Enhanced Insurance Up to $1,000,000

Multi-Regulated Broker

ActivTrades is regulated in multiple jurisdictions and fully complies with the strictest international regulatory guidelines.

Ring-Fenced,

Segregated Accounts

All client accounts are ring-fenced from company funds by being held in segregated accounts with reputable, internationally recognised financial institutions.

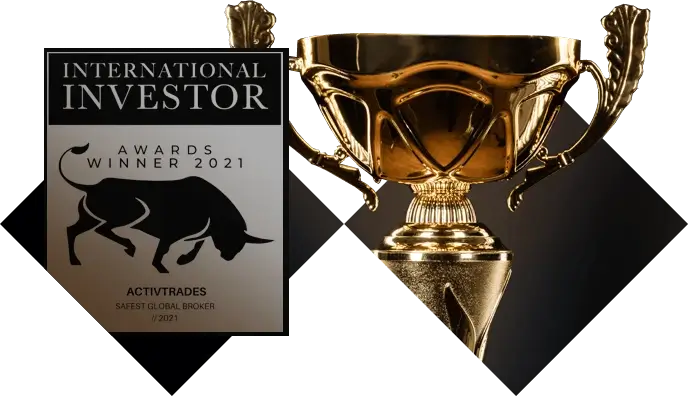

Award-Winning Security

At ActivTrades we invest heavily in our technological infrastructure, ensuring that our systems comply with the most stringent global security standards.

MiFID Compliant

ActivTrades is a fully MiFID-compliant financial services institution, so you can rest assured when trading that your broker of choice is always operating according to the law's letter.

Twenty Years of Success

For two decades now, Activtrades has been democratising financial markets and offering professional financial services to clients all across the globe.