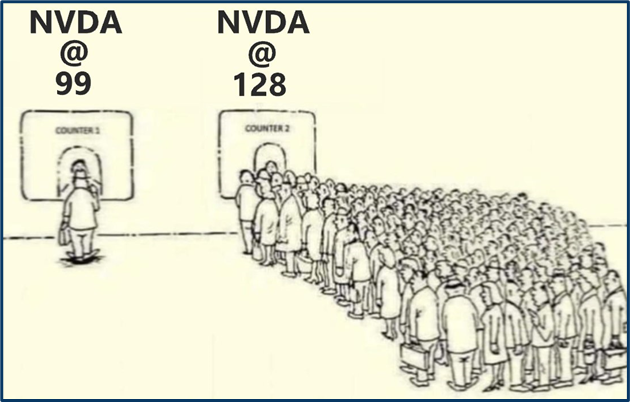

Someone shared the cartoon below, in one of the trading discords I am a member of, and it immediately struck a chord with me.

Because it says so much about trader behaviour, sentiment and the herd instinct, or crowding, that’s so commonplace in the markets.

I would always want to be on the left-hand side here, not because the price of Nvidia is far lower in that queue, but simply because I want to think for myself, form my own opinions and generate my own ideas.

Source: Barchart.com

Crowding In

Now don't get me wrong crowding, and the herd instinct has its place. Not least when I am looking for catalysts and momentum, to bring a trading idea/set-up to life.

In these circumstances, I like to think that I am taking advantage of those market traits rather than them taking advantage of me.

Success in trading over the long-term is often about what happens at the margins, being in more successful trades for longer, and being able to repeat that consistently, for example, should generate recurring and compounding profits.

Part of that of course, is knowing when to head for the exit, and also recognising when you are at the back of a very long and crowded queue. Being tail-end Charlie all the time is unlikely to be a recipe for success.

Thinking ahead

One way that I try to get myself into the shorter queue is by trying to think ahead.

I am not the only one in the market trying to do this obviously, but the window of opportunity is probably wider and open for longer than you think because the majority of people are still in the other queue.

At the moment the market is waiting on the Fed and specifically, it's waiting for the Fed to cut interest rates at its September meeting.

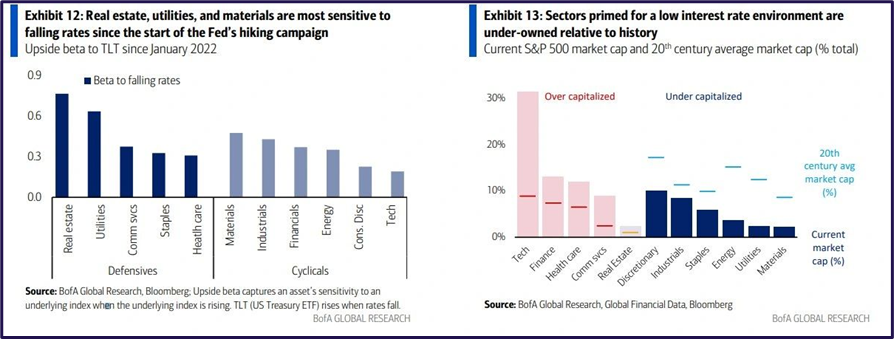

That's hardly a secret, in fact, Bank of America produced the charts below specifically because the market believes rates will fall in 2024, and continue to do so in 2025. I don't think they need to come down because the US economy is doing very nicely as it is, but that's another story.

Source: Bank of America

Fed chair Jerome Powell confirmed that US interest rates would come down in his comments at the Jackson Hole Symposium last week the question now is how many times will ther Fed cut and over what time frame.

A turning point in the interest rate cycle is no small matter and the reasons for that pivot will also come under scrutiny let's not forget that some people were calling for emergency out-of-meeting rate cuts from the Fed after some weaker-than-anticipated employment numbers less than one month ago.

