Difficult Start to the Week: Profit-Taking Continues in the DAX, Tech Bubble Fears

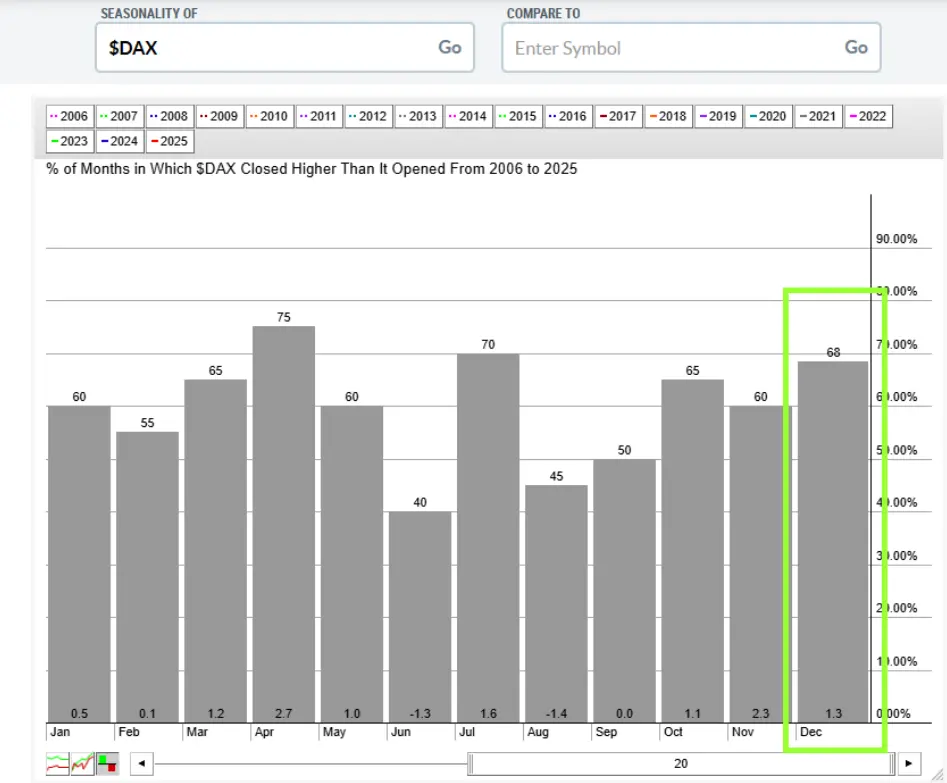

The start of the week was sobering for the DAX: The leading index failed to find its usual rhythm for the annual Christmas rally on Monday either. Instead, profit-taking dominates the market, and investors are heading into the remaining two trading weeks with noticeable unease. The main topic is the supposed Tech Bubble. There is a growing fear that the valuations of AI stocks are significantly higher than their actual company value. Analysts and investors are increasingly drawing parallels to the DotCom Bubble of the late 90s, when internet companies virtually exploded on the stock market.

Rheinmetall Stock Under Pressure: Peace Talks as a Price Risk

A glimmer of hope for Europe comes from the intensifying peace negotiations between Ukraine and Russia. It is rumored that a genuine Christmas ceasefire may be within reach. According to reports, 90 percent of all critical issues may already be resolved, although an official statement from the Kremlin is still pending.

Paradoxically, this progress is turning into a price risk for Rheinmetall shareholders. The stock, which has gained massively since the start of the war in Ukraine, is coming under increasing pressure at a high level, as an end to the conflict could dampen defense orders. The stock carried the red lantern in the DAX yesterday with a loss of 4 percent. Over the past three months, Rheinmetall is second to last with a negative performance of 17.2 percent (only Scout24 was weaker).

Fear of a Crash: Must the DAX Retest 24,000 Points?

Technically, the DAX appears ready to retest the psychologically important 24,000-point mark. Investors must now fear that the index will slip below this threshold again—contrary to the hoped-for Christmas rally that targeted the high at 24,500 points.

The realistic chance for a proper year-end rally only exists if the DAX manages to turn back upwards this week. Today, Tuesday, with the subsequent release of US labor market data, will be directional. Should the data signal further weakness, it could support the hope for future interest rate cuts and stabilize the DAX again.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.