If you’re looking to trade foreign exchange, selecting the right online forex trading platform is one of the most crucial decisions you will make. Your choice will significantly influence your trading experience, affecting factors such as the tools at your disposal, minimum deposit requirements, user-friendliness, and the resources available to support your trading strategies.

Given the multitude of options available, finding the best forex trading platform can be overwhelming.

In this article, we will delve into the essential features and considerations to help you identify the forex trading platform that best aligns with your needs and trading goals.

8 Tips to Choosing the Right Forex Trading Platform

There are eight key factors to consider when choosing the best forex trading platform for your trading style and goals:

Platform

A forex trading platform is the online interface through which traders execute trades and manage their portfolios. Platforms can vary significantly, ranging from web-based or app-only options to those compatible with advanced software.

The ActivTrades forex trading platform, ActivTrader, is a comprehensive cloud-based platform accessible via desktop, mobile app, and tablet options. ActivTrades also offers Meta 4 and Meta 5. This means that ActiveTrades platforms are suitable for beginners and experienced traders, offering a range of basic to advanced tools.

Your choice of platform must have the tools you need to simplify and streamline your trading process. The best forex trading platform for beginners will provide all of these tools while being relatively straightforward to use.

Leverage and Margin

Leverage enables traders to control larger positions with a smaller amount of capital, while margin serves as the collateral required to open and maintain these positions. Understanding how these two concepts work together is crucial, as they can significantly influence your potential risk exposure and profitability.

Different trading platforms offer varying levels of margin and leverage requirements. This makes it essential for traders to choose an online forex trading platform that not only aligns with their trading strategy but also matches their risk tolerance.

ActivTrades stands out by offering competitive leverage options alongside strong risk management tools, ensuring that clients can avoid inadvertently overextending their exposure.

Spread

A currency pair represents the exchange rate between two currencies, indicating how much of one currency (the quote currency) is needed to purchase one unit of another (the base currency). The difference between the bid and ask prices for a currency pair is referred to as the spread. This spread is an essential factor in forex trading costs; a tighter spread means lower expenses per trade, which can significantly benefit high-frequency traders.

ActivTrades is recognised for its competitive spreads, allowing traders to maximise their profits and retain more of their earnings.

Timing and Availability

Forex markets function across multiple time zones, providing traders with 24-hour trading opportunities. The currency pairs you choose will dictate the hours when you can expect the most activity. For example, if you are trading GBP/USD, your busiest times will typically coincide with UK and U.S. trading hours.

Deposit and Withdrawal

Hidden fees can significantly diminish your capital, as some platforms impose charges for funding or withdrawing from your account. ActivTrades takes a transparent approach to its fee structure, ensuring that traders are fully aware of the costs involved, thereby avoiding any unexpected charges. This clarity allows traders to concentrate on their trading activities without the stress of unnecessary expenses. When selecting the best forex trading platform to achieve your trading goals, understanding the fee structure is a crucial consideration.

Comparison of Forex Trading Platforms

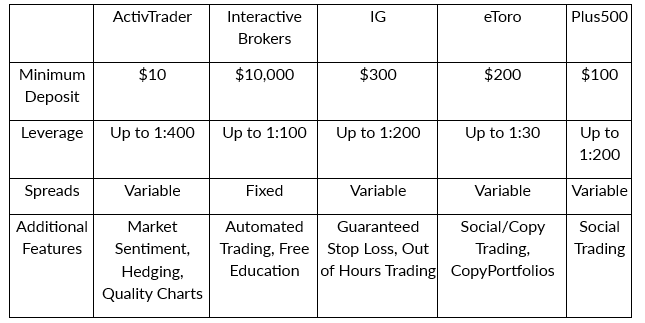

While most online forex trading platforms offer a demo account, multilingual support is available 24 hours a day between Monday and Friday, there are some key differences between them.

Here’s a quick breakdown of some of the differences between leading platforms, including ActivTrader from ActivTrades.

One of the standout features of the ActivTrader online forex trading platform is its low minimum deposit requirement, making it an accessible and lower-risk option for new traders with limited budgets. In contrast to platforms like Interactive Brokers, which can demand a hefty minimum deposit of $10,000, ActivTrader’s approach is particularly appealing to beginners. Coupled with its intuitive and user-friendly tools, ActivTrader is a fantastic choice for those just starting their trading journey.

