The AI juggernaut shows no sign of slowing down, in fact, in some cases, it’s been accelerating.

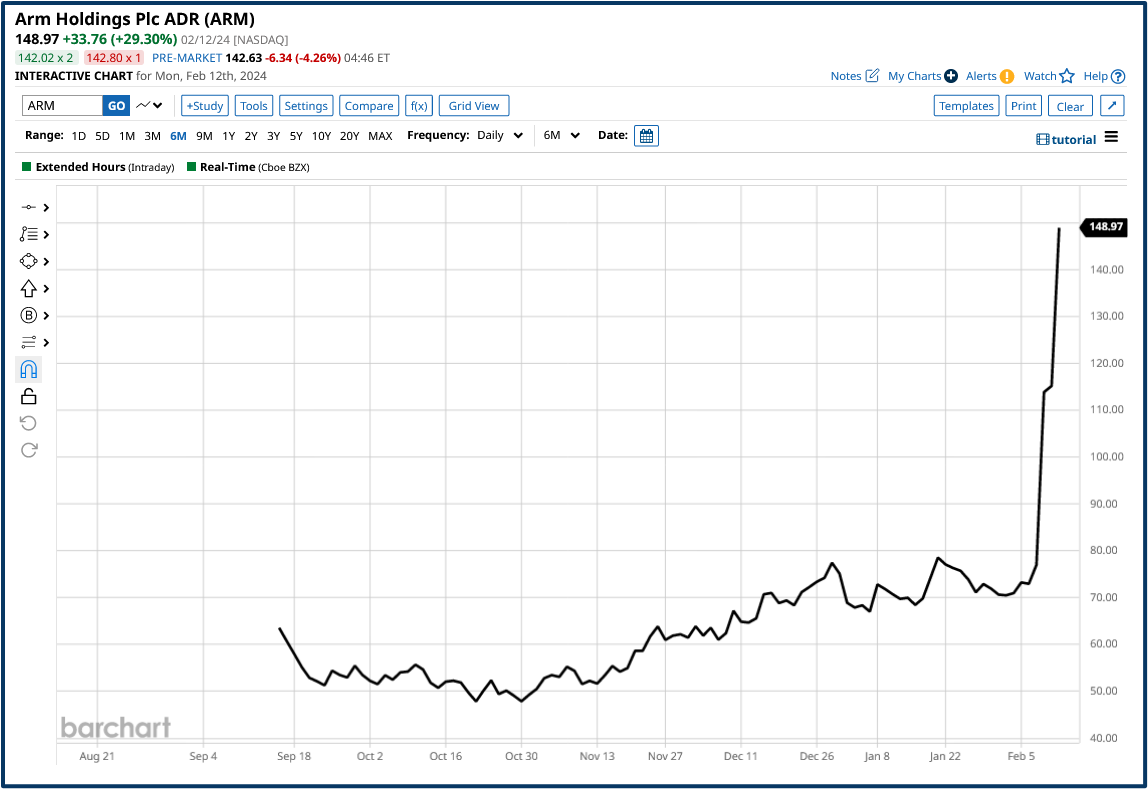

For example, take a look at the share price of UK-based, but US-listed, chip designer, ARM Holdings.

The company recently reported earnings, for the first time, since its IPO.

ARM’s numbers were better than expected and its outlook was positive, thanks to new orders for chipsets, specifically designed for AI applications.

Source Barchart.com

Lift off

That was all the incentive the market needed - the ARM chart went parabolic (see above) as the stock price leapt by +103.0% in a week.

ARM now trades on a forward PE of 96.0 times earnings, its market cap is now $118.0 billion, verus the $54.50 billion it stood at when it listed in New York, back in September.

ARM isn't an S&P 500 stock, but if we use that index as a benchmark, we find that there are only a handful of stocks that have a higher forward PE multiple.

Looking the other way,

however, the market isn’t looking at valuations right now rather it's in an AI feeding frenzy.

Much of this is likely driven by FOMO or the Fear of Missing Out as money managers and retail traders alike, jump on the AI bandwagon.

I have already written about how the AI story could end, so I won't go over old ground. Instead, I thought i would take a look at alternatives or complimentary areas to the AI story.

After all, even now AI isn't the only game in town, it's just that the other games are being overshadowed and overlooked.

Shareholder Yield

One such area is dividends and stock buybacks, which combine to form what's known as shareholder yield.

UK oil major Shell announced another $3.50 billion share buyback when it reported earnings early in February.

Analysts at US investment bank Jefferies crunched some numbers, and suggested that if Shell continued to perform as it had been, the company would be on course to buy back 50.0% of its outstanding shares by 2030.

