expansion in the services sector, which is the greater part of the US economy.

Source: Trading Economics

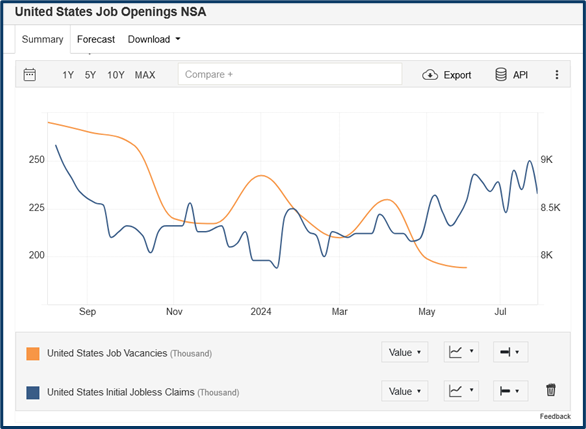

Fears about employment, the falling number of US job vacancies, and rising numbers of new claims for unemployment benefits, could be a source of concern.

Source: Trading Economics

But not to the extent that Fed needs to adjust monetary policy (cut interest rates) between meetings which is what some were calling for last week.

I find it very telling that it was a comment from the BOJ last week, rather than the Federal Reserve, that restored calm to the markets.

Not that last week was all bad for all US equities either

The table below captures S&P 500 stocks which were up by +5.70% or more last week.

What’s more well over 100 stocks in the index, made gains of +2.0% or more.

Source: Barchart.com

The take away from all this is that things are rarely as dark as they painted:

Earnings among S&P 500 stocks reporting Q2 numbers are growing at around +10.80% year-over-year, according to data from Factset. The highest growth rate seen since Q4 2021, which again doesn't sound recessionary to me.

Sources of concern

There are things to be concerned about. It's an US election year and the outcome of that is uncertain.

The war in Europe has taken an unexpected turn, as Ukraine take the fight to Russia on its home soil.

Whilst tensions in the Middle East, between Israel and Iran, appear to ratcheting higher once more, and the Chinese economy continues to disappoint.

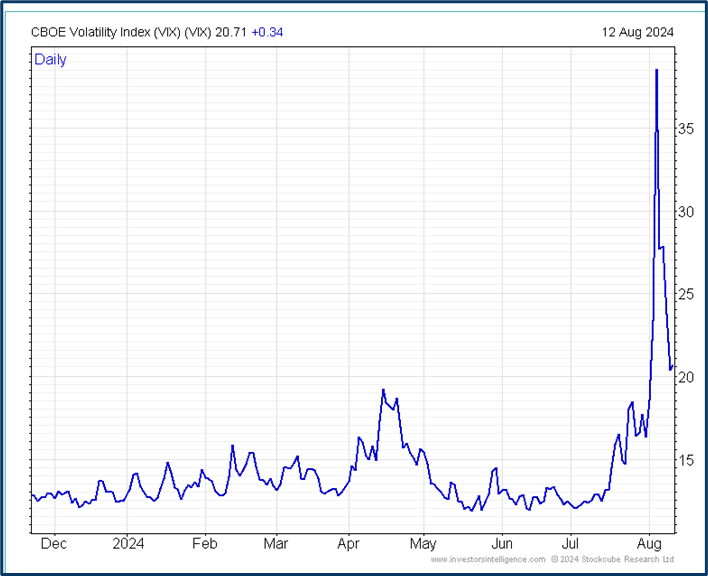

Pragmatism and a sense of proportion are whats required now- The sharp jump in volatility is now behind us though the VIX index remains above its recent averages so its not time for complacency either.

Markets are complicated beasts and they don’t (always) act rationally.

Last week’s tantrum reminds us that risk is with us all of the time, even if it's hidden from view.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.