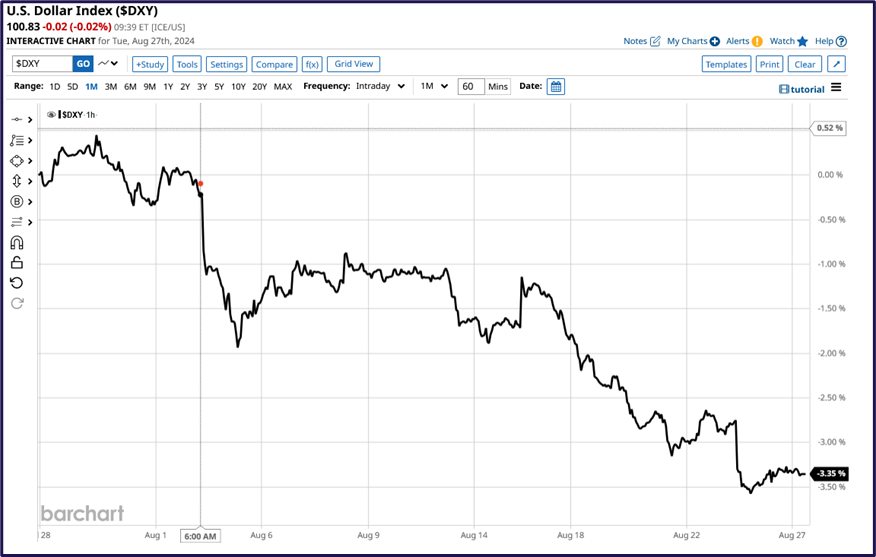

The dollar index has reflected the market’s changing views on US interest rate policy It has fallen by more than 3.0% over the last month having racked up gains of +9.50% over the last three years.

Source: Barchart.com

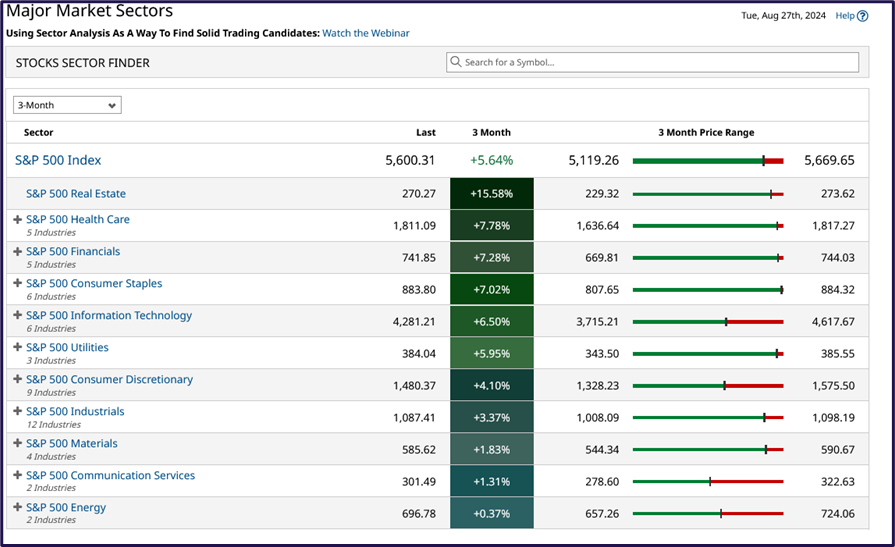

We can also see the mood change playing out at sector levels in the S&P 500 for example over the last quarter Real Estate has added +15.58% comfortably outperforming every other sector in this time frame.

Source: Barchart.com

Financials are rising

Perhaps counter-intuitively Financials have also risen during this time frame.

I say that because banks and other lenders, tend to enjoy bigger margins when interest rates are higher and rising.

Those margins typically contract as rates fall.

Perhaps in this instance, traders are hoping for a shallow glide path for rates (one and done in 2024?) and that increased volumes of mortgages, loans and other rate-sensitive products make up for lower margins.

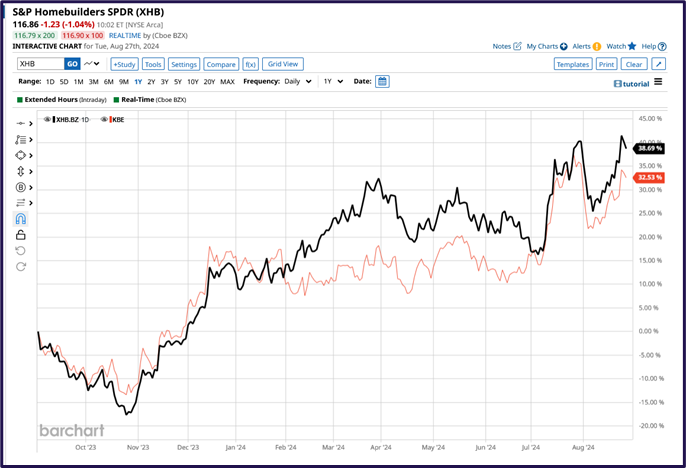

This chart can help to shine a light on that relationship XHB is the S&P 500 House Builders ETF whilst KBE is the S&P 500 Bank ETF they have tracked each other closely over the last year.

Source: Barchart.com

However a one-month version of that chart could suggest that the party is over indeed market orthodoxy is that you sell the first rate cut.