On that basis alone shareholders would see nominal earnings per share double, all other things being equal.

Dividends and technology

Dividends have also driven AI gains this year if I can say that.

Meta Platforms the owner of Facebook and Instagram announced an inaugural dividend when it reported earnings a couple of weeks ago.

Paying a dividend means that the stock is suddenly more investable, or at least it's now available to investors, to whom, a stock without a dividend, was previously off limits.

Meta stock jumped by +20.32% post earnings. That added a whopping $200.0 billion to Meta’s market cap. This was the biggest single-day market gap gain ever, for a listed company.

It’s hard to say exactly how much of that move was down to the news of a dividend, but it was certainly a contributing factor. At the same time, Meta also authorised a $50.00 billion share buyback program.

Are there any others?

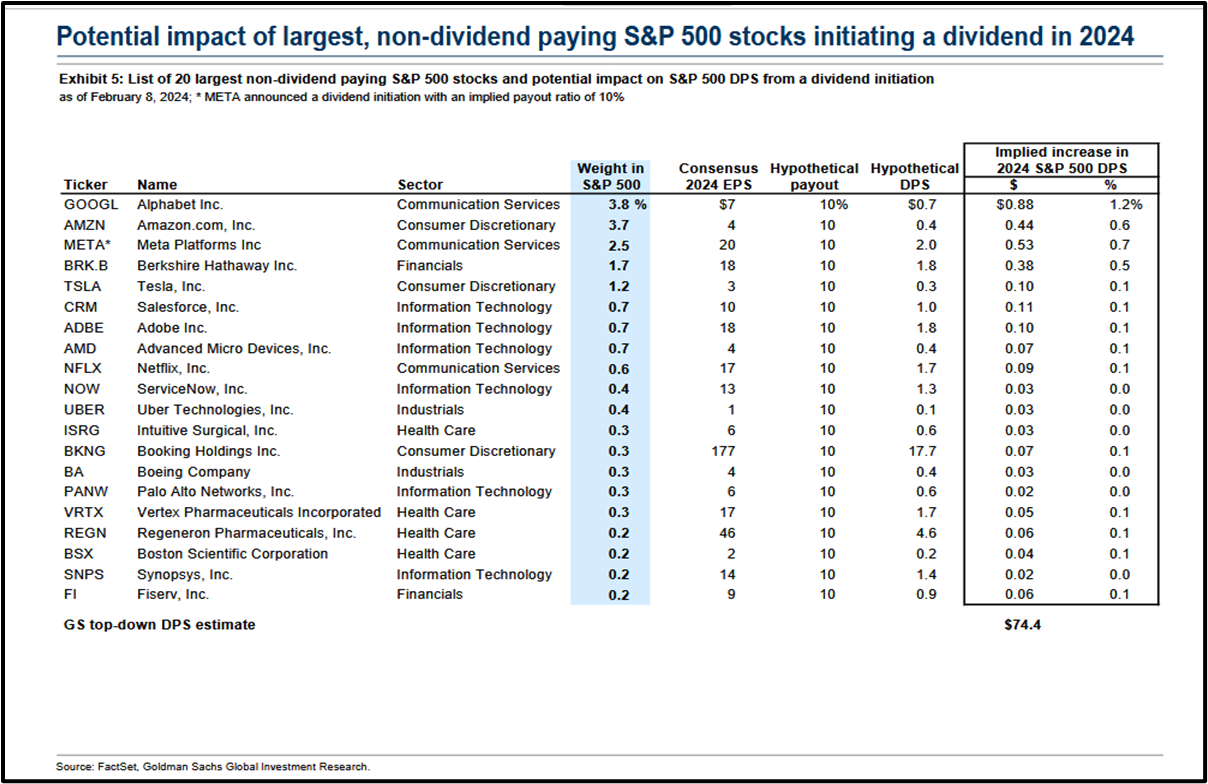

Goldman Sachs recently highlighted 15 other stocks which it thought had the potential to join Meta in initiating a dividend, many of these names are also technology companies.

Source: Goldman Sachs Research

Separately Godmans noted that stocks which have a high yield and a solid history of dividend growth have often outperformed their peers, and the equal-weight S&P 500 index, since 2021.

Thats not to say that these stocks are a buy

However, the recent share price performance of Meta Platforms could well spark discussions about dividends and shareholder returns among the managers of these companies.

It should also encourage institutional shareholders to push for dividends, and or, stock buybacks.

After all Salesforce, Adobe, Netflix and others in Goldman’s list, are well-established businesses, that don’t fit the growth company label anymore, which is really more suited to young start-ups.

So maybe it’s time for these stocks to grow up.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.