ActivTrader also offers leverage of up to 1:400, allowing traders to manage larger positions with a smaller capital investment. This higher leverage option enhances trading flexibility and accommodates a broader range of trading strategies.

Additionally, ActivTrader features variable spreads that adapt to market conditions, ensuring competitive pricing. It also provides a comprehensive set of tools that empower traders, whether they are novices or more experienced, to stay informed and make better trading decisions.

How to Forex Trade with ActivTrades

It’s simple to get started trading forex with ActivTrades. Here’s a step-by-step guide:

- Open A Trading Account

Visit the ActivTrades website and create a new account. You’ll need to provide your personal details and complete identity verification. You should choose the type of account to suit your trading needs. Beginners should start with a risk-free demo account to practice before real trading.

- Deposit Funds

The minimum deposit for trading with ActivTrades is $10. This can be deposited in your account using one of the available payment methods such as credit/debit card or bank transfer.

- Download and Install ActivTrader

If you’re using the ActivTrader platform, it can be downloaded for desktop, mobile or tablet, direct from the ActivTrades website or app store.

- Choose Your Forex Pair

ActivTrades offers a wide selection of currency pairs. Search for the forex pairs you want to trade (e.g., EUR/USD, GBP/USD, USD/JPY) from the list of available major, minor, or exotic pairs.

- Analyse the Market

Market analysis will be key to the performance of your trades. Using ActivTrader’s charting tools, you monitor live market data, and make use of indicators like RSI, MACD, and moving average. Also pay attention to any important news events that could impact forex markets.

- Set Your Parameters

Using your market analysis, decide whether to buy or sell based on your trading strategy. Input the size of your trade, and set risk management tools like stop loss, taking profit to maximise gains or limit potential losses.

- Execute Your Trade

Once you’re happy with your proposed trade, click the buy or sell button to open your position. You should double-check the details of your trade before confirming.

- Monitor Your Position

The ActivTrader dashboard makes it easy to track your open position in real-time. Use price alerts and market news to stay updated and adjust your strategy if necessary.

- Close Your Position

When your trade reaches the desired outcome, or if you need to exit early, click close to finalise your position.

- Withdraw Funds

If you've successfully made a profit and wish to withdraw your funds, simply navigate to the withdrawal section of the platform and choose your preferred method.

Trading on ActivTrader is designed to be straightforward and quickly becomes intuitive for users. This ease of use is one of the key reasons many traders regard ActivTrader as one of the best forex trading platforms available today.

FAQS

- What is a forex trading platform?

A forex trading platform is software that allows traders to access the forex market, execute trades, and manage their positions.

- What makes a good forex trading platform?

A good platform should be easy to use, offer competitive spreads, have a low minimum deposit requirement, and a robust approach to risk management. The tools should be compatible with your trading strategy.

- What types of forex trading accounts are available?

Online forex trading platforms offer different account types for their users, including demo accounts to gain risk-free experience, standard accounts for everyday trading, and more advanced MT4 and MT5 accounts for professional and experienced traders.

- Do I need prior experience to start trading forex?

No prior experience is necessary to start forex trading, but having some exposure to the market can be beneficial before risking real money. Platforms like ActivTrader offer valuable resources to enhance your understanding of forex trading, including beginner-friendly tools and demo accounts that allow you to practice without any financial risk.

- Can I trade forex with a small initial investment?

It’s possible to begin trading forex with a low initial investment. This can be particularly important for newcomers looking to learn how to trade while reducing potential losses.

- Why is the minimum deposit important?

The lower the minimum deposit requirement, the more accessible a platform is for traders with smaller budgets. ActivTrader has a $10 minimum deposit, making it a great option for new traders compared to competitors requiring higher amounts.

- What are spreads, and why do they matter?

Spreads refers to the difference between the bid and ask prices for a currency pair. Lower spreads have lower trading costs, which make them important for profitability. ActivTrader has competitive variable spreads.

- How does leverage work in forex trading?

Leverage allows traders to control larger positions with smaller capital. ActivTrader offers leverage up to 1:400. This means you can trade $400 for every $1 in your account.

- What forex pairs can I trade on ActivTrader?

ActivTrader supports a wide range of forex pairs, including majors like EUR/USD, minors like GBP/JPY, and exotic pairs.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.