We started 2024 with a clear narrative in our minds.

It was obvious: inflation in the US, and elsewhere was falling, and was on course to hit the Federal Reserves +2.0%, or close to, target.

And that meant that the central bank would trim interest rates.

Because that was the tool that it had been using to bring inflation down.

Never mind the fact that most of the inflationary pressures in the USA had been caused by supply-side issues, and shocks and not through excess domestic demand.

And because inflation was falling so quickly the Fed would make five or maybe even six rate cuts during 2024.

Lower interest rates meant good news for equities and for bonds. Whose prices had fallen dramatically to allow their yields to compete with money market funds and cash deposits that were offering a +5.0% “risk-free return”.

Not so certain now

However, all of a sudden the certainty that rates are coming down is evaporating before our eyes.

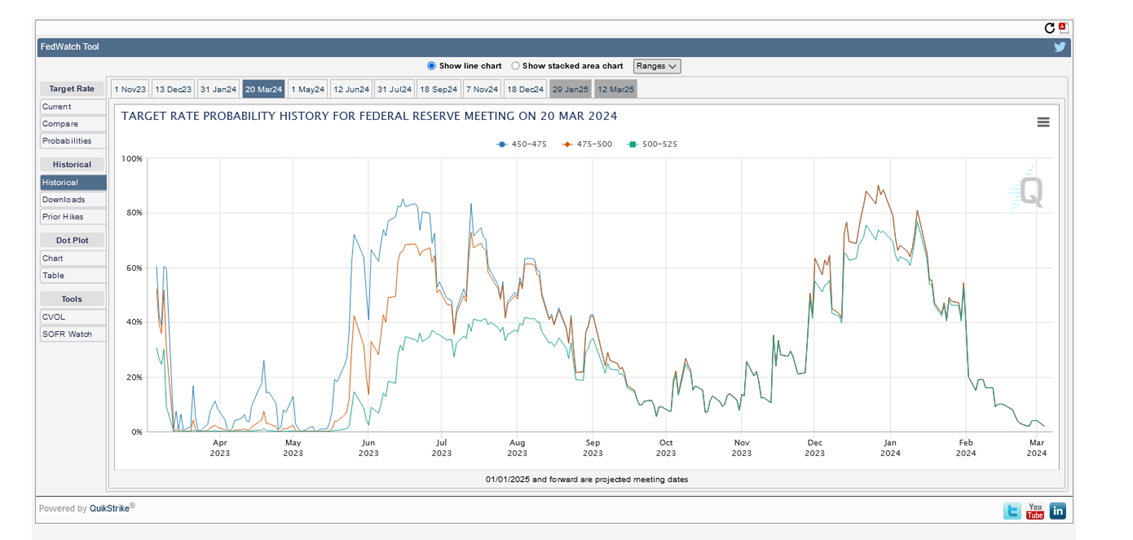

The chart below- courtesy of the CME Fedwatch Tool -shows us the probabilities, as far as Fed Funds Futures are concerned, that US interest rates will be below the current 5.25% to 5.50%, come the end of the FOMC meeting on March 20th.

Source: CME Fedwatch

As of December 23rd, there was a 73.86% probability that rates would fall by -0.25% at the March 2024 meeting. Yet, by Friday, March 1st, that certainty had been cut to just 4.0%.

From a near certainty to an outside bet in less than a quarter!

What's going on?