Source: Barchart.com

Mortgages matter

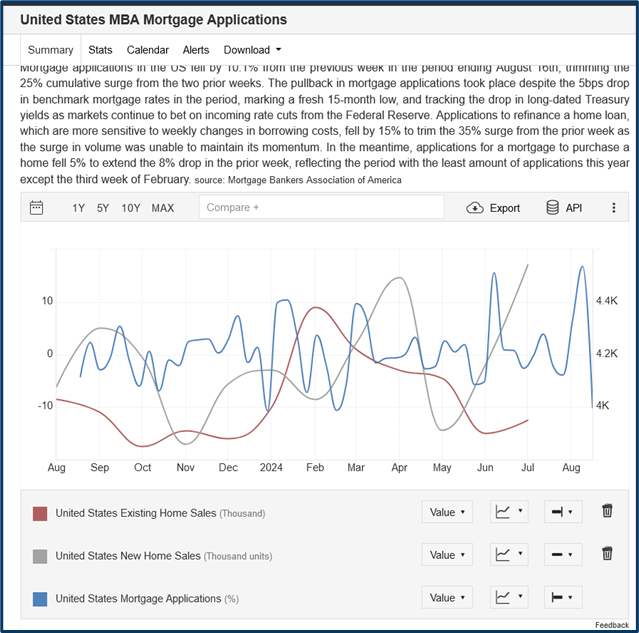

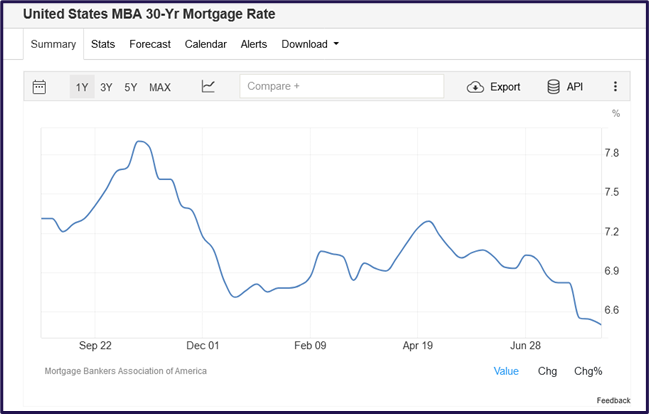

We can get some more idea about what's going on in the US housing market from this chart, which plots MBA mortgage applications against both existing and new home sales in the USA.

The home sales data lags behind the mortgage applications data but we can see that new home sales spiked from May onward as mortgage rates in the US began to dip (see the lower chart). Even existing home sales started as homeowners sensed that there might now be an opportunity to move house.

Mortgage applications spiked in July but that proved short-lived. Buyers were likely put off by the volatility in early August and are now probably happy to sit in their hands until after Labor Day and perhaps even the FOMC meeting on September 18th.

Source: Trading Economics

Source: Trading Economics

How can we position ourselves to be in the shorter queue for the last quarter of 2024?

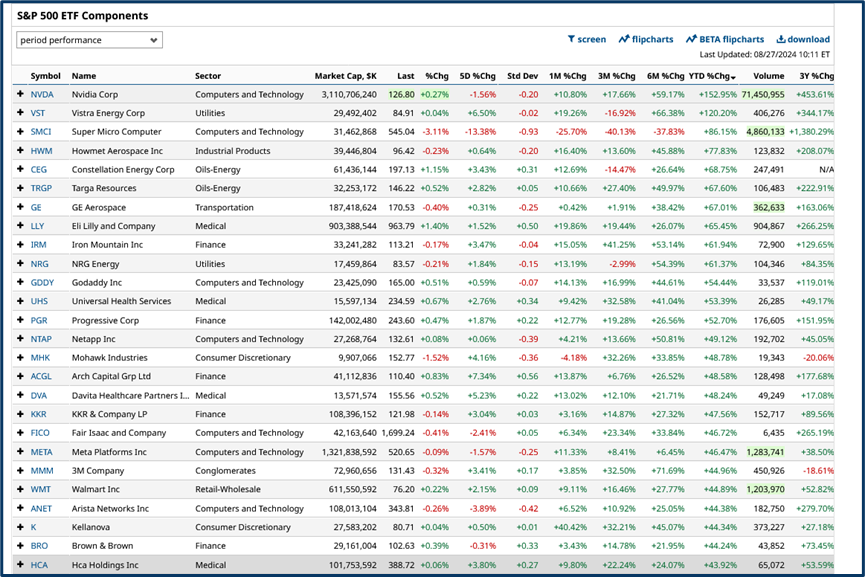

Well one way might be to monitor the performance of stocks that have enjoyed the biggest year-to-date gains, some of which are listed below.

This wouldn't be a case of picking tops, and then selling them, because thats likely to be a recipe for disaster.

However, if we see clear signals from the market about trend changes or changes of control; from buyers to sellers, then that could be the time to act.

Remember though that being short of popular stocks can be a lonely and expensive place to be.

It's in those circumstances that we want people to change queues, and join us.

But of course that only happens when the herd recognises and reacts to the change in the narrative, however, when the penny drops, they often all head for the exit together.

Source: Barchart.com

We should have a clearer idea about market sentiment towards Tech and AI from its reaction to Nvidia, which reports earnings after the close on the 28th of August.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.