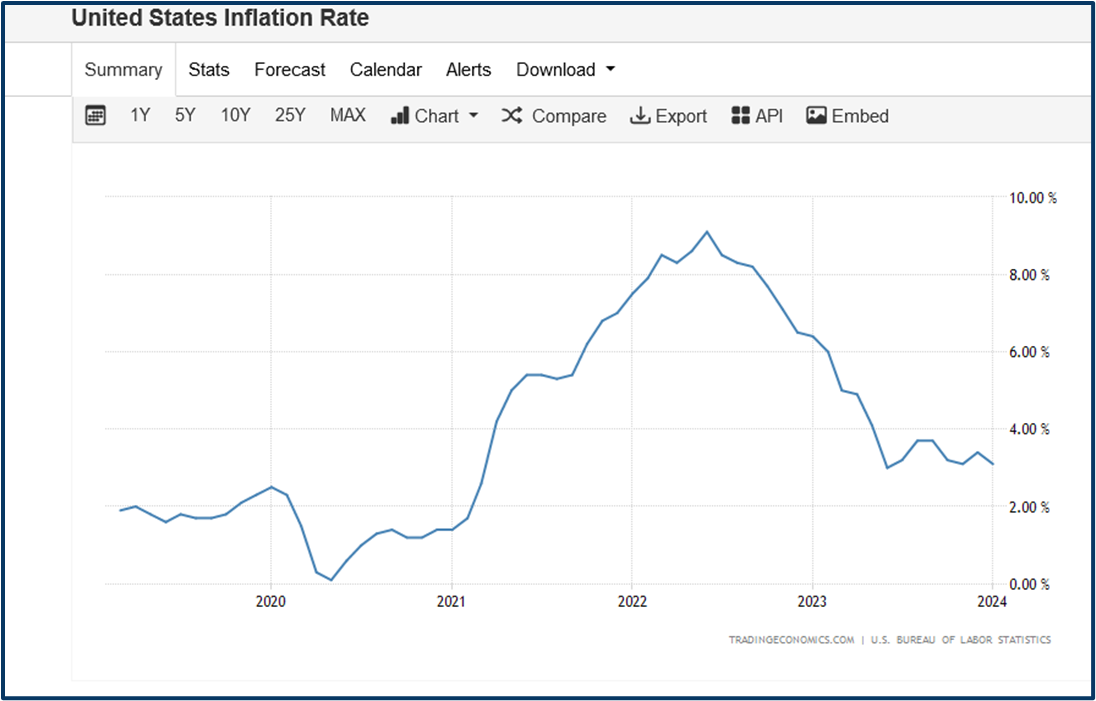

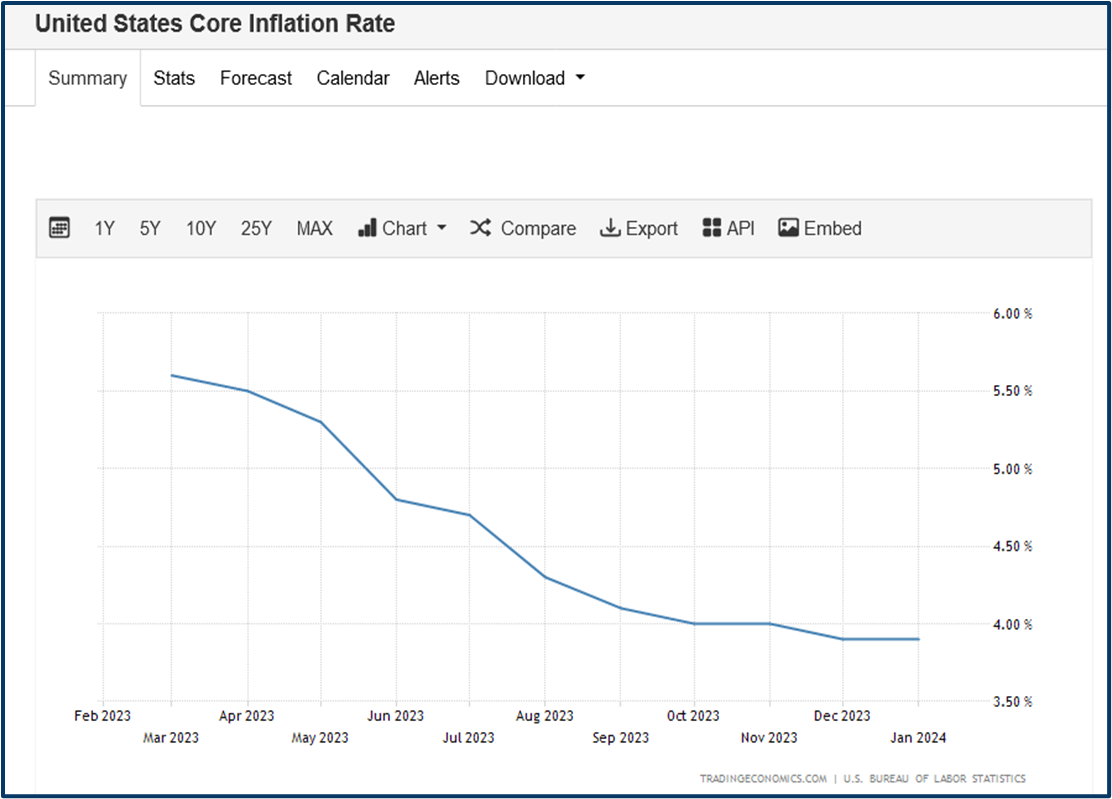

Well put simply, prices have stopped falling as quickly as they were, and in some prices they are not falling at all anymore.

See the charts below which track inflation and core inflation rates in the US.

Source: Trading Economics

Source: Trading Economics

Our third chart on Inflation shows us the bond market's view of inflation over the next five years.

The so-called break-even rate.

That rate had been heading lower since the Spring of 2022. Earlier this year it had come within a whisper of 2.00%. However, it is now starting to climb once more.

Source: St Louis Fed

Hold on though, don't forget that inflation is not just a measure of price change. It is also an indicator of the level of demand in an economy.

Demand that we need to have if an economy is to grow.

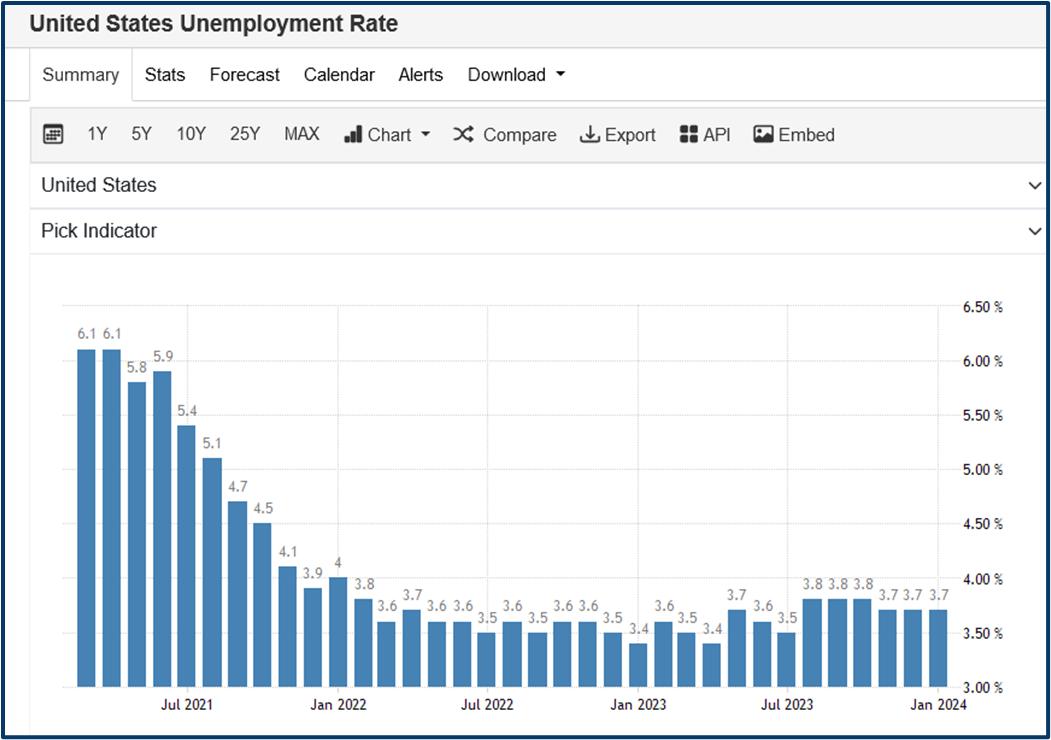

Let’s not forget, as well, that the Federal Reserve has a dual mandate. The second part of which is to maintain employment.

Something that the Fed has done very well, by and large since the pandemic.

Source: Trading Economics

Not all bad

So we have an economy with some of the lowest rates of unemployment it has ever seen, in which prices/ demand are expected to move higher over the medium term. To my mind that sounds almost like a Goldilocks situation.

So why are market participants starting to get twitchy? And or, row back on their interest rate cut expectations in 2024?

Well, the simple answer could be politics

After all it’s an election year, one in which US voters could face some tough choices.

Choices that could be driven by sound-byte like this one from Bank of America on the scale of, and, rapid rise in, the US national debt.

“The US national debt is rising $1.0tn every 100 days - $32.0 tn to $33.0 tn took 92 days, $33.0 tn to $34.0 tn 106 days, $34.0 tn to $35.0 tn will take 95 days”

Tn = Trillion Dollars or $1,000,000,000,000

The concern is not just that the increase in national debt is an issue in itself, its also that the policies that are being implemented by the current US government (which is spending money freely and would, given the chance, spend even more) could create a situation known as Fiscal Dominance.

Under which the level of government spending pushes so much additional money into the economy, that it simply overwhelms the central bank’s efforts to control inflation.

Rock and a hard place?

On the other hand, a change of administration might not be much better as far as inflationary pressures are concerned.

That is because Donald Trump has been banging the trade tariff drum again. Suggesting that he might implement tariffs on Chinese goods, and others of +60.0% or more.

Analysts at Rabobank expect Trump to make trade tariffs a key campaign message, and a policy, that he would seek to implement soon after inauguration if he is elected.

Rabo’s research finds that the costs of tariffs imposed by President Trump, during his previous term in office were largely borne by US consumers and producers. And not by the foreign companies at which they were aimed.

Rabobank summed up as follows:

“The imposition of a universal tariff on US imports may not only have an upward impact on PCE inflation in 2025, it would also hurt US firms that use foreign inputs in their production process.

This could negatively affect domestic employment growth, as those firms try to get their costs under control. Retaliatory tariffs by foreign governments on US exporters could have a similar impact on domestic employment.

The combination of higher inflation and slower employment growth would force the FOMC to make another trade-off between the two legs of its dual mandate of price stability and full employment.”

So despite the ongoing “AI boom” and US equity markets hitting new all-time highs, there are grounds for concern among investors and traders alike.

What we haven’t seen yet is how the equity market will react to the prospect of higher for longer interest rates and or the possible return of inflationary pressures in the US economy.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.